1/ My thoughts on the $CRYPTO market for the upcoming week, Tuesday is a BIG day!👇

Sponsored by @Delta_Exchange

'Fear and Indecisiveness'

Sponsored by @Delta_Exchange

'Fear and Indecisiveness'

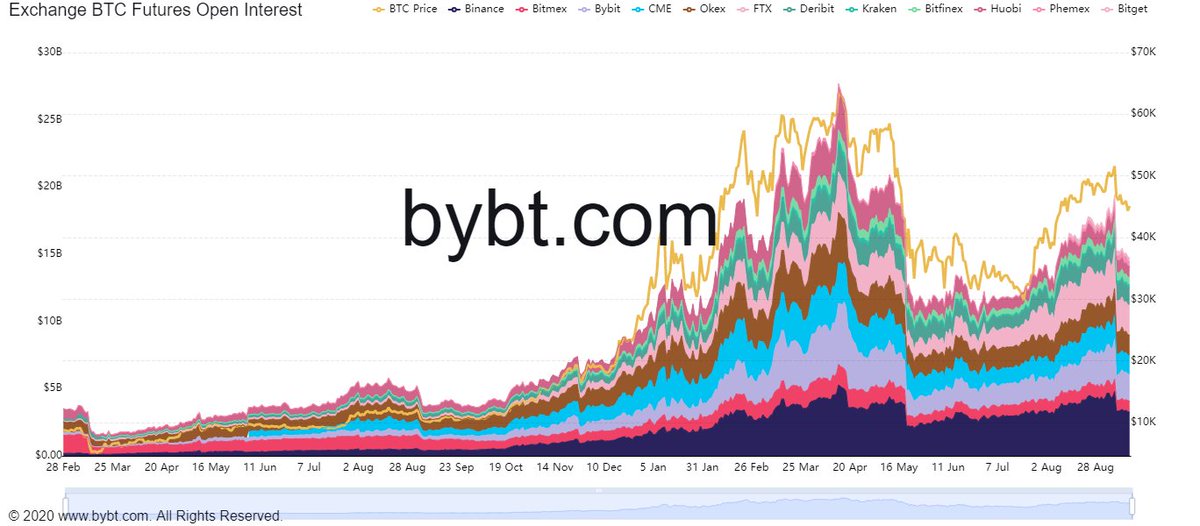

2/ The Crypto markets have shifted into a range-bound environment following last week’s mass liquidation event in the crypto derivatives market.

Since the 7th September, $5,000,000,000 USD of open interest has left the BTC futures market.

Since the 7th September, $5,000,000,000 USD of open interest has left the BTC futures market.

3/

Neither bulls or bears have been able to take a firm grip, leaving the market hunting stops at the range high and low!

If you’re a swing trader or long-term investor this is very painful to watch and all signs point to this type of price action continuing in the short-term

Neither bulls or bears have been able to take a firm grip, leaving the market hunting stops at the range high and low!

If you’re a swing trader or long-term investor this is very painful to watch and all signs point to this type of price action continuing in the short-term

4/

#LambdaStrike indicates that Bitcoin and Ethereum are in what is called a ‘Volatility Squeeze’ environment, in such an environment the high probability play is to buy at the range low (in this case it would be $43,000 USD) and sell at the range high ($47,000 USD).

#LambdaStrike indicates that Bitcoin and Ethereum are in what is called a ‘Volatility Squeeze’ environment, in such an environment the high probability play is to buy at the range low (in this case it would be $43,000 USD) and sell at the range high ($47,000 USD).

5/

It is worth noting that a ‘Volatility Squeeze’ often precedes a large directional move.

Implied Volatility is trending lower, however did spike briefly on Monday as news of a partnership between Walmart and Litecoin ($LTC) trended across Twitter and across news outlets.

It is worth noting that a ‘Volatility Squeeze’ often precedes a large directional move.

Implied Volatility is trending lower, however did spike briefly on Monday as news of a partnership between Walmart and Litecoin ($LTC) trended across Twitter and across news outlets.

6/

The news was short lived (as was the spike in IV) as Walmart quickly denied the claims of a partnership.

Litecoin moved as high as $237 USD (30% higher on the day) but ended up closing the day down at $179 USD

The news was short lived (as was the spike in IV) as Walmart quickly denied the claims of a partnership.

Litecoin moved as high as $237 USD (30% higher on the day) but ended up closing the day down at $179 USD

7/

As for the significance of this event, US authorities may use this as ammunition for when they inevitably go after Crypto Exchanges. The tweet below is commentary on an excerpt from Gary Gensler’s pre-prepared statement to US Senate on Tuesday.

As for the significance of this event, US authorities may use this as ammunition for when they inevitably go after Crypto Exchanges. The tweet below is commentary on an excerpt from Gary Gensler’s pre-prepared statement to US Senate on Tuesday.

https://twitter.com/attorneyjeremy1/status/1437487301601411074

8/

‘Investor Protection’ is the key theme that Gensler is trying to push ahead of his statement. It's likely that the $LTC move on Monday, can and will be used as an example to further the ‘Investor Protection’ narrative when the SEC push for more regulation on ‘Crypto Finance’

‘Investor Protection’ is the key theme that Gensler is trying to push ahead of his statement. It's likely that the $LTC move on Monday, can and will be used as an example to further the ‘Investor Protection’ narrative when the SEC push for more regulation on ‘Crypto Finance’

9/

The short-term implications of this event on the Crypto market could be quite negative. Gensler is said to be targeting stable coins and tackling the topic of crypto ‘tokens’ as securities…

The short-term implications of this event on the Crypto market could be quite negative. Gensler is said to be targeting stable coins and tackling the topic of crypto ‘tokens’ as securities…

10/

a pre-prepared statement from Gensler tells that the SEC believe that the majority of tokens listed on major Crypto exchanges at the current time, are in fact ‘securities’ and should be treated as such.

a pre-prepared statement from Gensler tells that the SEC believe that the majority of tokens listed on major Crypto exchanges at the current time, are in fact ‘securities’ and should be treated as such.

11/

It will remain to be seen, if the SEC are genuinely pushing the ‘Investor Protection’ narrative to protect investors, OR, if they are doing this for other reasons!

It will remain to be seen, if the SEC are genuinely pushing the ‘Investor Protection’ narrative to protect investors, OR, if they are doing this for other reasons!

12/

Compounding this risk event for the crypto markets is the release of US inflation data (CPI data), so prepare yourself on for heightened market volatility intra-day on Tuesday!

Compounding this risk event for the crypto markets is the release of US inflation data (CPI data), so prepare yourself on for heightened market volatility intra-day on Tuesday!

13/

'Indecisive Options Market Flows'

Both #Bitcoin and #Ethereum have established defined trading ranges over recent days, forming the perfect environment for buying support and selling at resistance!

'Indecisive Options Market Flows'

Both #Bitcoin and #Ethereum have established defined trading ranges over recent days, forming the perfect environment for buying support and selling at resistance!

14/

Although this a great way for scalpers to make money, swing traders are feeling the pain of low volatility!

The options market seems to indicate that this low volatility will continue at least in the short-term, positive gamma should keep price ‘pinned’ at current levels

Although this a great way for scalpers to make money, swing traders are feeling the pain of low volatility!

The options market seems to indicate that this low volatility will continue at least in the short-term, positive gamma should keep price ‘pinned’ at current levels

17/

Thanks for listening to my Ted talk!

If you would like this kind of analysis delivered to your email inbox twice weekly for FREE see the link below 👇

getrevue.co/profile/tedtal…

Thanks for listening to my Ted talk!

If you would like this kind of analysis delivered to your email inbox twice weekly for FREE see the link below 👇

getrevue.co/profile/tedtal…

• • •

Missing some Tweet in this thread? You can try to

force a refresh