The Union Cabinet is expected to approve the Production Linked Incentive (PLI) Scheme for Textiles sector of Rs 10,683 crores tomorrow.

A short 🧵on Himatsingka Seide, which operates the world's largest Cotton Spinning plant!

1/12

A short 🧵on Himatsingka Seide, which operates the world's largest Cotton Spinning plant!

1/12

2/12

Himatsingka Seide is an integrated Home Textile player focused on:

✅ Bedding (Bed-Pillow sheets)

✅ Bath (Terry towels)

✅ Drapery

✅ Yarn & Fibre

Branded portfolio constitutes ~90% of sales.

Exports to 32 countries (80% of sales from US); strong focus on Europe.

Himatsingka Seide is an integrated Home Textile player focused on:

✅ Bedding (Bed-Pillow sheets)

✅ Bath (Terry towels)

✅ Drapery

✅ Yarn & Fibre

Branded portfolio constitutes ~90% of sales.

Exports to 32 countries (80% of sales from US); strong focus on Europe.

3/12

Model: Owned private + licensed brands

It has procured manufacturing and distribution rights for 15 top-notch global brands due to its vast distribution network and in-house design capabilities.

In FY21, it has added The Walt Disney co. to its global portfolio in Europe.

Model: Owned private + licensed brands

It has procured manufacturing and distribution rights for 15 top-notch global brands due to its vast distribution network and in-house design capabilities.

In FY21, it has added The Walt Disney co. to its global portfolio in Europe.

4/12

Capacity and utilization: Significant improvement in last 6 months shows improving demand.

1⃣ Bedding (61 Mn metres; 80% utilisation)

2⃣ Terry towel: 25,000 MT (up from ~30% in FY20 to 65% in Q1 FY22)

3⃣ Upholstery (2 Mn metres)

Capacity and utilization: Significant improvement in last 6 months shows improving demand.

1⃣ Bedding (61 Mn metres; 80% utilisation)

2⃣ Terry towel: 25,000 MT (up from ~30% in FY20 to 65% in Q1 FY22)

3⃣ Upholstery (2 Mn metres)

5/12

Capex: Rs 2,500 crs over FY17-FY20 to set up 1 brownfield (bedding) & 2 Greenfield projects (spinning & towels) & this is helping co. to cater for the robust demand from the US.

Note: The capacity of terry towel has reached ~66% in just 14 months of commencement!

Capex: Rs 2,500 crs over FY17-FY20 to set up 1 brownfield (bedding) & 2 Greenfield projects (spinning & towels) & this is helping co. to cater for the robust demand from the US.

Note: The capacity of terry towel has reached ~66% in just 14 months of commencement!

6/12

Management Focus:

📌Broaden portfolio by partnering with more brands

📌Expanding on e-com platforms for reach

📌Price hikes in near-term to cover high RM cost

📌Improve utilization given strong order flows

📌Expand EBITDA to ~20% levels in the next 3 yrs.

📌Debt reduction

Management Focus:

📌Broaden portfolio by partnering with more brands

📌Expanding on e-com platforms for reach

📌Price hikes in near-term to cover high RM cost

📌Improve utilization given strong order flows

📌Expand EBITDA to ~20% levels in the next 3 yrs.

📌Debt reduction

7/12

Sector’s near term tailwinds:

1⃣ Strong demand from US (India & Vietnam are key beneficiaries of China +1 focus)

2⃣ Strong demand from Europe if India allows FTA, with Pakistan’s GSP+ status being withdrawn.

Note: Pakistan exports ~5 Bn Euro of textile & apparels to Europe

Sector’s near term tailwinds:

1⃣ Strong demand from US (India & Vietnam are key beneficiaries of China +1 focus)

2⃣ Strong demand from Europe if India allows FTA, with Pakistan’s GSP+ status being withdrawn.

Note: Pakistan exports ~5 Bn Euro of textile & apparels to Europe

8/12

As Europe is reconsidering its partnership with Pakistan, India might take advantage of this disruption.

#RoSCTL - an export incentive scheme has been extended till Mar’24 so additionally this will also encourage textile exporters as it will improve their revenues by ~5%.

As Europe is reconsidering its partnership with Pakistan, India might take advantage of this disruption.

#RoSCTL - an export incentive scheme has been extended till Mar’24 so additionally this will also encourage textile exporters as it will improve their revenues by ~5%.

9/12

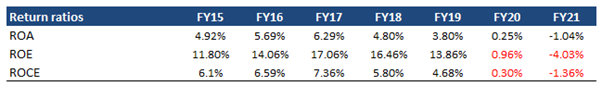

Financials:

While last 2 years have been subdued (see image),

there are signs of uptick with Himatsingka reporting its highest ever quarterly sales and profits in Q1 FY22. The management is targeting 20% EBITDA margins over next 3 years.

screener.in/company/HIMATS…

Financials:

While last 2 years have been subdued (see image),

there are signs of uptick with Himatsingka reporting its highest ever quarterly sales and profits in Q1 FY22. The management is targeting 20% EBITDA margins over next 3 years.

screener.in/company/HIMATS…

10/12

Return ratios:

Given favorable sector tailwinds, Himangsingka Seide might see strong order growth and as utilisation increases, we can expect the return ratios to improve from here.

Return ratios:

Given favorable sector tailwinds, Himangsingka Seide might see strong order growth and as utilisation increases, we can expect the return ratios to improve from here.

11/12

Key risks:

1⃣ High debt - Started deleveraging the balance sheet; debt reduced by 350 cr to 2467 cr in FY21 (still high)

2⃣ High dependence on US markets: Looking to expand in Europe.

Key risks:

1⃣ High debt - Started deleveraging the balance sheet; debt reduced by 350 cr to 2467 cr in FY21 (still high)

2⃣ High dependence on US markets: Looking to expand in Europe.

12/12

Link to the latest Annual report: Good read bseindia.com/bseplus/Annual…

Latest earning call:

bseindia.com/xml-data/corpf…

/end

Link to the latest Annual report: Good read bseindia.com/bseplus/Annual…

Latest earning call:

bseindia.com/xml-data/corpf…

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh