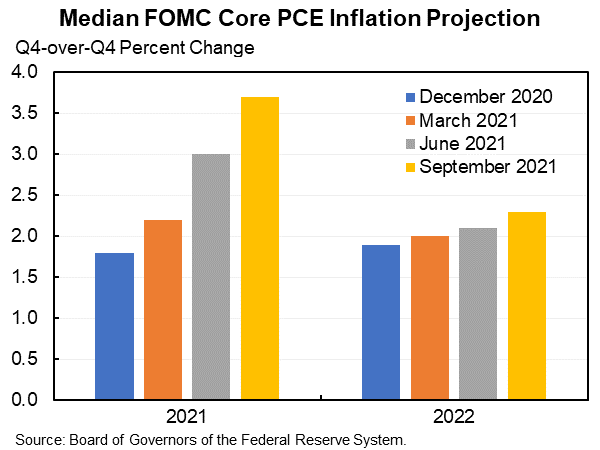

The FOMC median inflation projections are likely, once again, underestimating future inflation. But less obviously true than their previous projections.

They expect PCE / core PCE inflation to be 4.2% / 3.7% this year. To hit that would require a large inflation slowdown.

They expect PCE / core PCE inflation to be 4.2% / 3.7% this year. To hit that would require a large inflation slowdown.

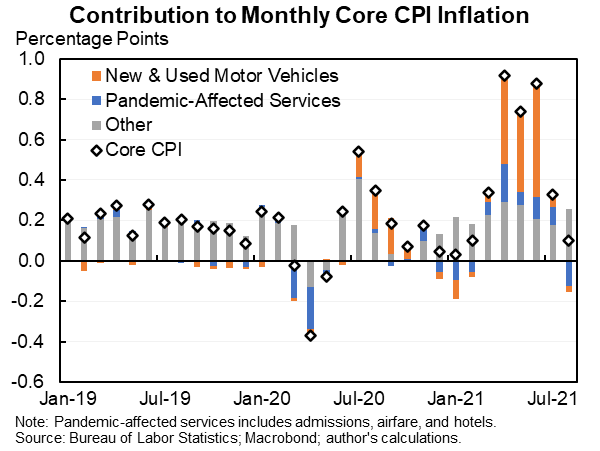

In the first 8 months of the year (including a reasonable forecast for Aug based on the CPI & PPI), inflation rose at around a 5% annual rate. To hit their numbers for the full year will require it to slow to about a 1.5% annual rate. In other words, 0.12% monthly prints.

That could happen if either a lot of transitory level increases reverse themselves (e.g., used car prices will likely fall more) or if there are transitory falls due to spreading virus (e.g., further falls in travel/tourism prices).

But I would take the over on any forecast of 0.11% monthly prints in September, October, November and December given momentum and expectations, places where prices have risen a lot yet and sectors like shelter (smaller in PCE than CPI but non trivial).

Notably, the FOMC's inflation projections for 2021 have risen a lot (not surprising given effectively eight months of data) but have only risen a little for 2022. That means they don't think price levels will fall back but also don't think momentum will carry forward.

I have a much wider confidence interval for 2022 but I view 3% as much, much more likely than 1% and would not hesitate to take the over on their 2.3% forecast at even odds.

(BTW, note the FOMC median forecast has the property that many forecasts have which is that inflation slows down a lot to about 0.10% monthly prints before rising again to 0.20% monthly prints. Is broadly believed that we'll have an inflation lull before it picks up again.)

The question remains if (as I view more likely than not) inflation is above their expectation what does that do to their interest rate path? If you think inflation is going to be 2.3 / 2.2 / 2.1 then you can focus on employment, but if that doesn't happen then what?

I continue to think the Fed should raise its inflation target to 2-3 percent or 3 percent. But if they don't do that the consistent predictions that an inflation slowdown is right around the corner will eventually start to cause problems if they keep being wrong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh