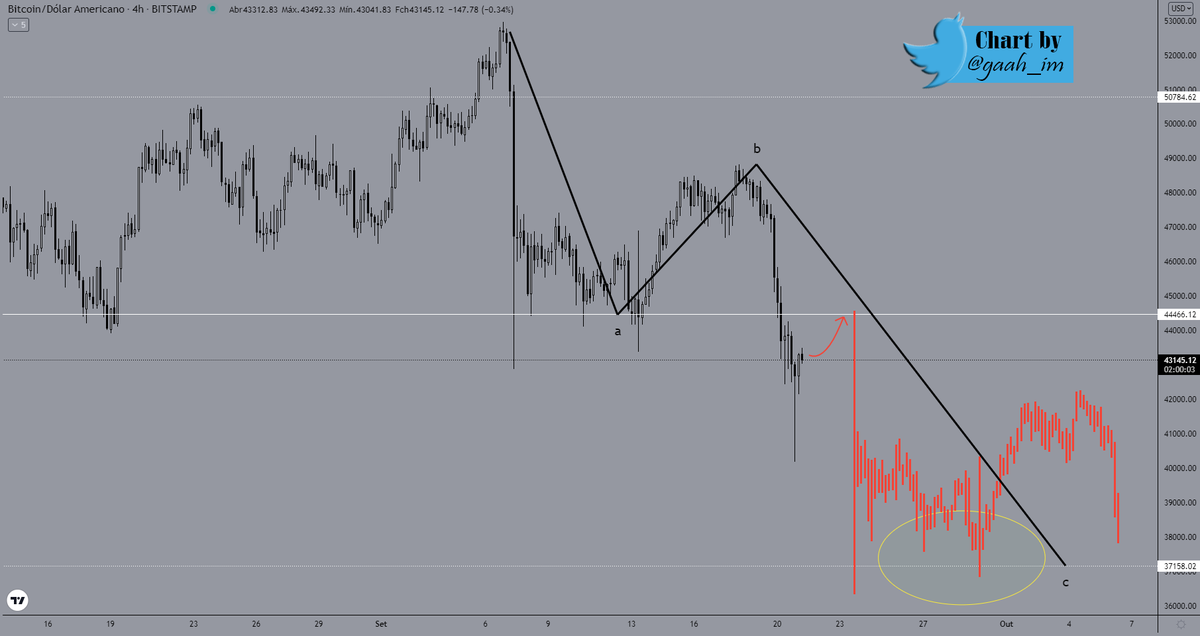

2.5 channel breaks in the correction we are currently in, much softer than 2013 even retracing -55% since the last top.

After testing in the Neutral Zone, retracement to the stealth point (50% of the REFERENCE CHANNEL) historically occurs.

This point is important as it is where market sentiment turned, as well as being the daily close of the first dip and also the bar close of the Monthly chart.

This point is important as it is where market sentiment turned, as well as being the daily close of the first dip and also the bar close of the Monthly chart.

The Neutral Zone is the top of the Resistance. After breaking through, it will be the reference support, as it is the lower range of the new Reference Channel for the trend.

In 2013 you can clearly see the top of the resistance being confirmed as support after breaking through. This is the target after the move to the stealth point around $37,000

The difference between the channel breaks is seen above the Neutral Zone. In 2013 the movement within the sub-cycle was larger compared to the current one, yet it was not Reversal of the main trend.

Therefore, it is still fully open for a retest in the quoted range for the price resumption to move forward, thus forming a bullish PIVOT after a few weeks of highs.

[Current Momentum can technically be seen in 2013]

#Bitcoin #BTC

Read also in a quick and direct way at Quicktake:

cryptoquant.com/quicktake/614a…

#Bitcoin #BTC

Read also in a quick and direct way at Quicktake:

cryptoquant.com/quicktake/614a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh