🎯

How understand world of investing and capital through the lens of Cycles..

Time for a thread on an amazing book "CAPITAL RETURNS"..

Capital is the engine of all cycles if you think about it..

And we need framework around it.. which is

(1/n)

🧵🧵🧵

amzn.to/38ZlhE1

How understand world of investing and capital through the lens of Cycles..

Time for a thread on an amazing book "CAPITAL RETURNS"..

Capital is the engine of all cycles if you think about it..

And we need framework around it.. which is

(1/n)

🧵🧵🧵

amzn.to/38ZlhE1

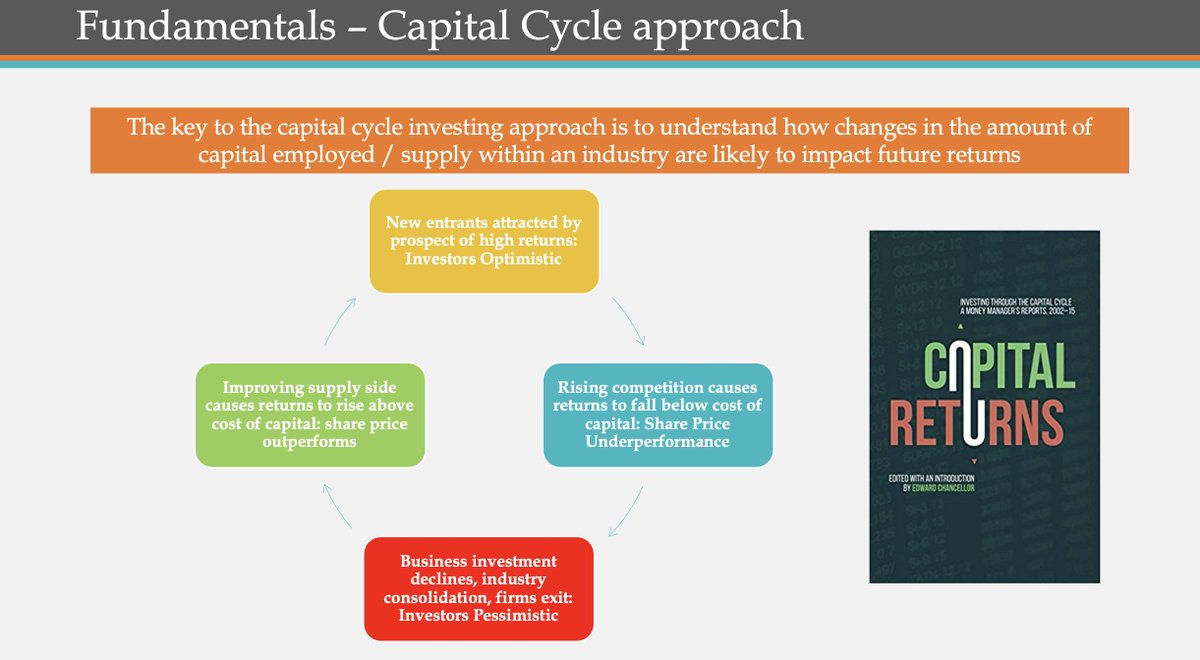

Theme of this book how capital cycles can help predict periods of booms and bursts for an industry.

If you can understand these 4 stages

You can understand how changes in amount of capital employed / supply within any industry are likely to impact future returns..

How?

(2/n)

If you can understand these 4 stages

You can understand how changes in amount of capital employed / supply within any industry are likely to impact future returns..

How?

(2/n)

Ultimately, it's all about demand and supply...world, countries, economies, companies, products

Stage-1: New investors in any sector/industry gets attracted by prospects of high returns

Think about startups around us...they see problems..they see opportunities..

Next is

(3/n)

Stage-1: New investors in any sector/industry gets attracted by prospects of high returns

Think about startups around us...they see problems..they see opportunities..

Next is

(3/n)

Stage-2: Rising competition causes returns to fall below cost of capital: Share Price Underperformance

Stage-3: Business investment declines, industry consolidation, firms exit: Investors Pessimistic

There is problem now...

(4/n)

Stage-3: Business investment declines, industry consolidation, firms exit: Investors Pessimistic

There is problem now...

(4/n)

Stage 3 is where you will see consolidation and major pain...

See what's happening to telecom industry currently..and see how it was in step-1 10 years back...we had telenor, tata, aircel, videocon and many more players jumping in..

what next? Is pain forever?

(5/n)

See what's happening to telecom industry currently..and see how it was in step-1 10 years back...we had telenor, tata, aircel, videocon and many more players jumping in..

what next? Is pain forever?

(5/n)

Ofcourse not...it's all CYCLICAL ultimately...

Capital returns eventually 😀

Stage-4: Improving supply side causes returns to rise above cost of capital: share price outperforms

This is the best stage to be in..infact somewhere between stage 3 and stage 4...

(6/n)

Capital returns eventually 😀

Stage-4: Improving supply side causes returns to rise above cost of capital: share price outperforms

This is the best stage to be in..infact somewhere between stage 3 and stage 4...

(6/n)

If you want to apply this in highly cyclical sectors, it's stage where companies are still in losses but it's decreasing...

That's where you get biggest delta and stock price appreciation if sector turns around...

Ofcourse sometimes it's long wait as well..

(7/n)

That's where you get biggest delta and stock price appreciation if sector turns around...

Ofcourse sometimes it's long wait as well..

(7/n)

This is where price volume action coupled with fundamental knowledge of sectors can help you to reduce wait time... #TechnoFunda

This capital cycle strategy encourages investors to eschew the simple ‘growth’ and ‘value’ dichotomy..

(8/n)

This capital cycle strategy encourages investors to eschew the simple ‘growth’ and ‘value’ dichotomy..

(8/n)

This helps to identify firms that can deliver superior returns either because capital has been taken out of an industry, or because the business has strong barriers to entry (what Warren Buffett refers to as a ‘moat’)

Very powerful...isn't it...read on..

(9/n)

Very powerful...isn't it...read on..

(9/n)

The key to the “capital cycle” approach is to analyse how the competitive position of a company is affected by changes in the industry’s supply side

Studying competitive advantages along with Porter's 5 forces can be very powerful here...

What are the forces to study?

(10/n)

Studying competitive advantages along with Porter's 5 forces can be very powerful here...

What are the forces to study?

(10/n)

1. Bargaining power of suppliers and 2. of buyers

3. Threat of substitution

4. Rivalry among existing firms and

5. Threat of new entrants

Most investors devote more time to thinking about demand than supply.

Truth is - demand is more difficult to forecast than supply.

(11/n)

3. Threat of substitution

4. Rivalry among existing firms and

5. Threat of new entrants

Most investors devote more time to thinking about demand than supply.

Truth is - demand is more difficult to forecast than supply.

(11/n)

Changes in supply drive industry profitability. Stock prices often fail to anticipate shifts in the supply side

Few more important points to note:

- Management's capital allocation skills also play important role on how company can take benefit of capital cycles

And..

(12/n)

Few more important points to note:

- Management's capital allocation skills also play important role on how company can take benefit of capital cycles

And..

(12/n)

- Note that new technologies can also disrupt the normal operation of the capital cycle.

- Long-term investors are better suited to applying the capital cycle approach on longer cycles and play megatrends

And finally...

(13/n)

- Long-term investors are better suited to applying the capital cycle approach on longer cycles and play megatrends

And finally...

(13/n)

The ideal capital cycle opportunity for us has often been one in which a small number of large players evolve from a situation of excess competition and exert what is euphemistically called “pricing discipline.”

Hope you enjoyed reading..stay connected..

technofunda.co/connect

Hope you enjoyed reading..stay connected..

technofunda.co/connect

• • •

Missing some Tweet in this thread? You can try to

force a refresh