Hello Everyone. This is for everyone, who follows my call @CNBC_Awaaz . I always back the probabilities and try to give few picks which I've the max conviction upon. And my best of intentions is to offer my best. However there will be situations depending upon the market texture

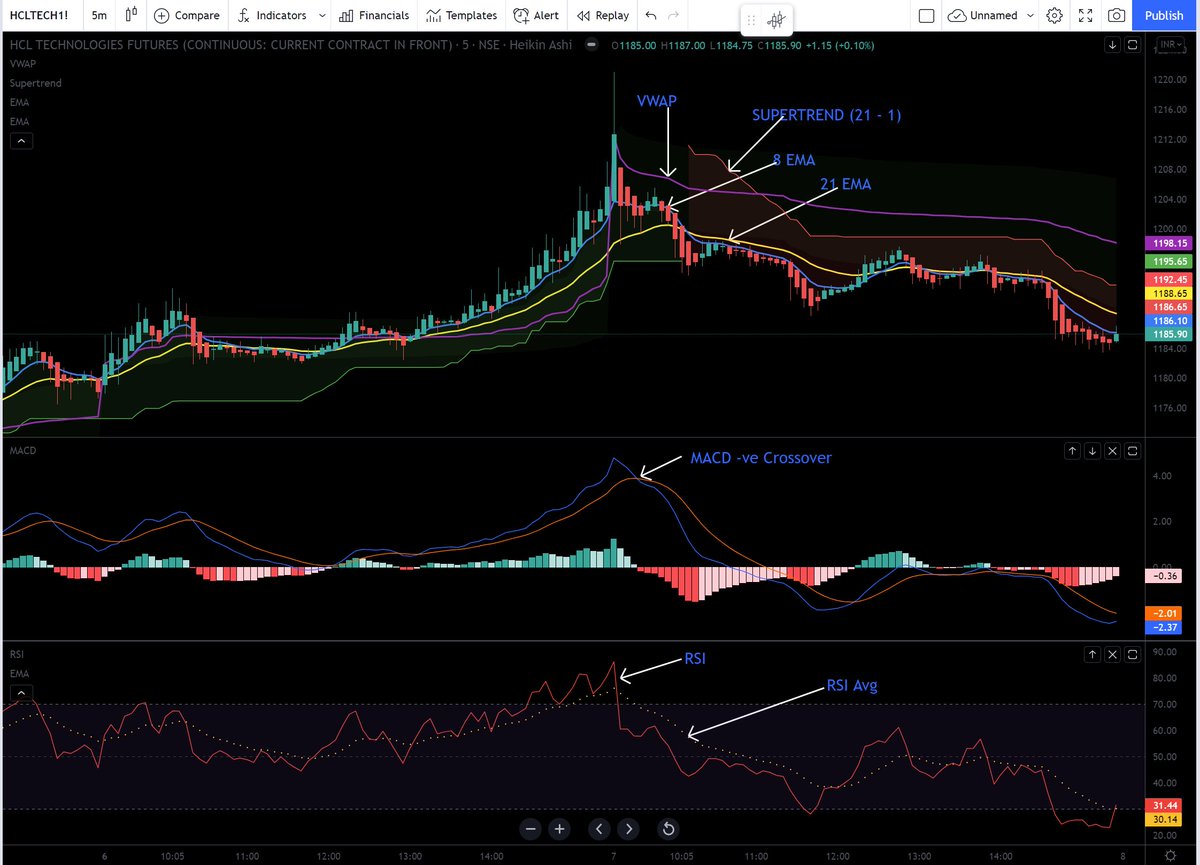

Things will always not go as per plan. HCL Tech was picked up at around 1,200 yesterday 3pm. It made a high in the first 5mnt candle and came down. Now just because the call was given, please ensure to do your due diligence. Below are few pointers, and these can be applicable

to any of the trades you might have at your end. Try to follow these basic rules at least to save yourself from any major loss.

1: Check the HK Candles, see the body size & color continuation of candles.

2: Price Below VWAP (Avoid longs, or bring SLs closer). A must follow rule

1: Check the HK Candles, see the body size & color continuation of candles.

2: Price Below VWAP (Avoid longs, or bring SLs closer). A must follow rule

3:ST (21/1) B/S signals must keep you on check

4: 8 Below 21 EMA should be a cause of concern

5: MACD Negative crossover must be also giving you a warning

6: RSI below RSI Avg. must keep your SLs tight or exit longs

Hopefully these are self explanatory. Follow these and

4: 8 Below 21 EMA should be a cause of concern

5: MACD Negative crossover must be also giving you a warning

6: RSI below RSI Avg. must keep your SLs tight or exit longs

Hopefully these are self explanatory. Follow these and

Add a layer of Options Data Reading, most of the times you will be in the right side of the market.

Finding a trade is the most easiest thing to do, managing a trade is another skillset all together. Own the time frame as per your wish (like 5 / 15 mints) for intra.

Finding a trade is the most easiest thing to do, managing a trade is another skillset all together. Own the time frame as per your wish (like 5 / 15 mints) for intra.

If you don't change the way you trade you will never be able to get the rewards that you always want to. Please follow at least this basic setup and you should be fine. Always do your own due-diligence. My long trade for HCL TECH..

Cheers

Cheers

• • •

Missing some Tweet in this thread? You can try to

force a refresh