Why @KlimaDAO matters.

The price of carbon credits varies widely from $1-$50 per, averages at $3-5/ton today. Price depends on:

1. Type of carbon offset project,

2. Carbon standard under which it was developed,

3. Location of offset,

4. Vintage year

5. Co-benefits

The price of carbon credits varies widely from $1-$50 per, averages at $3-5/ton today. Price depends on:

1. Type of carbon offset project,

2. Carbon standard under which it was developed,

3. Location of offset,

4. Vintage year

5. Co-benefits

Klima DAO will tokenise varified carbon credits into Tokenized Carbon Tons (TCT).

Every TCT will be backed by at least 1 tonne of CO2 credit.

When a TCT is brought on-chain, it will be removed from the off-chain database.

Every TCT will be backed by at least 1 tonne of CO2 credit.

When a TCT is brought on-chain, it will be removed from the off-chain database.

Using Creol’s open-source carbon-credit-tokeniser, Klima DAO will onboard Verified Carbon Units (VCUs) from the Verra Registry in to the ecosystem as TCTs.

Vera Registry has issued 760 million tons of VCUs and it was launched in 2020.

Vera Registry has issued 760 million tons of VCUs and it was launched in 2020.

According to Trove Research and University College London, the current surplus of carbon credits could be quickly eroded, with demand of carbon credits expected to increase 5-10x over the next decade as companies seek to deliver on zero emissions pledges.

greenbiz.com/article/carbon…

greenbiz.com/article/carbon…

@KlimaDAO's buy pressure on carbon credits will cause the value of carbon credits and $KLIMA token to rise.

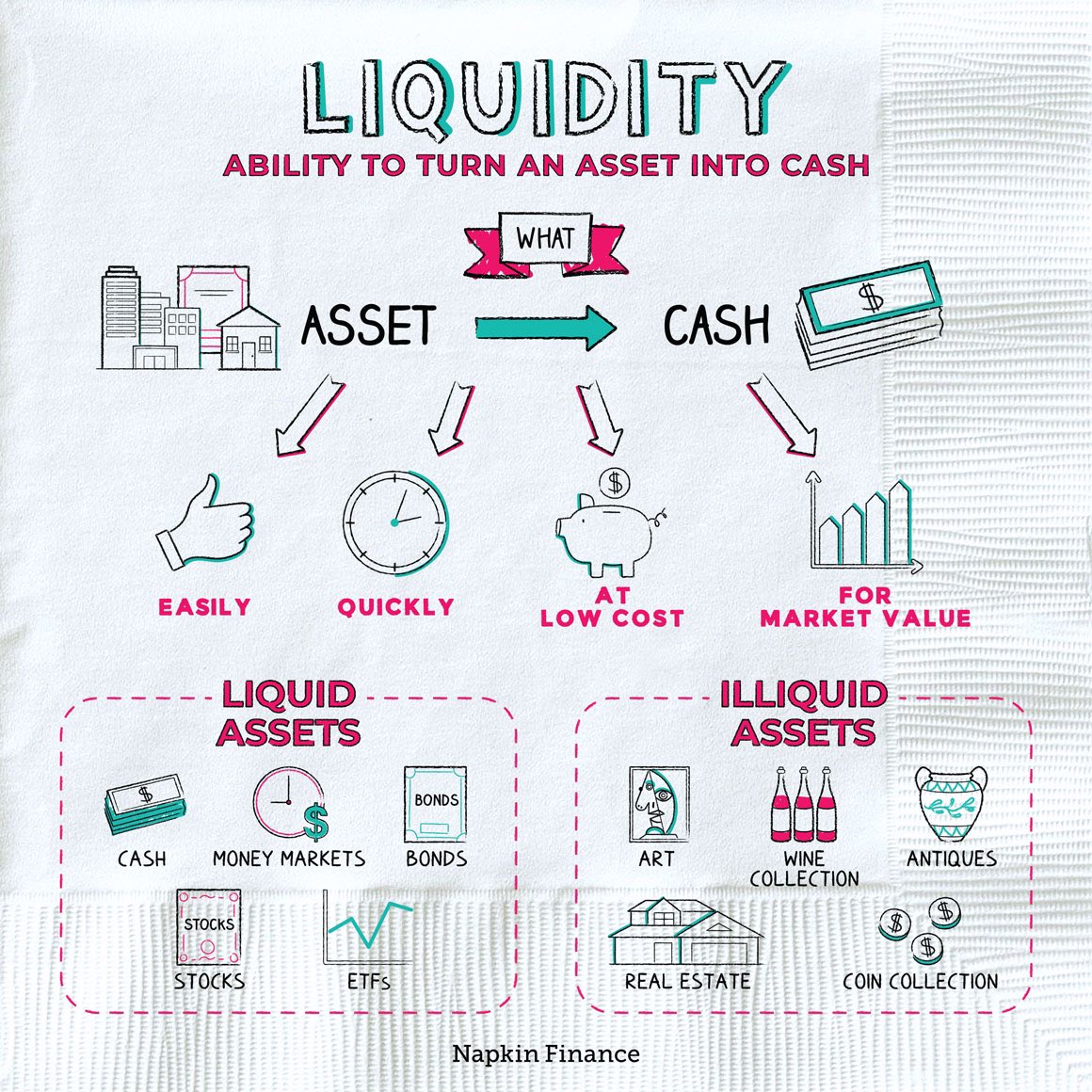

The $KLIMA token will likely trade at premium over Market Value of TCTs because $KLIMA will be more liquid, on-chain and standardized

The $KLIMA token will likely trade at premium over Market Value of TCTs because $KLIMA will be more liquid, on-chain and standardized

Company CFOs will prefer holding $KLIMA tokens on their balance sheet vs off-chain credits because mark-to-market accounting for $KLIMA will be easier due to on-chain liquidity

Carbon offset project developers will prefer selling CO2 credits to $KLIMA for similar reasons.

Carbon offset project developers will prefer selling CO2 credits to $KLIMA for similar reasons.

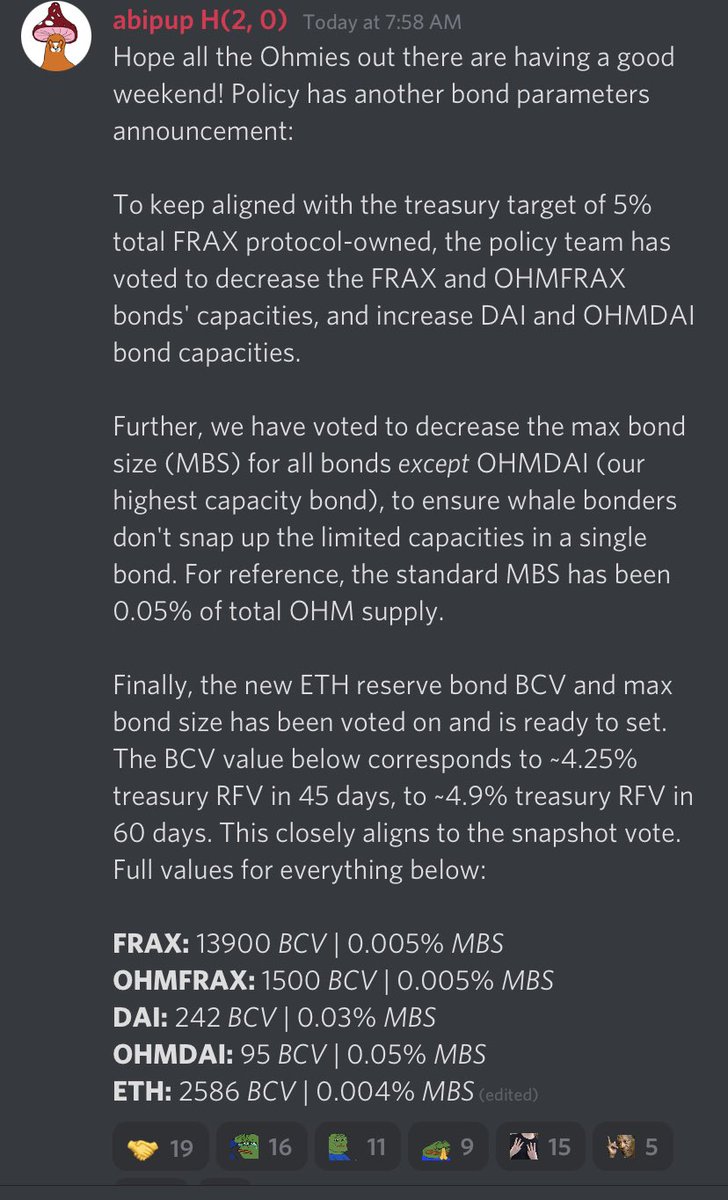

@KlimaDAO has a fiercely capable Ohmies community cheering for it as well because @OlympusDAO holds 70 million $pKLIMA, which is an option to convert to $KLIMA.

$OHM amassed a $147 mm Treasury + $102 mm in liquidity in 5.5 months.

How many CO2 tons will $KLIMA have in 1 year?

$OHM amassed a $147 mm Treasury + $102 mm in liquidity in 5.5 months.

How many CO2 tons will $KLIMA have in 1 year?

About 30-60 million tons is my estimate if trajectory is in line with $OHM (I see no reason why it won't be).

So this piece of code is saying, I can create capability to buy 30-60 million tons of CO2 in yr 1.

That's ~3% of all CO2 emitted by air travel atag.org/facts-figures.…

So this piece of code is saying, I can create capability to buy 30-60 million tons of CO2 in yr 1.

That's ~3% of all CO2 emitted by air travel atag.org/facts-figures.…

It won't stop there.

In time, @KlimaDAO could start pulling in 200-300 million tons of CO2 per year. At $30/ton, that's $6-9 billion per year!

Unlike other holders of such credits, $KLIMA will literally eat up credits and never give them out.

In time, @KlimaDAO could start pulling in 200-300 million tons of CO2 per year. At $30/ton, that's $6-9 billion per year!

Unlike other holders of such credits, $KLIMA will literally eat up credits and never give them out.

Imagine a $KLIMA treasury with a billion tons of CO2 with price / ton at $50.

$50 billion Treasury Market Value!

What's the market cap then? $200-300 bn?

Point being, $KLIMA can be incredibly huge because it's using the $OHM mechanism to buy CO2 credits.

$50 billion Treasury Market Value!

What's the market cap then? $200-300 bn?

Point being, $KLIMA can be incredibly huge because it's using the $OHM mechanism to buy CO2 credits.

The $OHM mechanism has proven that it can eat up USD at a rate of $15-20 million per month while owning its liquidity.

That's 3-4 million tons of CO2 per month. For context: San Francisco and New York produce 1.5 million tons / month.

State of Texas does 50 million tons / month

That's 3-4 million tons of CO2 per month. For context: San Francisco and New York produce 1.5 million tons / month.

State of Texas does 50 million tons / month

Best part? $KLIMA will be community run.

Some of the smartest people I know are Klimates because many Klimates are also Ohmies. And Ohmies are by far the smartest, most capable people I've ever worked with.

Great team, great design, compelling vision and product-market fit.

Some of the smartest people I know are Klimates because many Klimates are also Ohmies. And Ohmies are by far the smartest, most capable people I've ever worked with.

Great team, great design, compelling vision and product-market fit.

$KLIMA matters because it can actually create a meaningful "dent" in the climate change problem.

This isn't financial advice. This is an experiment. It's very risky, it's speculative. But to me, it looks like a damn good bet.

Good luck @ArchimedesCryp1 and team!

This isn't financial advice. This is an experiment. It's very risky, it's speculative. But to me, it looks like a damn good bet.

Good luck @ArchimedesCryp1 and team!

Forgot to emphasize one important detail.

1 $KLIMA will always be backed by 1 TCT and when $KLIMA is staked it will pay staking rewards same way as $OHM does.

Question is: do tokenized carbon credits belong in your portfolio? If yes then what %age is a fair allocation? Hmmmm.

1 $KLIMA will always be backed by 1 TCT and when $KLIMA is staked it will pay staking rewards same way as $OHM does.

Question is: do tokenized carbon credits belong in your portfolio? If yes then what %age is a fair allocation? Hmmmm.

And in case this part isn't obvious. A high price of carbon credits = more people willing to invest in carbon offsetting investments such as power plants installing a Heat Recovery Steam Generator or a home installing solar.

Up front cost gets off-set by selling carbon credits.

Up front cost gets off-set by selling carbon credits.

Home owners for example could get verified CO2 credits and use those to sell to get on the Vera Registry, from there $KLIMA can be obtained.

All this will reduce the "pay-back" period of a green energy investment which always requires up front capital.

All this will reduce the "pay-back" period of a green energy investment which always requires up front capital.

• • •

Missing some Tweet in this thread? You can try to

force a refresh