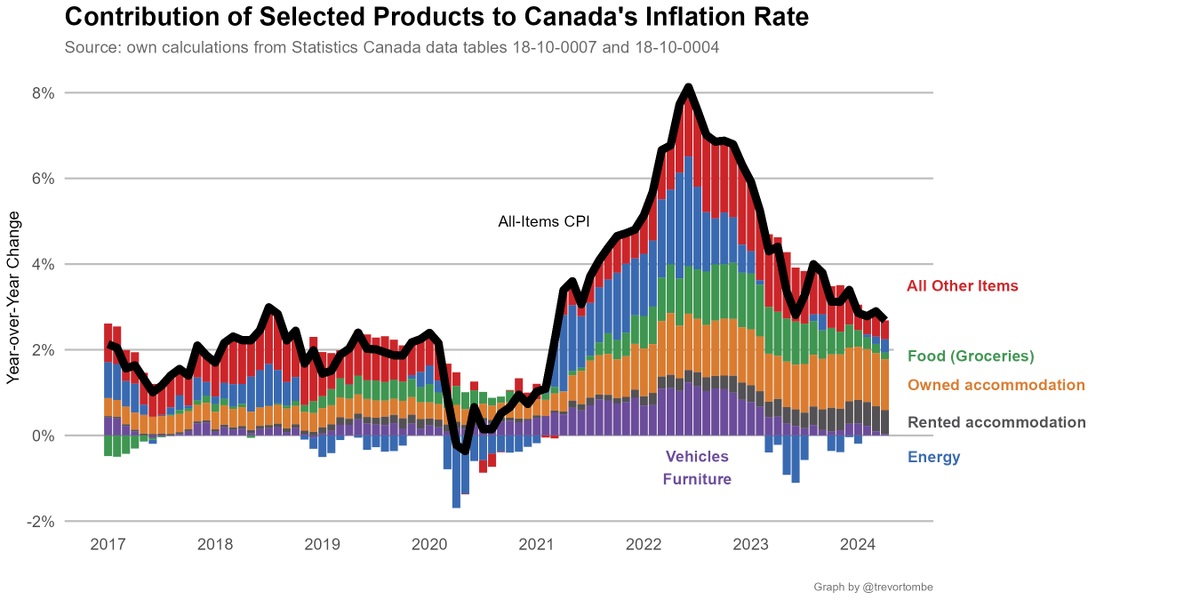

Today's data: inflation! 📈 www150.statcan.gc.ca/n1/daily-quoti…

CPI up 4.1% in August compared to last year. Highest since 2003. Excluding food/energy (which are highly volatile), prices up 3%. #cdnecon

CPI up 4.1% in August compared to last year. Highest since 2003. Excluding food/energy (which are highly volatile), prices up 3%. #cdnecon

Important to remember, though, that much of the higher inflation we've seen in recent months is in part due to drops during COVID and prices returning to trend today means above-average inflation since last year's levels are lower.

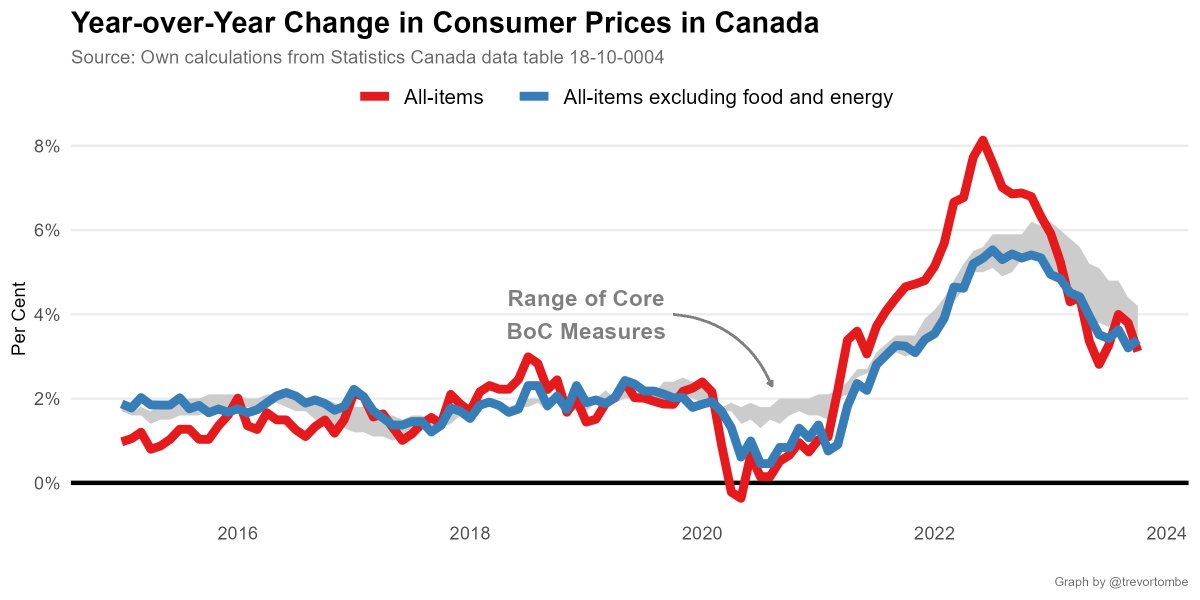

Here's an illustration of that.

Here's an illustration of that.

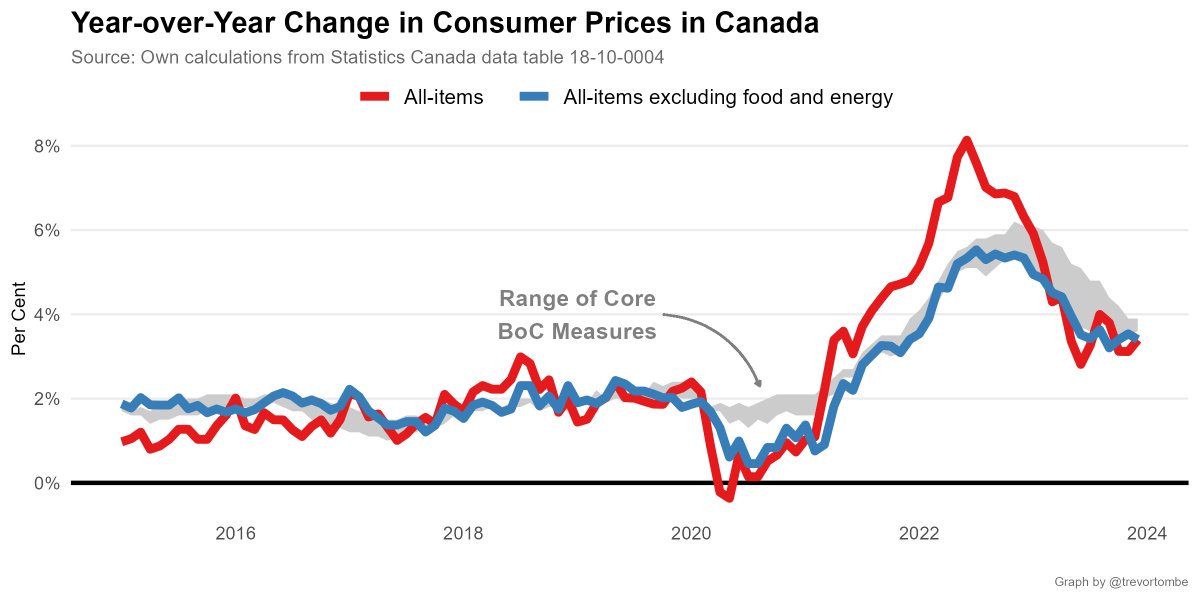

Also important to remember that the central bank looks to several measures to understand inflation pressures. Here are three of their main metrics. One exceeds the target range, the two others still don't.

Due to #Elxn44, some will take today's data and pull the fire alarm. This is premature. If one has a concern about monetary policy (that is, a target 1-3 range with BoC charged with independently achieving it) then say so. Ignore those who don't take monetary policy seriously.

What does the market currently expect inflation in Canada to be over the long-run? Comparing inflation protected government bonds to normal ones is a useful measure.

Here's the latest: expectations of ~1.7%. Markets (sensibly) don't expect today's elevated rates to persist.

Here's the latest: expectations of ~1.7%. Markets (sensibly) don't expect today's elevated rates to persist.

I should have flagged this earlier, but here's another important way to understand recent price moves. Large increase in accommodation prices. But you can see here it's from a very low base. Year-over-year comparisons are denoted with dots. www150.statcan.gc.ca/n1/daily-quoti…

Is there a way to avoid the weird COVID year? Some look to the comparison of today vs two years ago (annualized). Here's a measure of that. Inflation in this way, which avoids weird COVID base effects, is right on target around 2%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh