📊Mysterious case of the Missing candle

Time for a Thread 🧵

In the past few weeks, many screenshots of the FREAK TRADES are doing rounds on the social media.

Lets understand what causes freak trades and how to dodge them!

Time for a Thread 🧵

In the past few weeks, many screenshots of the FREAK TRADES are doing rounds on the social media.

Lets understand what causes freak trades and how to dodge them!

What is a Freak Trade: 👹

• Freak trade is a trade where the price of the underlying is being traded at a significantly abnormal price for a brief period usually micro seconds & thereafter the underlying again starts trading back to its normal levels

• Freak trade is a trade where the price of the underlying is being traded at a significantly abnormal price for a brief period usually micro seconds & thereafter the underlying again starts trading back to its normal levels

Example of freak trades:

• On Sep 7, 2021, BNF 36000 PE Sep 9, shot up suddenly to ₹750

• The option finally closed at ₹53.65.The option’s day low was 35.25.

• The underlying Bank Nifty Index opened at 36,559, hit a high of 36,686 and low of 36,152 before closing at 36,469

• On Sep 7, 2021, BNF 36000 PE Sep 9, shot up suddenly to ₹750

• The option finally closed at ₹53.65.The option’s day low was 35.25.

• The underlying Bank Nifty Index opened at 36,559, hit a high of 36,686 and low of 36,152 before closing at 36,469

Why such freak trades high does get recorded in the charts at few instances?

• Remember freak trades takes place in micro seconds

• The reversal to normal happens within a few seconds

• Hence it may or may not get captured on the charts 📊

• Remember freak trades takes place in micro seconds

• The reversal to normal happens within a few seconds

• Hence it may or may not get captured on the charts 📊

What is TER & how it works?

• Under trade execution range (TER), whenever the actual price is outside the trade execution range, no trade can be executed until the exchange increases the execution range manually

• Under trade execution range (TER), whenever the actual price is outside the trade execution range, no trade can be executed until the exchange increases the execution range manually

• NSE found it challenging to have a dynamic execution range so no trade could be executed unless the exchange increases the execution range manually

Why Freak trades are a regular phenomenon now?

• The exchange scrapped the TER in mid-August 2021

• NSE decided to follow other global exchanges & removed the restrictions

• To allow demand and supply to determine the price at which a trade gets executed

• The exchange scrapped the TER in mid-August 2021

• NSE decided to follow other global exchanges & removed the restrictions

• To allow demand and supply to determine the price at which a trade gets executed

• Leading to sudden rises and falls in prices triggering the stop loss market orders set by Traders

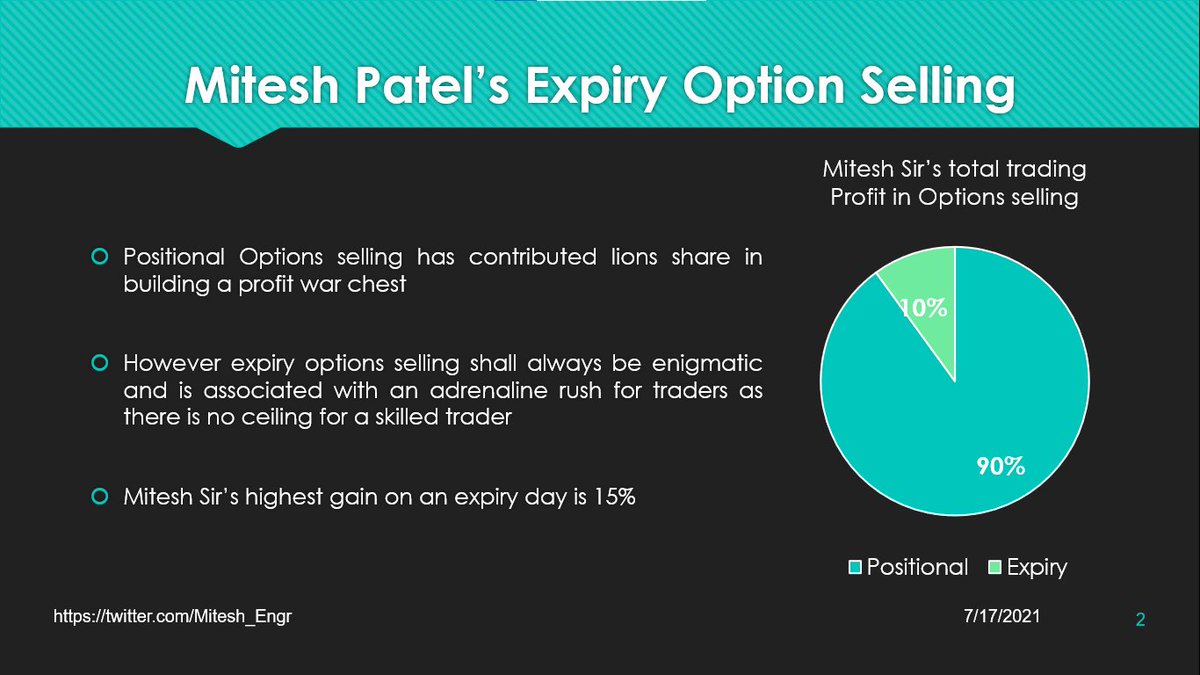

Who are benefited?

• Large whales who place orders in automated manner

• HFT (high frequency traders) usually institutional firms which are into algo trading

• Large whales who place orders in automated manner

• HFT (high frequency traders) usually institutional firms which are into algo trading

What are the possible solutions?

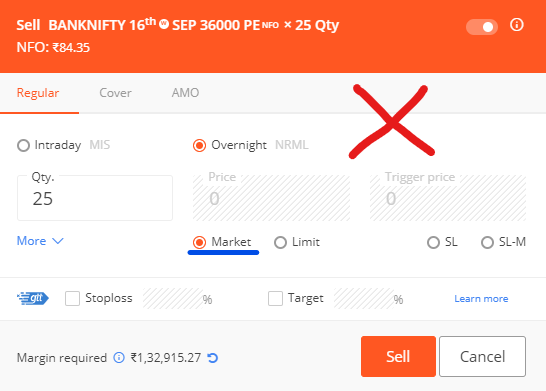

• Entry using limit orders instead of market

• For exits, avoid placing Stop Loss Market (SL-M) orders

• Better to opt for Stop Loss Limit (SL-L) orders

• SL-L order if triggered wont have high impact cost due to freak trades the way SL-M has

• Entry using limit orders instead of market

• For exits, avoid placing Stop Loss Market (SL-M) orders

• Better to opt for Stop Loss Limit (SL-L) orders

• SL-L order if triggered wont have high impact cost due to freak trades the way SL-M has

• If you opt for spreads (proper spread and not for leverage) then SL is not required

Final take, stay safe and dnt fall prey to such whales 🐋by opting for any of the solutions mentioned above

Hope you enjoyed reading this thread! 🤠

Will be posting more such curiosity-inducing threads 🧵

Will be posting more such curiosity-inducing threads 🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh