Special thanks to 50k Twitter Friends...

You have all been inspiration for my learning journey.

My sincere gratitude to all 🙏

Here is return gift of thread of threads to reflect on my journey.

Hope you will enjoy it...Don't forget to bookmark this memories..

Here you go..

You have all been inspiration for my learning journey.

My sincere gratitude to all 🙏

Here is return gift of thread of threads to reflect on my journey.

Hope you will enjoy it...Don't forget to bookmark this memories..

Here you go..

1>> How LOW PE stocks can also be expensive...

This was curated to help investors stay away from value traps and build focus on growth investing mindset...

This was curated to help investors stay away from value traps and build focus on growth investing mindset...

https://twitter.com/MashraniVivek/status/1383074226890891272

2>> 15 lies that the world feeds every investor...!!

This was on mindset and psychology.

How as an investor we can remove our biases given by somebody who mostly have never done it.

This was on mindset and psychology.

How as an investor we can remove our biases given by somebody who mostly have never done it.

https://twitter.com/MashraniVivek/status/1351916017358839808

3>> A super awesome thread on megatrend that is shifting the world in drastic way...

What's that??

These are platform businesses....READ ON...

What's that??

These are platform businesses....READ ON...

https://twitter.com/MashraniVivek/status/1322208859264413703

4>> Invest - Books - Wisdom....all are inter-connected

Here are 10 BEST BOOKS FOR STOCK INVESTING

This gives immense diversity in terms of stock selection, sector identification, application of technical analysis, position sizing and risk-reward..

Here are 10 BEST BOOKS FOR STOCK INVESTING

This gives immense diversity in terms of stock selection, sector identification, application of technical analysis, position sizing and risk-reward..

https://twitter.com/TechnoFunda_IN/status/1316611785315680256

5 >> Protecting Downside and Capital Protection ensures best investing outcome

Here is the thread to understand various accounting manipulations and checks you should do...

>> First things first - CAPITAL PROTECTION is of utmost importance

READ ON..

Here is the thread to understand various accounting manipulations and checks you should do...

>> First things first - CAPITAL PROTECTION is of utmost importance

READ ON..

https://twitter.com/MashraniVivek/status/1310971881420333056

6>> Thread on sector dynamics and selection...only for educational purpose...personal views...

Some interesting sectors currently are...

Some interesting sectors currently are...

https://twitter.com/MashraniVivek/status/1308335142826438656

8>> What happens when you go behind DIVIDEND YIELD ignoring GROWTH...

Educational thread based on learning from Mr. Market...

READ ON..

Educational thread based on learning from Mr. Market...

READ ON..

https://twitter.com/MashraniVivek/status/1305759655272968192

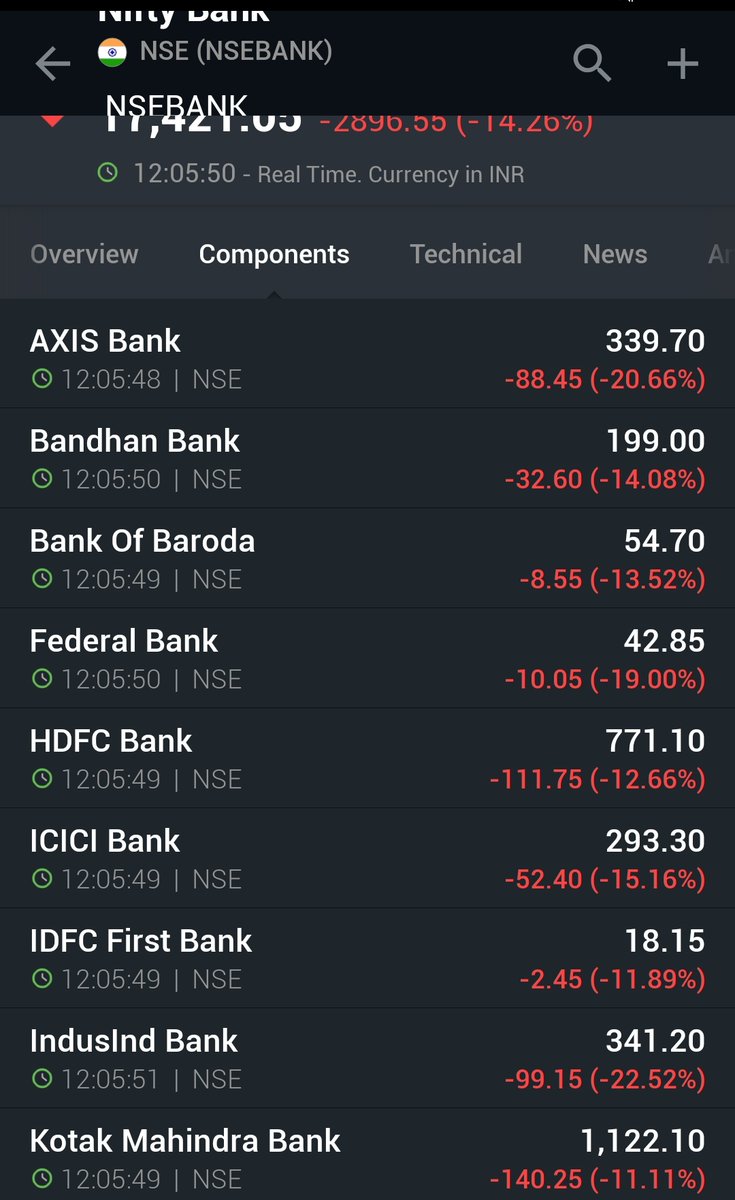

9>> Lessons of bull market....thinking to create a thread where I will keep posting on euphoria phase we all had been into.

No offense to anyone, we all are human and we make mistakes, just for serious learning.

No offense to anyone, we all are human and we make mistakes, just for serious learning.

https://twitter.com/MashraniVivek/status/1245284547677188096

10>> Special thanks to all who encouraged me in my journey, motivated me and helped in my learning journey..

And I feel, it's just the beginning...

Let's keep collaborating to grow together..

Let's stay connected: linktr.ee/technofunda

And I feel, it's just the beginning...

Let's keep collaborating to grow together..

Let's stay connected: linktr.ee/technofunda

• • •

Missing some Tweet in this thread? You can try to

force a refresh