One of the best proposals in the current legislative negotiations was Chris Coons' Industrial Finance Corporation - a $500 billion national development bank that could fund decarbonization and reshoring of supply chains. See @yayitsrob here:

theatlantic.com/science/archiv…

theatlantic.com/science/archiv…

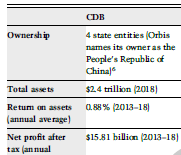

The proposal would have put the US about even with KfW - the German development bank that @Thomas_Marois has written extensively about.

And it's not just $500 billion in direct lending and investing capacity: the Coons proposal would have crowded in lots of private investment that would otherwise go into socially wasteful activities.

coons.senate.gov/news/press-rel…

coons.senate.gov/news/press-rel…

That's trillions of bucks that could have helped execute the administration's ambitious supply chain plans...

https://twitter.com/toddntucker/status/1402284881095311361

And gets the topline spending closer to what many climate advocates say is necessary to deliver fuller decarbonization.

https://twitter.com/Ben_Beachy/status/1425559118887198723

Unfortunately, it does not seem like the Industrial Finance Corporation proposal made it into the $3.5 trillion reconciliation bill working its way through Congress. (See absence from the House Financial Services Committee draft text.)

docs.house.gov/meetings/BA/BA…

docs.house.gov/meetings/BA/BA…

Assuming that omission lasts, other legislative vehicles like the National Defense Authorization Act or the bipartisan US Innovation and Competition Act should be contemplated.

democrats.senate.gov/newsroom/press…

democrats.senate.gov/newsroom/press…

Here's the link to Thomas' book, about which more forthcoming.

https://twitter.com/Thomas_Marois/status/1436386185476255761?s=19

Another apparent reconciliation casualty: White House asked for $50 billion for supply chain resilience, but House Energy and Commerce only appropriates one fifth that.

whitehouse.gov/briefing-room/…

whitehouse.gov/briefing-room/…

And instead of a national green bank that could leverage $27.5 billion in appropriations into $275 billion in lending capacity, we're getting a national green grantmaker that will share $27.5 billion with state green banks. So some indirect but no direct leverage, as I read it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh