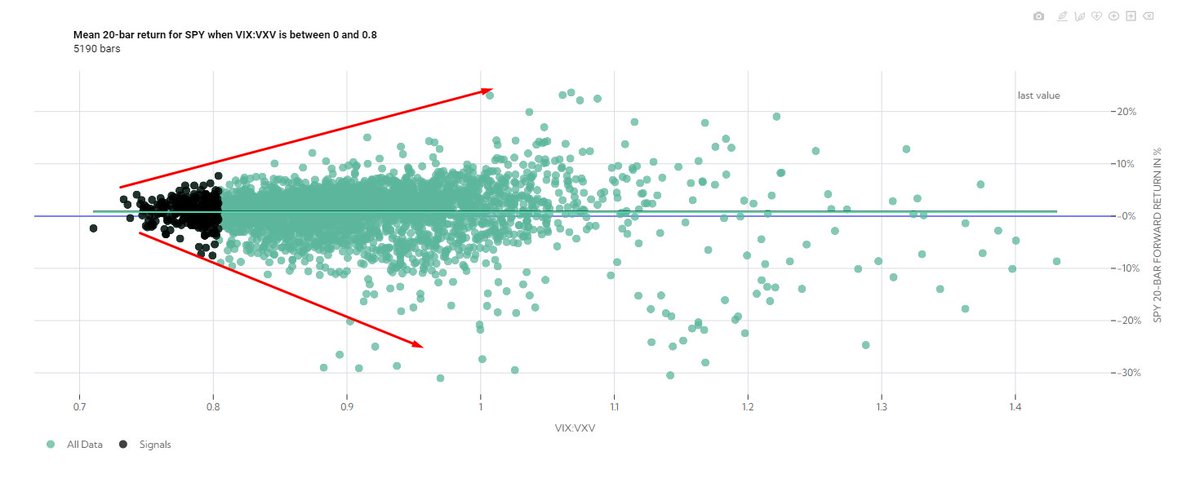

The ratio of $VIX: 3M VIX is in steep contango, closing .80 on Friday [1] and dropping clues to the next market moves. Historically when contango has been this steep, $VIX has gone⬆️over the following month by 15% Vs. anytime $VIX returns* of 3% [2] ~Super~ Bearish right?

*Sorry if $VIX % Returns make you mad.

Over the following month $VIX ended higher 75.9% of the time. So what did $VIX futures do...

$VXX returned on average -5.27% during the same time period compared to it's anytime return of -3.55%. Contango at work.

Over the following month $VIX ended higher 75.9% of the time. So what did $VIX futures do...

$VXX returned on average -5.27% during the same time period compared to it's anytime return of -3.55%. Contango at work.

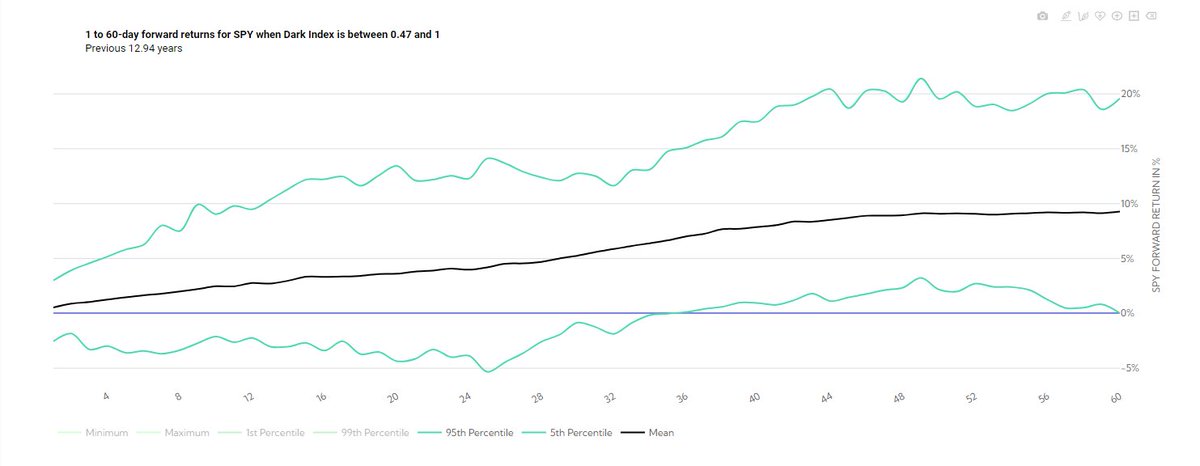

And how about the S&P500 ETF $SPY?

It was consistently some of the least volatile action over the following 1 month compared the anytime $SPY returns.

So if you were looking to get all bear'd up, you might have to look elsewhere!

It was consistently some of the least volatile action over the following 1 month compared the anytime $SPY returns.

So if you were looking to get all bear'd up, you might have to look elsewhere!

• • •

Missing some Tweet in this thread? You can try to

force a refresh