How to get URL link on X (Twitter) App

In 2013 the price advanced 2 full channels (3 phases), leaving the first move without phase4.

In 2013 the price advanced 2 full channels (3 phases), leaving the first move without phase4.

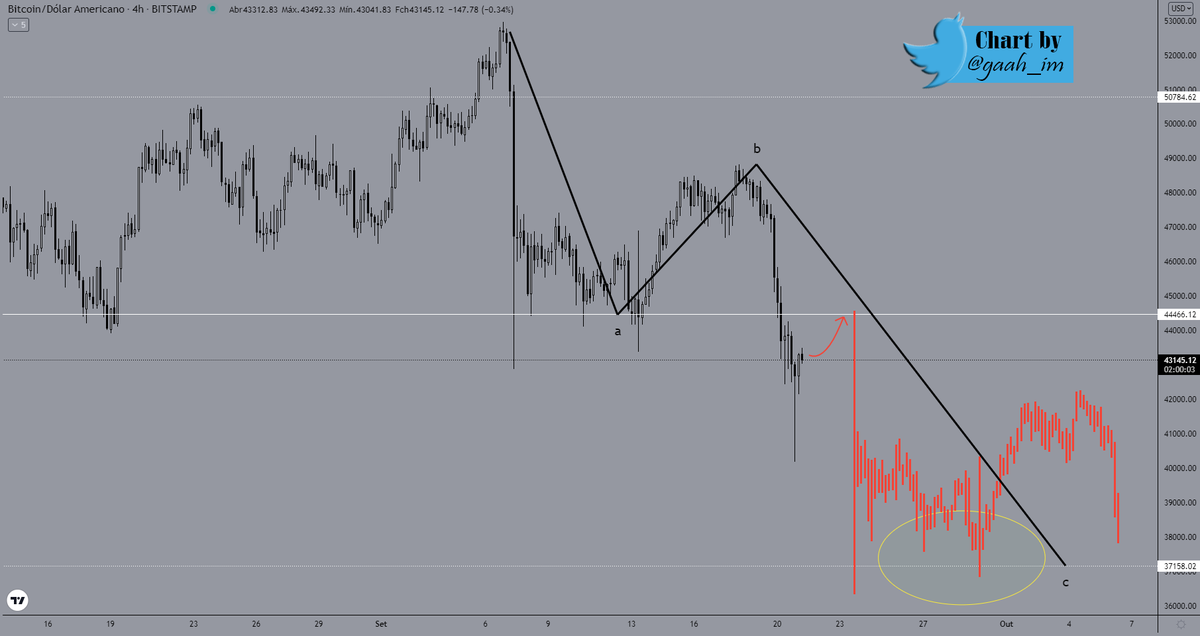

$40.8k is the key to probability being in favor of a trend reversal (breaking $44.4k), currently the risk of breaking $37k still exists if $40.8k continues to be Resistance!

$40.8k is the key to probability being in favor of a trend reversal (breaking $44.4k), currently the risk of breaking $37k still exists if $40.8k continues to be Resistance! https://twitter.com/gaah_im/status/1501932369837576194?s=20&t=G4Iz5bEA2LP6hf9tCW2VOw

After a spent output is realized, the price in USD of the UTXO created/UTXO spent shows whether the UTXO realized profit/loss.

After a spent output is realized, the price in USD of the UTXO created/UTXO spent shows whether the UTXO realized profit/loss.

1. Ranking the phases of the cycles in sequence of 1-3 starting with NUMBER 1 after the start of the bull market and the top meeting in the middle of the bullish cycle.

1. Ranking the phases of the cycles in sequence of 1-3 starting with NUMBER 1 after the start of the bull market and the top meeting in the middle of the bullish cycle.

https://twitter.com/gaah_im/status/1437340763319422977

Breaking through sets up a new full move and hits $37k, at the stealth point of the price rebound.

Breaking through sets up a new full move and hits $37k, at the stealth point of the price rebound.

2. Already the average number of tokens transferred on the network points to another new top, followed by 3 tops in sequence since trapping at major support. The latest record points to an average of 42.15 #BTC transferred per transaction.

2. Already the average number of tokens transferred on the network points to another new top, followed by 3 tops in sequence since trapping at major support. The latest record points to an average of 42.15 #BTC transferred per transaction.

I recently posted the pattern identified in the MPI, which shows when miners sell.

I recently posted the pattern identified in the MPI, which shows when miners sell.https://twitter.com/gaah_im/status/1430318030001737731?s=20

2/5 This indicator is the value of the sum of unspent coins, transaction output in live days, and their value.

2/5 This indicator is the value of the sum of unspent coins, transaction output in live days, and their value.

-Price from the breaking of the last ATH:

-Price from the breaking of the last ATH:

2/7 The yellow box is touched when prices make a mid-cycle top, historically the end-of-cycle top is only realized with Puell Multiple hitting the red box, this has been the case in all previous cycles.

2/7 The yellow box is touched when prices make a mid-cycle top, historically the end-of-cycle top is only realized with Puell Multiple hitting the red box, this has been the case in all previous cycles.

1. The mapped sequence tells the timing during Bitcoin's bull and bear market. The cycles are standardized and the movements are similar.

1. The mapped sequence tells the timing during Bitcoin's bull and bear market. The cycles are standardized and the movements are similar.

We are now at this same level and descending from the historical top, ready to start going up in volume slaughtering the bears?

We are now at this same level and descending from the historical top, ready to start going up in volume slaughtering the bears?

https://twitter.com/gaah_im/status/14175289277786562581. I recently posted a Quicktake saying that we are not in a bear market and did the comparison of the current cycle with the previous cycle, 2017 using the MVRV. Now, we have the full chart from the first moves to the first Halving and the 2013 cycle which is quite similar to...

https://twitter.com/gaah_im/status/1417249215030435843The test at the main support, $30,000 was successful and a new trap was made below this level, we have not lost the wick of the last bear trap, this is very positive.