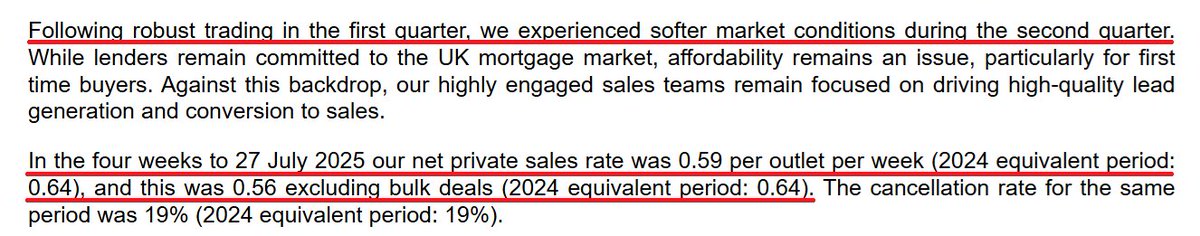

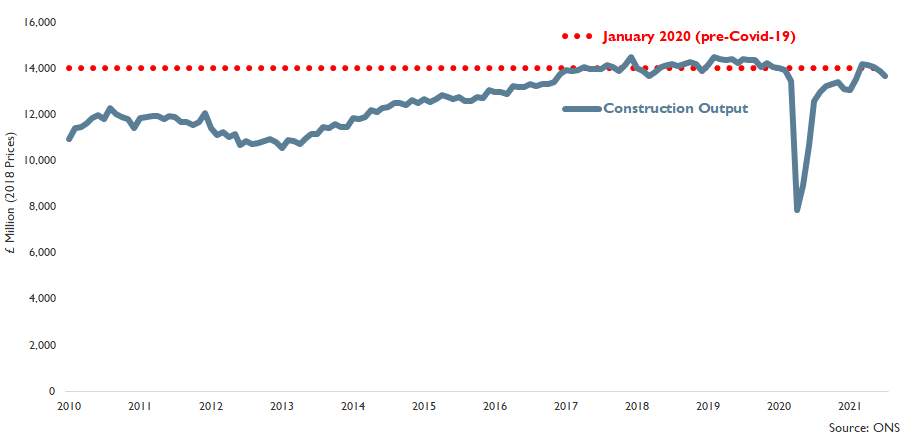

According to the ONS, construction output fell 1.6% in July 2021. It has fallen for 4 consecutive months & is 2.5% lower than in January 2020 although note the ONS appears to have issues estimating private housing output...

#ukconstruction #construction

ons.gov.uk/businessindust…

#ukconstruction #construction

ons.gov.uk/businessindust…

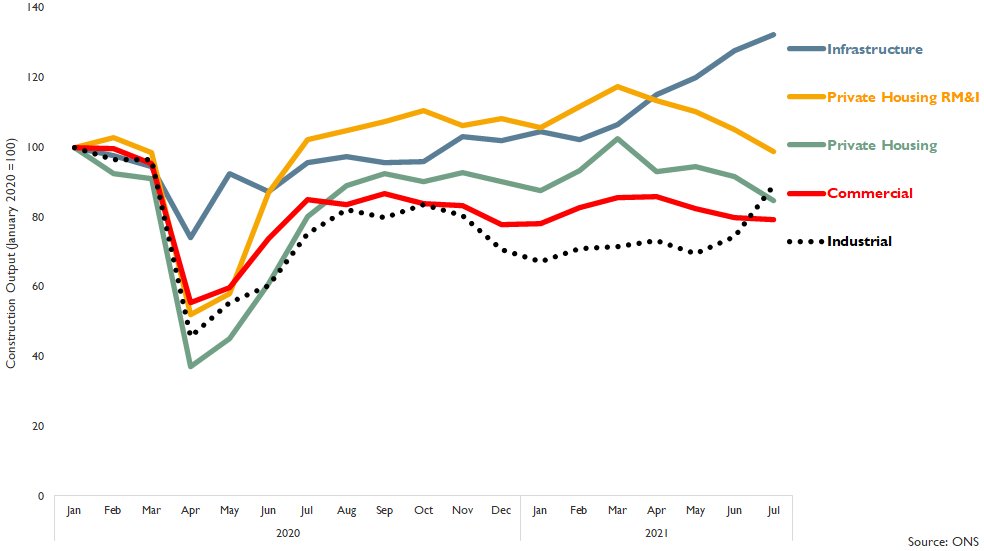

Looking across the sectors, the main contributors to the 1.6% fall in total construction output in July were private housing (-7.5%) & private housing repair, maintenance & improvement (rm&i) whilst the largest rise was in industrial (warehouses)...

#ukconstruction #construction

#ukconstruction #construction

Looking at the evolution of construction output in the key sectors since Covid-19, infrastructure continues to go from strength to strength whilst industrial is rising sharply from a low base as warehouse projects are finally coming through &...

#ukconstruction #construction

#ukconstruction #construction

... commercial new build activity remains subdued as would be expected but the key issues revolve around the private housing new build & private housing repair, maintenance & improvement (rm&i) sectors...

#ukconstruction #construction

#ukconstruction #construction

... commercial new build activity remains subdued as would be expected but the key issues revolve around the private housing new build & private housing repair, maintenance & improvement (rm&i) sectors...

#ukconstruction #construction

#ukconstruction #construction

Private housing rm&i output has been falling for 4 consecutive months, since its recent peak in March 2021 (boosted by catch-up in activity after the rain-affected February). The poor weather hasn't helped in recent months but...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

... the key reason for the decline in private housing rm&i activity has been supply issues, primarily the cost & availability of materials & products but also in some key areas skills shortages have delayed activity...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

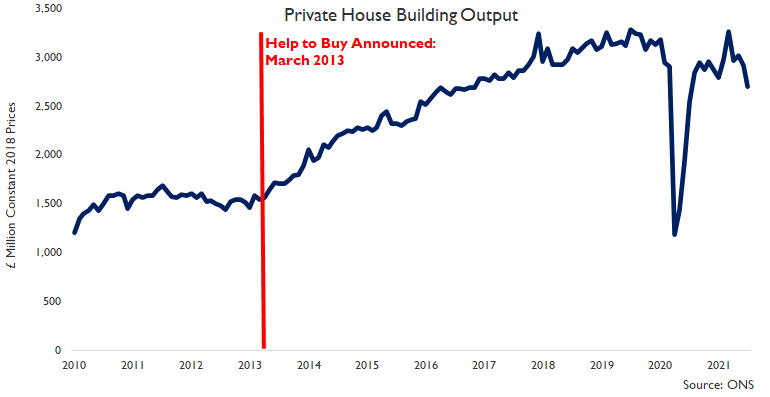

The ONS estimate of the sharp decline in private housing output is considerably more difficult to account for. Not just the 7.5% fall in July but the ONS estimate that private housing output in July was 17.2% lower than in March & ...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

... the ONS estimate that private housing output is at its lowest level since July 2020 (just after the initial lockdown). None are in line with the Housing PMI, indications from house builder trading statements & data (brick sales etc)...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

... & just as a couple of examples, it is worth noting that although brick sales fell in July 2021, they remained 6.7% higher than in 2019 & ...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

https://twitter.com/NobleFrancis/status/1435159910363377665?s=20

... whilst the IHS Markit/CIPS Housing PMI in July was 60.3 (50=no monthly change), illustrating growth, albeit at rates slower than in previous months so I would be wary of the ONS private housing estimate...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

https://twitter.com/NobleFrancis/status/1423201765651005443?s=20

... House builders have been affected by the availability of materials, products & labour although less so than in rm&i &, in particular, less so for major house builders given set allocations & the ability to plan/purchase in advance...

#ukconstruction #construction #ukhousing

#ukconstruction #construction #ukhousing

... Infrastructure output in July 2021 was 3.7% higher than in June & 32.4% higher than in January 2020 (pre-Covid-19) as activity continues to rise based on major projects (HS2, Hinkley Point C, Thames Tideway) as well as...

#ukconstruction #construction #ukinfrastructure

#ukconstruction #construction #ukinfrastructure

... frameworks & long-term programmes of small & medium size projects within regulated sectors such as water, roads, rail, energy etc. plus some ports work (refurbishment/expansion & free ports)...

#ukconstruction #construction #ukinfrastructure

#ukconstruction #construction #ukinfrastructure

Commercial output in July was 0.7% lower than in June & it remained 20.7% lower than in January 2020 but note that it is currently a two-speed sector with many contractors reporting strong workloads & others reporting subdued activity...

#ukconstruction #construction

#ukconstruction #construction

... & contractors working on the renewing, reusing & repurposing of existing offices, retail & leisure buildings still report that activity is relatively buoyant although skills shortages are a key constraint, particularly in London, whilst...

#ukconstruction #construction

#ukconstruction #construction

... whilst new commercial towers activity (36% of which is in London) is not only subdued but falling due to projects that were signed up to or started pre-Covid-19 finishing this year with fewer new towers projects in the pipeline to replace them.

#ukconstruction #construction

#ukconstruction #construction

@threadreaderapp Unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh