NFL could be hit with punitive damages > $10B in Rams relocation lawsuit. The reasons: (1) pre-2020 MO law has a lower threshold ("reckless disregard"); (2) compensatory damages > $3B; (3) NFL = multi-billion $ corp.; and (4) PD/CD ratios OK'd in past MO cases > 5:1

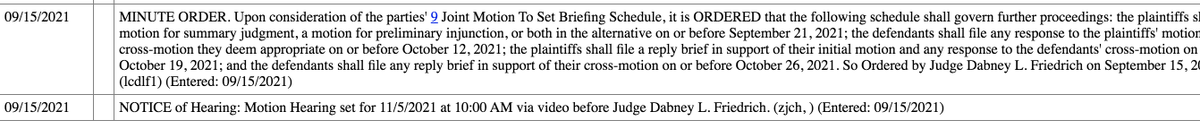

The timing of this lawsuit couldn't be worse for the NFL. Prior to 2014, punitive damages were statutorily capped in Missouri. In 2020, the MO legislature passed a new law making it harder to recover PDs. This lawsuit was filed in 2017: no cap and less egregious conduct needed.

For cases filed before August 28, 2020, the standard is whether the defendant intentionally acted "either by a wanton, willful or outrageous act, or reckless disregard for an act's consequences (from which evil motive is inferred).”

The new punitive damages statute (enacted in 2020) eliminates "reckless disregard" as a basis for awarding, and, instead, requires that a defendant "intentionally harm" the plaintiff or act with with "deliberate and flagrant disregard for the safety of others."

By filing suit in 2017, the City of St. Louis avoids the newer "intent to harm" threshold needed for punitive damages. Had this lawsuit been filed 3 years later, there is almost zero chance that punitive damages would have been awarded.

But under the pre-2020 "reckless disregard" standard, the City has a much better chance of being able to demonstrate entitlement to punitive damages. The alleged conduct--if proven--would appear to satisfy that standard.

As for the "amount" of punitive damages that could be awarded, several factors come into play: (1) the high amount of compensatory damages ($3B, assuming it includes disgorgement of relocation fee and increased team value); and (2) NFL's status as a multi-billion $ corporation.

Under State Farm v. Campbell (a #SCOTUS decision), punitive damages awards with a single-digit multiplier (the ratio of punitive damages to actual or compensatory damages) generally comport with due process. Missouri courts follow Campbell in assessing punitive damages.

Missouri appellate courts have consistently upheld punitive damage awards where the ratio of punitive to compensatory was between 5:1 and 11:1. See, e.g., Ingham, 608 S.W.3d 663 (Mo. Ct. App. 2020) (5:1 ratio); Mansfield v. Horner, 443 S.W.3d 627 (Mo. Ct. App. 2014) (11:1 ratio).

2020 Missouri appellate decision:

"A ratio of 5.72:1 is well within the limits of punitive damages consistently upheld."

Ingham v. Johnson & Johnson, 608 S.W.3d 663, 722–23 (Mo. Ct. App. 2020) courthousenews.com/wp-content/upl…

"A ratio of 5.72:1 is well within the limits of punitive damages consistently upheld."

Ingham v. Johnson & Johnson, 608 S.W.3d 663, 722–23 (Mo. Ct. App. 2020) courthousenews.com/wp-content/upl…

The NFL's status as multi-billion dollar corporate defendant is also factor justifying a higher punitive damages award. (The same can be said of all 32 NFL teams, and Mr. Kroenke personally). More below ⤵️

"A much larger amount of punitive damages is required to have a deterrent effect on a multi-billion dollar corporation than a smaller business, such as a “mom and pop” store." Poage v. Crane Co., 523 S.W.3d 496, 523–24 (Mo. Ct. App. 2017).

“Common sense suggests that a corner ‘mom and pop’ store should not be subject to the same punitive level of damages as a company worth close to a billion dollars. The latter would simply not be deterred by an award that might be large enough to put the former out of business."

“High-ratio punitive damage awards are sometimes necessary in order to have a sufficient deterrent effect.” Indeed, “[a] much larger amount of punitive damages is required to have a deterrent effect on a multi-billion dollar corporation than a smaller business.” Id.

"Because Defendants are large, multi-billion dollar corporations, we believe a large amount of punitive damages is necessary to have a deterrent effect in this case. Thus, the higher ratio of 5:72-1 is justified." Ingham v. Johnson & Johnson, 608 S.W.3d 663 (Mo. Ct. App. 2020).

Let's assume a sub-optimal scenario on compensatory damages: the City prevails on unjust enrichment, but the court declines to award the increased value of the Rams as damages. There is still enough left--relocation fee + lost revenues--to justify a $10B punitive damage award.

On the opposite end of the spectrum, if the court awards (i) the relocation fee, (ii) increased franchise value due to the LA move, and (iii) the City's lost revenues as compensatory damages (totaling > $3B), that could justify punitive damages > $15B. A 5:1 ratio (within range).

Remember, the defendants are the NFL (a multi-billion $ corporation with $15B in annual revenues), 32 NFL teams (each worth > $2B), 32 NFL owners (all billionaires with Stan Kroenke worth $10B). So, $15B in punitive damages is plausible with these compensatories and net worth.

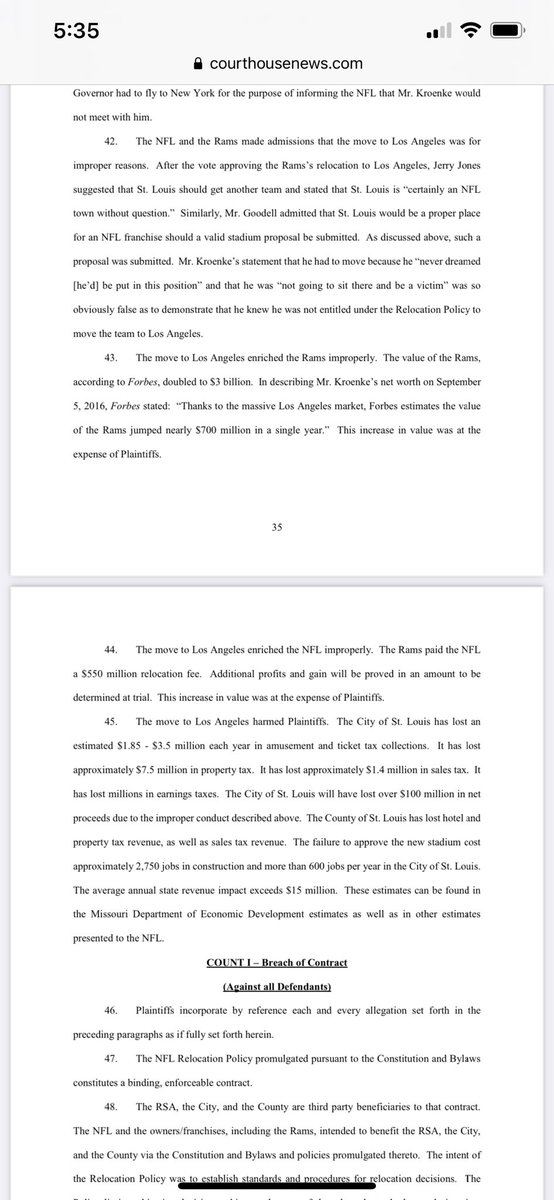

One final thought about compensatory damages. Can the City recover as its damages for unjust enrichment a disgorgement of the NFL's relocation fee and the increase in franchise value due to the LA move. Missouri law and judge's pretrial rulings suggest that the answer is "yes."⤵️

Under Missouri law, disgorgement and/or restitution of ill-gotten gains is one of the remedies for a claim of unjust enrichment.

A key ruling from the Missouri court on summary judgment: damages on unjust enrichment are not tied to "direct payments" made by a plaintiff. The benefit conferred must simply be "at the expense of the plaintiff." This puts relocation fee and increase in franchise value in play.

This is consistent with the Court's discussion of that issue from its 12/23/17 order denying the NFL's motion to dismiss for failure to state a claim:

"The benefit conferred upon the defendant must simply be 'at the expense of the plaintiff.' The Court finds that Plaintiffs have adequately pleaded a benefit conferred upon Defendants at the expense of the Plaintiffs." This ruling puts the relocation fee and team value in play.

• • •

Missing some Tweet in this thread? You can try to

force a refresh