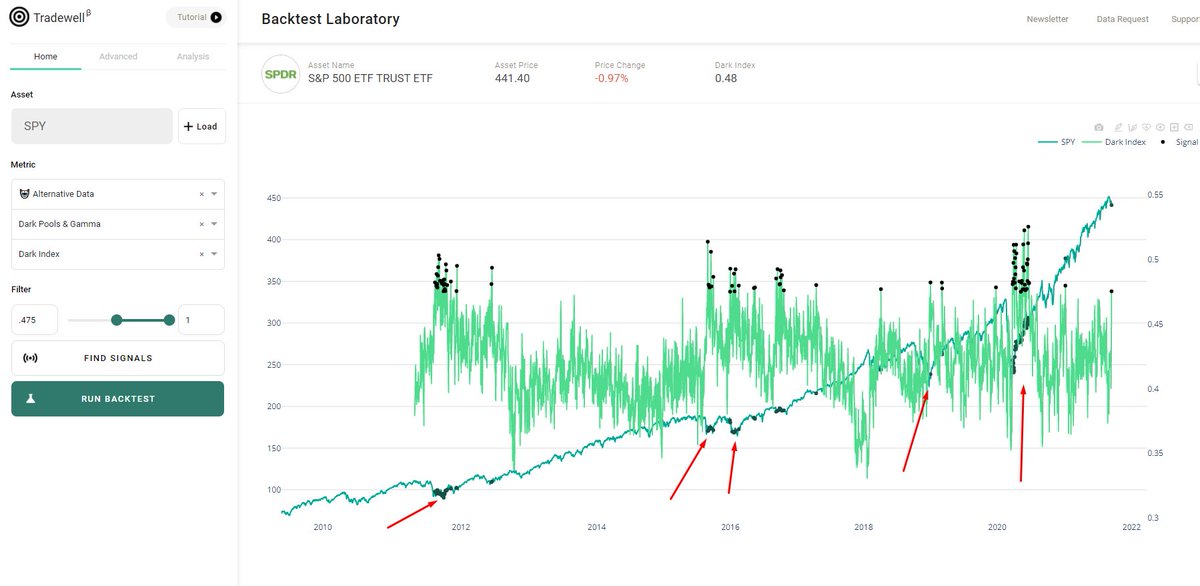

What to look for in the week to come... the $DIX closed quite elevated at 47.5%.

https://twitter.com/SqueezeMetrics/status/1438983328850395138?s=20⬇️

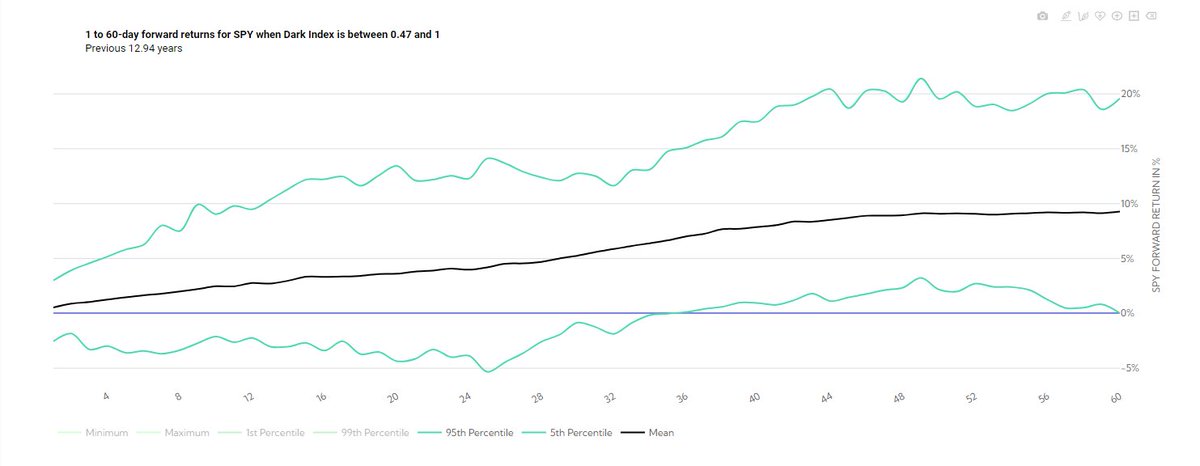

Over the next week the S&P500 returned 1.46% on average compared to anytime returns of .31% in the past ~decade. A elevated $DIX did not preclude short term risk capping out at about -5%, historically.

In the intermediate term this has been overwhelmingly bullish with the S&P returning 9% over the next 60 trading days with the 5th percentile return at 0%.

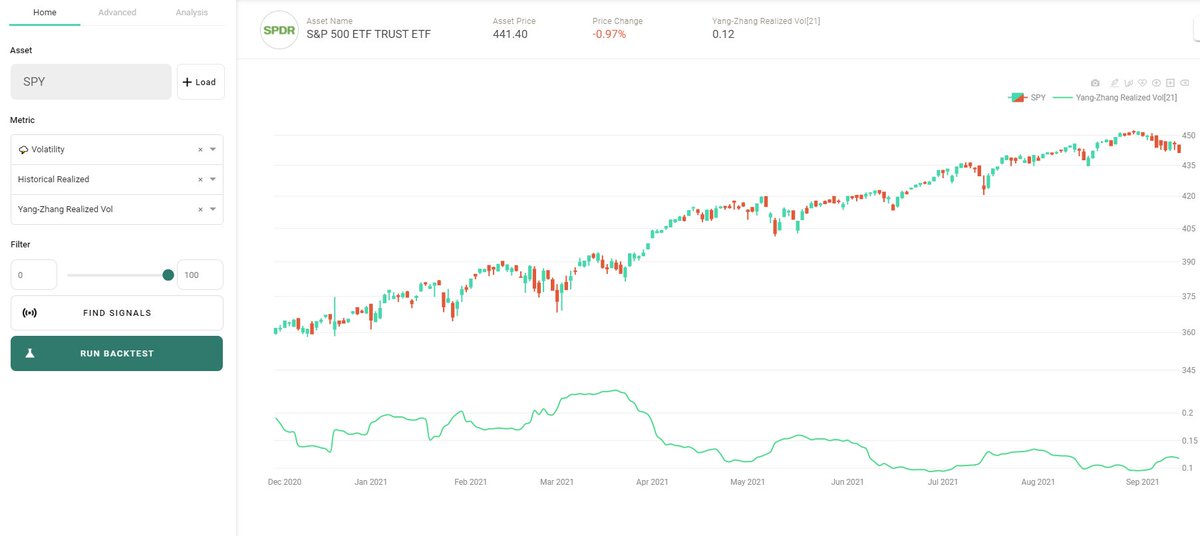

It's should be considered that $DIX is usually elevated during period of high realized volatility (1) and usually after large drops, and we are miles from that currently with monthly realized vol at 12% and actually declining on the week despite ending lower (2).

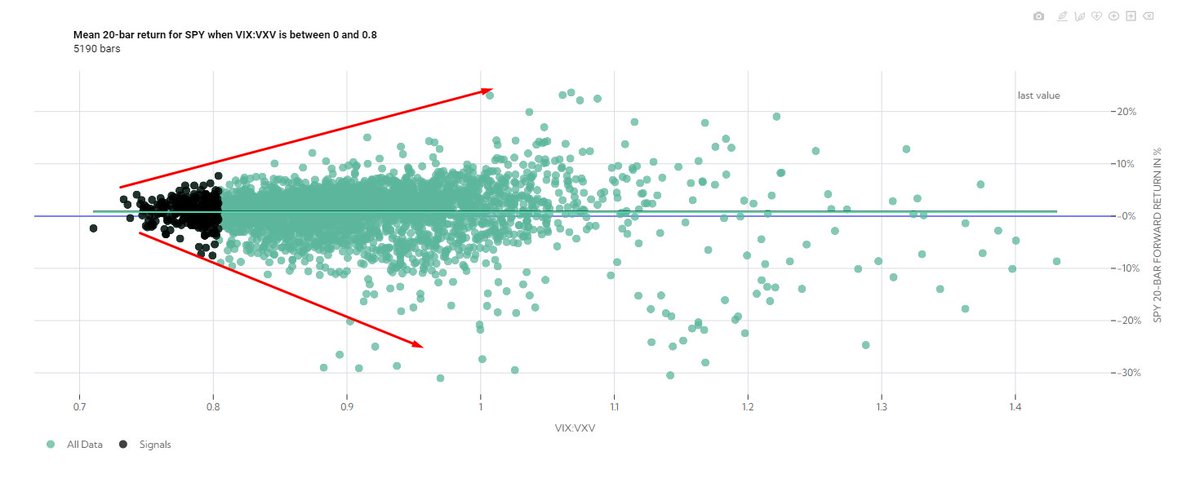

Moving on.... $VIX index term structure remains near flat, closing the week exactly the same spot as last week and nearly flat at (.9)... Meaning we should expect more volatility than usual.

https://twitter.com/HalfersPower/status/1437118978866880512?s=20

And Implied-realized spreads remain high but haven't really "spiked" yet on this move as we saw occur many times in 2020. Shown is $VIX-YangZhang Realized vol with the 5 period Rate of Change Below filtered between 5 and 8 points change on the week. Last week close 1.7pts.

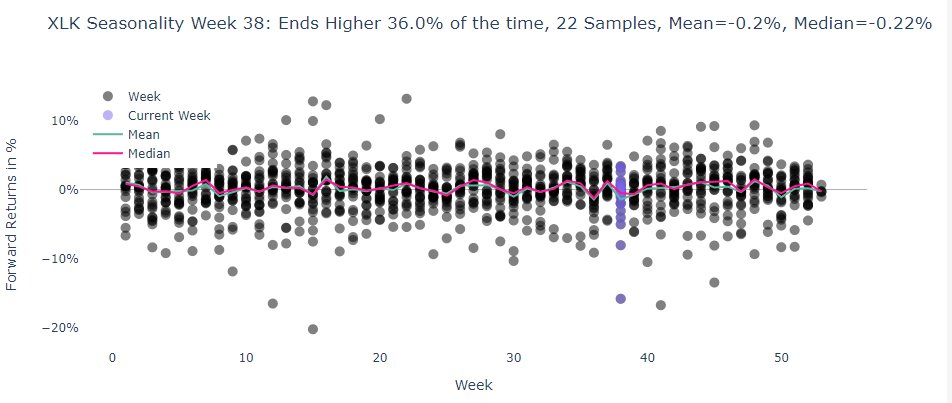

Lot's of people have now covered this week seasonal tendencies @QuantifiablEdgs @SJD10304 and have highlighted that it is a pretty terrible weak seasonally, ending the week down the overwhelming majority of the time.

Taking a look at the sectors, $XLK was one of the weaker sectors trading higher only 8 of 22 years for trading week 38 for mean and median returns of -2% and -.22% respectively.

Thanks and have a great week all. All charts, backtests, etc produced with tradewell.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh