My fav non-Tech, US based Co.'s. ~6⃣0⃣ names.

I love my Tech names for a majority of my Portfolio (BigTech, Small Tech, HW, SaaS, E-Commerce, FinTech, Consumer Tech), but there's plenty of great Co's outside of these.

Few of the other Sectors & my fav names in there.⬇️

I love my Tech names for a majority of my Portfolio (BigTech, Small Tech, HW, SaaS, E-Commerce, FinTech, Consumer Tech), but there's plenty of great Co's outside of these.

Few of the other Sectors & my fav names in there.⬇️

✔️US based

✔️Tech (in a traditional sense) is not the main product of these Co.'s although they leverage it.

✔️Many of these have a mix of some of these below characteristics

✔️Tech (in a traditional sense) is not the main product of these Co.'s although they leverage it.

✔️Many of these have a mix of some of these below characteristics

✔️Great products/services

✔️Long-term oriented Mgmt teams

✔️Customer obsession

✔️Differentiated Biz Model

✔️Durable demand

✔️Innovative culture

✔️Lean operations

✔️Good Financial governance

✔️Very moaty or critical in their value chain

✔️Mkt (S&P) beaters over the 5/10 yr periods

✔️Long-term oriented Mgmt teams

✔️Customer obsession

✔️Differentiated Biz Model

✔️Durable demand

✔️Innovative culture

✔️Lean operations

✔️Good Financial governance

✔️Very moaty or critical in their value chain

✔️Mkt (S&P) beaters over the 5/10 yr periods

✅Financial Services

Visa* $V

Mastercard* $MA

S&P Global $SPGI

Moody's $MCO

MSCI $MSCI

Nasdaq $NDAQ

Fair Isaac $FICO

First Republic $FRC

Broadridge $BR

Marketaxess $MKTX

Silicon Valley bank $SIVB

Schwab $SCHW

Visa* $V

Mastercard* $MA

S&P Global $SPGI

Moody's $MCO

MSCI $MSCI

Nasdaq $NDAQ

Fair Isaac $FICO

First Republic $FRC

Broadridge $BR

Marketaxess $MKTX

Silicon Valley bank $SIVB

Schwab $SCHW

✅Healthcare

Intuitive Surgical* $ISRG

Align Technologies* $ALGN

Abiomed* $ABMD

Guardant Health* $GH

Novocure* $NVCR

Illumina $ILMN

Masimo $MASI

Thermo Fisher Scientific $TMO

Dexcom $DXCM

Repligen $RGEN

United Health $UNH

Idexx Labs $IDXX

Zoetis $ZTS

Intuitive Surgical* $ISRG

Align Technologies* $ALGN

Abiomed* $ABMD

Guardant Health* $GH

Novocure* $NVCR

Illumina $ILMN

Masimo $MASI

Thermo Fisher Scientific $TMO

Dexcom $DXCM

Repligen $RGEN

United Health $UNH

Idexx Labs $IDXX

Zoetis $ZTS

✅Consumer (1)

✔️Retail

Disney* $DIS

Nike* $NKE

Lululemon* $LULU

Costco $COST

TJX $TJX

Ross $ROST

Burlington $BURL

Dollar General $DG

Five Below $FIVE

Ulta Beauty $ULTA

Vail Resorts $MTN

AutoZone $AZO

✔️Retail

Disney* $DIS

Nike* $NKE

Lululemon* $LULU

Costco $COST

TJX $TJX

Ross $ROST

Burlington $BURL

Dollar General $DG

Five Below $FIVE

Ulta Beauty $ULTA

Vail Resorts $MTN

AutoZone $AZO

✅Consumer (2)

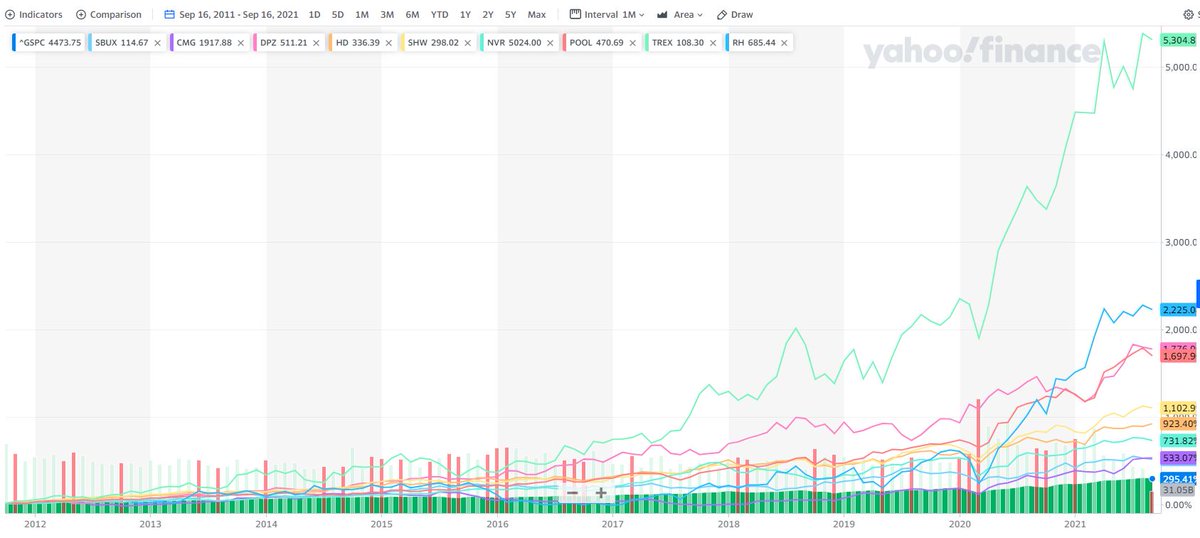

✔️Food

Starbucks* $SBUX

Chipotle* $CMG

Dominos $DPZ

✔️Housing

HomeDepot $HD

Sherwin Williams $SHW

NVR $NVR

Pool Corp $POOL

Trex $TREX

Restoration Hardware $RH

✔️Food

Starbucks* $SBUX

Chipotle* $CMG

Dominos $DPZ

✔️Housing

HomeDepot $HD

Sherwin Williams $SHW

NVR $NVR

Pool Corp $POOL

Trex $TREX

Restoration Hardware $RH

✅Industrials & Adjacent Svcs

Cognex $CGNX

Copart $CPRT

Cintas $CTAS

Danaher $DHR

Roper Tech $ROP

Transdigm $TDG

Heico $HEI

Lockheed Martin $LMT

Cognex $CGNX

Copart $CPRT

Cintas $CTAS

Danaher $DHR

Roper Tech $ROP

Transdigm $TDG

Heico $HEI

Lockheed Martin $LMT

✅Dividends

American Tower $AMT

SBA Communications $SBAC

Crown Castle $CCI

Equinix $EQIX

American Water works $AWK

Brookfield Infra Partners* $BIP

Innovative Industrial Properties $IIPR

NextEra $NEE

American Tower $AMT

SBA Communications $SBAC

Crown Castle $CCI

Equinix $EQIX

American Water works $AWK

Brookfield Infra Partners* $BIP

Innovative Industrial Properties $IIPR

NextEra $NEE

The stocks from Financial, Consumer (non-staples) and Industrial names are usually hit hard during a recession (irrespective of how much impact the individual Company actually sees), making them a good time for Qualitative selection and add or start positions.

The stocks above from Healthcare and Dividends below might be less sensitive to the actual Economy and depends more on the long-term adoption of their Products/Services, making them ideal to slowly accumulate over time as they execute.

I'm very underweight in this non-Tech basket (as 75% of my new positions in the last 5 yrs have been Tech focused), but looking forward to few opportunities (during temporary Earnings disappointments, Bear Market periods) to initiate/add.

Winners win, but only if they don't take their eyes off the ball (Customer value proposition).

Past is a decent indicator but always check Fundamental/Qualitative/Growth/Competitive factors & Fin strength on an ongoing basis.

Disc : None of these are recs. Do your DD.

/END

Past is a decent indicator but always check Fundamental/Qualitative/Growth/Competitive factors & Fin strength on an ongoing basis.

Disc : None of these are recs. Do your DD.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh