Sep 1, 2021, fresh month starts with a challenge i.e. introduction of Peak Margin rules by SEBI

Time for a 🧵

Lets demystify the Peak Margin rules and try to find solutions for the option sellers!

Time for a 🧵

Lets demystify the Peak Margin rules and try to find solutions for the option sellers!

Peak Margin by SEBI:

• 100% upfront margin for intraday trades in the derivative segment

• Effectively MIS orders = NRML orders, as both will attract same margin in the derivative segment

• Minimum margin for equity intraday trades will be 20% of trade value i.e. 5X leverage

• 100% upfront margin for intraday trades in the derivative segment

• Effectively MIS orders = NRML orders, as both will attract same margin in the derivative segment

• Minimum margin for equity intraday trades will be 20% of trade value i.e. 5X leverage

How things used to operate erstwhile?

• Until last year there were no standardization of leverage

• Brokerage firms used to offer their clients intraday leverage of 5x, 10, 15x, 20x etc. as margin reporting was done on EoD basis

• Until last year there were no standardization of leverage

• Brokerage firms used to offer their clients intraday leverage of 5x, 10, 15x, 20x etc. as margin reporting was done on EoD basis

• Brokerage firms were allowing customers to take intraday positions with margins far lesser than required via products like MIS, BO, CO, etc. as the positions used to get squared off before the trading hours

• Eg: If 1 lot of Nifty futures require (SPAN + exposure of) Rs. 1.1L, brokerage houses would allow to trade with just 20-30% of this amount i.e Rs. 33k

What was the problem?

• Margins are collected to protect the broker from client defaults

• Brokerage house collects just a sliver of the entire requisite margin, hence they are exposed to additional risk

• Margins are collected to protect the broker from client defaults

• Brokerage house collects just a sliver of the entire requisite margin, hence they are exposed to additional risk

• SEBI considers high leverage destroys the retail traders and wants to safeguards traders interest hence the peak margin initiative

What is Peak margin?

• SEBI requires brokers to compute & collect the margin requirements using the intraday peak position instead of the erstwhile End of Day (EoD) position

• SEBI requires brokers to compute & collect the margin requirements using the intraday peak position instead of the erstwhile End of Day (EoD) position

How does it affect the broking industry?

•Earlier, just to attract customers, brokerage firms were competing by offering crazy intraday margin

•Now SEBI has made this a level playing field

•But due to lower or no leverage the overall turnover will reduce

•Earlier, just to attract customers, brokerage firms were competing by offering crazy intraday margin

•Now SEBI has made this a level playing field

•But due to lower or no leverage the overall turnover will reduce

How does it impacts us, traders?

• Either maintain higher capital to trade as per his/her original size prior to this peak margin rule or

• Cut down on the positions with his/her existing capital due to no leverage

• Either maintain higher capital to trade as per his/her original size prior to this peak margin rule or

• Cut down on the positions with his/her existing capital due to no leverage

What’s the solution?

Charles Darwin had said – “Survival of the Fittest”

• Arguments can be saved for debates over a cup of coffee

• Accept the fact that there is no leverage

• SEBI incentivizes traders to go for hedged positions resulting in lower margins

Charles Darwin had said – “Survival of the Fittest”

• Arguments can be saved for debates over a cup of coffee

• Accept the fact that there is no leverage

• SEBI incentivizes traders to go for hedged positions resulting in lower margins

• Strategies that can be deployed by option sellers are: Calendars, Iron Fly, Iron Condor, CE or PE Credit Spreads

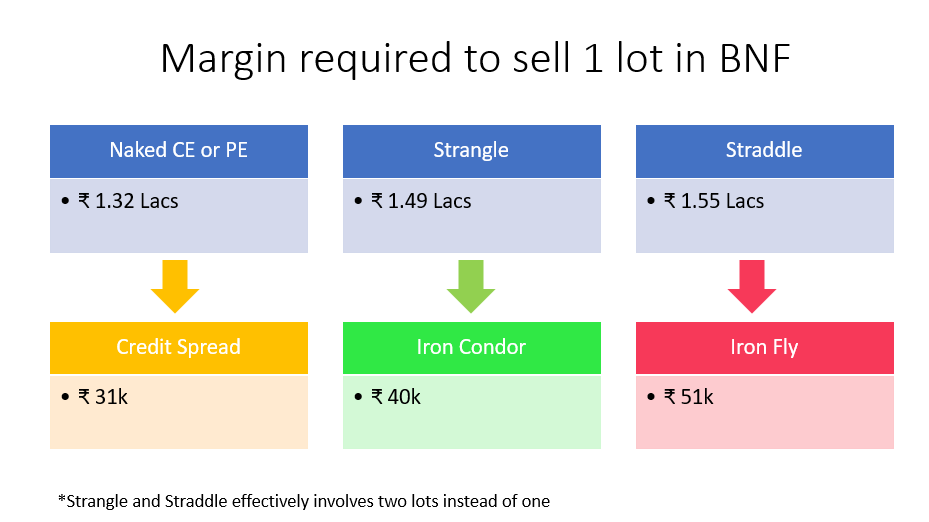

Check the pictures in order:

1) Margin required for selling a naked PE or CE

2) Margin required for selling a Strangle

3) Margin required for selling a Straddle

1) Margin required for selling a naked PE or CE

2) Margin required for selling a Strangle

3) Margin required for selling a Straddle

Check the pictures in order:

1) Margin required for selling a PE Credit Spread

2) Margin required for selling a Iron Condor

3) Margin required for selling a Iron Fly

1) Margin required for selling a PE Credit Spread

2) Margin required for selling a Iron Condor

3) Margin required for selling a Iron Fly

Important aspects on the hedge:

• If the hedge is close to the sold strikes resulting in lower losses and hence lower margin & vice-versa

• However, if you buy a close hedge, the cost of hedge goes up denting your profits, so finding a right balance of risk & reward is crucial

• If the hedge is close to the sold strikes resulting in lower losses and hence lower margin & vice-versa

• However, if you buy a close hedge, the cost of hedge goes up denting your profits, so finding a right balance of risk & reward is crucial

• One can do various permutations & combinations to find the right balance of Risk/Reward as per their position

• Last but not the least, always close your sell leg first to avoid the margin penalty, as now we operate on PEAK MARGIN on intraday basis & not on EoD basis

• Last but not the least, always close your sell leg first to avoid the margin penalty, as now we operate on PEAK MARGIN on intraday basis & not on EoD basis

Final take on peak margins whether its good or bad or worse:

• Each one reserves a right to have an opinion on the same, but the final take-away for us is Adapt or Perish!

• Each one reserves a right to have an opinion on the same, but the final take-away for us is Adapt or Perish!

Hope you enjoyed reading this thread!🤠

Will be posting more such curiosity-inducing threads🧵

Will be posting more such curiosity-inducing threads🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh