What is inside the Black Box?

A thread about the @missingfrontier and @missingwatcher covering:

- What is GameFi?

- What is Frontier?

- What is in the Black Box?

- What are Flash Blocks?

- Who is The Watcher?

- What is $DATA utility token?

- When can you play?

- Should you ape?

A thread about the @missingfrontier and @missingwatcher covering:

- What is GameFi?

- What is Frontier?

- What is in the Black Box?

- What are Flash Blocks?

- Who is The Watcher?

- What is $DATA utility token?

- When can you play?

- Should you ape?

1. What is GameFi?

It’s like DeFi but with games.

You collect items and solve puzzles. Along the way you earn more crypto assets + the assets you bought become more valuable.

Remember how World of Warcraft characters would sell for $10k in 2007?

This is that on steroids.

It’s like DeFi but with games.

You collect items and solve puzzles. Along the way you earn more crypto assets + the assets you bought become more valuable.

Remember how World of Warcraft characters would sell for $10k in 2007?

This is that on steroids.

2. What is Frontier?

A community driven Player versus Player (PvP) online game.

The founder says: “we are sitting on an Riot Games of NFT level opportunity by turning the Browser Game into a competitive AAA game”

Here’s a preview of product quality and what to expect.

A community driven Player versus Player (PvP) online game.

The founder says: “we are sitting on an Riot Games of NFT level opportunity by turning the Browser Game into a competitive AAA game”

Here’s a preview of product quality and what to expect.

https://twitter.com/missingfrontier/status/1436369337967947779

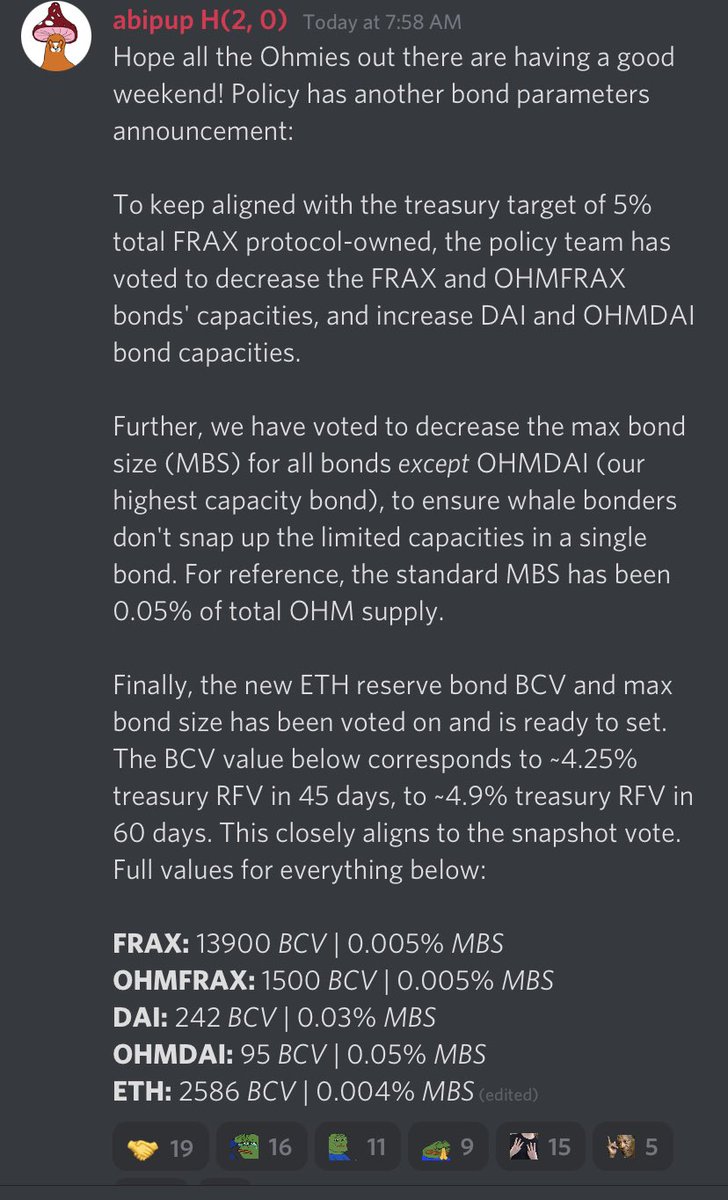

3. What is in the Black Box?

Folks holding the Black Box on a certain date will get The Data Key.

Those holding Black Box + The Watcher (shown here) will get The Data Key [Stellar Edition]

When you open a Black Box you will be able to mint 2 Flash Blocks.

Folks holding the Black Box on a certain date will get The Data Key.

Those holding Black Box + The Watcher (shown here) will get The Data Key [Stellar Edition]

When you open a Black Box you will be able to mint 2 Flash Blocks.

4. What are Flash Blocks?

Weapons, shields and abilities you can use during the game.

Whether you are attacking or defending a sector, you will be offered the opportunity to use three of them.

Depending on their effects, you can dramatically impact the outcome of a battle.

Weapons, shields and abilities you can use during the game.

Whether you are attacking or defending a sector, you will be offered the opportunity to use three of them.

Depending on their effects, you can dramatically impact the outcome of a battle.

5. Who is The Watcher?

The Watcher S/N 404 is a mysterious entity sent out for a mission on TRIUMPH-1.

The community controls the hero and experience his story.

NFT Collectors receive handmade physical pieces that are unique to each episode.

Here’s where the story is at:

6.

The Watcher S/N 404 is a mysterious entity sent out for a mission on TRIUMPH-1.

The community controls the hero and experience his story.

NFT Collectors receive handmade physical pieces that are unique to each episode.

Here’s where the story is at:

6.

https://twitter.com/missingwatcher/status/1430245755801964555

6. What is the $DATA utility token?

$DATA Tokens will provide:

✚ Airdrops (20% and royalties)

✚ In-Game Utility such as voting power

✚ Official Ownership (+IP)

✚ Copyrights allowing you to create and sell Frontier-related products

✚ Token Valuation

$DATA Tokens will provide:

✚ Airdrops (20% and royalties)

✚ In-Game Utility such as voting power

✚ Official Ownership (+IP)

✚ Copyrights allowing you to create and sell Frontier-related products

✚ Token Valuation

7. When can you play?

TBD. For now you can join the discord server and find most info there.

Both the Watcher and Black Boxes are on @opensea and @rarible for purchase. Including OpenSea links here.

1. opensea.io/collection/fro…

2. opensea.io/THE_WATCHER?id…

discord.gg/thewatch

TBD. For now you can join the discord server and find most info there.

Both the Watcher and Black Boxes are on @opensea and @rarible for purchase. Including OpenSea links here.

1. opensea.io/collection/fro…

2. opensea.io/THE_WATCHER?id…

discord.gg/thewatch

8. Should you ape?

Here’s a framework I found thanks to @DoughYeasty

Key questions are:

1. Is it a breakthrough project?

2. Is it credible?

3. Are there incentives or utility?

4. What is collectibility quotient?

5. Aesthetically pleasing?

NFA/DYOR

medium.com/@yeastydough/a…

Here’s a framework I found thanks to @DoughYeasty

Key questions are:

1. Is it a breakthrough project?

2. Is it credible?

3. Are there incentives or utility?

4. What is collectibility quotient?

5. Aesthetically pleasing?

NFA/DYOR

medium.com/@yeastydough/a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh