Rubicon Water Limited $RWL $RWL.AX is an irrigation efficiency hardware and software company. They've built out from Australia into US, Europe and recently China and India - big markets. After successfully IPO'ing this month, they're up 75%.

Here's why I'm not chasing 👇

Here's why I'm not chasing 👇

1. Investment Thesis: Unknown

❌Stalwart

❌Slow Grower

❌Fast Grower

❌Cyclical

❌Asset Play

❌Turnaround

✅Story Stock

"Water water everywhere, but not a drop to drink", Coleridge poem.

❌Stalwart

❌Slow Grower

❌Fast Grower

❌Cyclical

❌Asset Play

❌Turnaround

✅Story Stock

"Water water everywhere, but not a drop to drink", Coleridge poem.

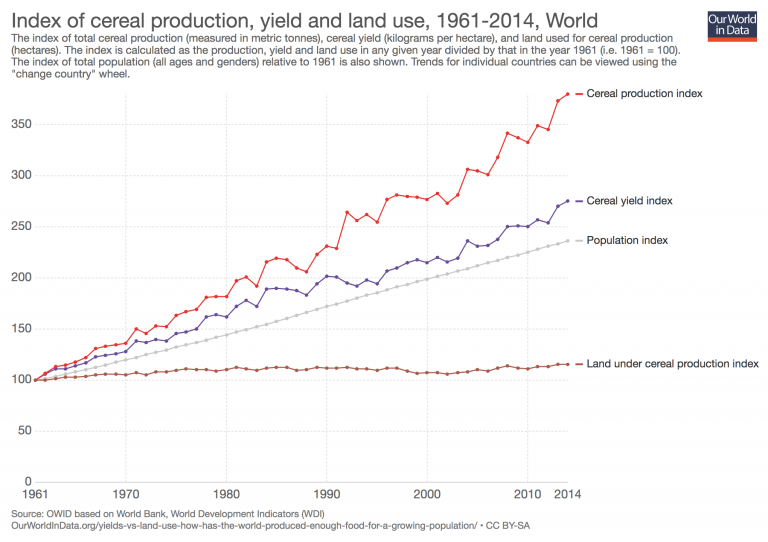

2. Story starts at food security.

With a growing population and increasing wealth, we simply have a need for more food production. This trend is not going to stabilise any time soon.

With a growing population and increasing wealth, we simply have a need for more food production. This trend is not going to stabilise any time soon.

3. After the green revolution, there's the blue revolution.

Green revolution was all about improving land productivity through fertilizers, seed improvements, genetics, etc. It massively improved our total productivity, though also with some side effects. Here's cereals:

Green revolution was all about improving land productivity through fertilizers, seed improvements, genetics, etc. It massively improved our total productivity, though also with some side effects. Here's cereals:

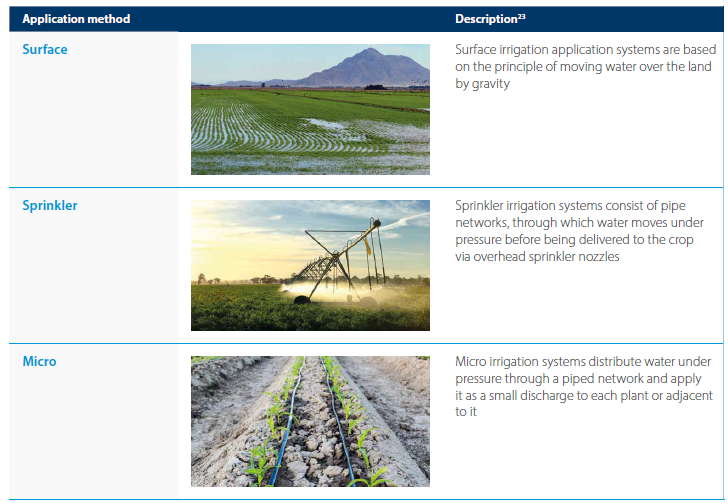

4. Blue revolution is amongst us.

This focuses on improving water efficiency. Accessible surface water is only 0.3% of all water (rest is salty), and ~70% of that is used for agriculture. And water scarcity is only getting worse, so irrigated agriculture needs to improve.

This focuses on improving water efficiency. Accessible surface water is only 0.3% of all water (rest is salty), and ~70% of that is used for agriculture. And water scarcity is only getting worse, so irrigated agriculture needs to improve.

5. Irrigated agriculture market is growing.

The market growth rates well and truly passes my 'baked beans test' - it is only a small TAM, but growing at ~20% CAGR to around $1.2bn by FY26 according to Rubicon.

The market growth rates well and truly passes my 'baked beans test' - it is only a small TAM, but growing at ~20% CAGR to around $1.2bn by FY26 according to Rubicon.

6. Australia once at the forefront.

Australia, California and Israel were early adopters of irrigation efficiency due to the climate. This involved creating water markets (incentives), shifting from flooding surfaces to targeted drip irrigation etc.

Australia, California and Israel were early adopters of irrigation efficiency due to the climate. This involved creating water markets (incentives), shifting from flooding surfaces to targeted drip irrigation etc.

7. Emerging markets.

The big and growing markets are unsurprisingly in Asia, where the tech has not been deployed. Central Asia still uses pre-Soviet systems; South Asia lacks the physical capital; and East Asia is in the midst of modernisation.

The big and growing markets are unsurprisingly in Asia, where the tech has not been deployed. Central Asia still uses pre-Soviet systems; South Asia lacks the physical capital; and East Asia is in the midst of modernisation.

8. Rubicon's products - complex version.

Rubicon is a water technology solutions business that designs, manufactures, installs and maintains irrigation automation software and hardware. Here's their schematic.

Rubicon is a water technology solutions business that designs, manufactures, installs and maintains irrigation automation software and hardware. Here's their schematic.

9. Rubicon's products - simple version.

Rubicon essentially builds gates, put sensors on them, and has software to open/close when the water is needed. This is an example of their FlumeGate.

Rubicon essentially builds gates, put sensors on them, and has software to open/close when the water is needed. This is an example of their FlumeGate.

10. Expanding footprint.

Recently Rubicon expanded from Australia into China (2018) and India (2020) with joint ventures. This has expanded their manufacturing and reach.

Recently Rubicon expanded from Australia into China (2018) and India (2020) with joint ventures. This has expanded their manufacturing and reach.

11. Diversifying revenue.

These expansions are already paying off in terms of dramatically increasing revenue from Asia. Look at these awesome charts!

These expansions are already paying off in terms of dramatically increasing revenue from Asia. Look at these awesome charts!

12. Cool story, bro.

So that's the story. A lot of the +75% growth is no doubt based on that. But if you've read this far, you know that's not where the story ends.

Borat's sister in Kazakhstan used 19th century Soviet irrigation technology - a concrete channel.

So that's the story. A lot of the +75% growth is no doubt based on that. But if you've read this far, you know that's not where the story ends.

Borat's sister in Kazakhstan used 19th century Soviet irrigation technology - a concrete channel.

13. Two steps forward, one step back.

The percentage growth in Asia has been because of the decline by Australia. The total revenue has been relatively flat - particularly if you factor in ~$5m of FY20 sales pushed to FY21 due to Covid.

The percentage growth in Asia has been because of the decline by Australia. The total revenue has been relatively flat - particularly if you factor in ~$5m of FY20 sales pushed to FY21 due to Covid.

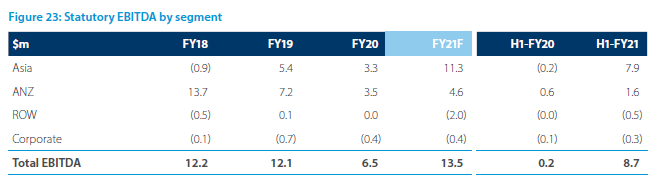

14. Margins being squeezed.

When looking at the EBITDA, you can see the same trends but slightly worse. Reality is that margins for India and China are much lower and competition is stronger.

When looking at the EBITDA, you can see the same trends but slightly worse. Reality is that margins for India and China are much lower and competition is stronger.

15. Where's the operating earnings?

The cash flow statement illuminates something very interesting. Despite the operating earnings, they are draining cash. It's all going into working capital. Hmm.

The cash flow statement illuminates something very interesting. Despite the operating earnings, they are draining cash. It's all going into working capital. Hmm.

16. Trade and other receivables ballooning.

Bare with me, as this is from a separate annual report filing. But you can see here a huge increase in unpaid trade receivables.. maybe nothing to worry about.

Bare with me, as this is from a separate annual report filing. But you can see here a huge increase in unpaid trade receivables.. maybe nothing to worry about.

17. Reducing impairments on increasing loans.

While current receivables have 5xed since listing, their late payments are now at $5m. Meanwhile, they've reduced the impairment by 30%. I'm sure it's all fine.

While current receivables have 5xed since listing, their late payments are now at $5m. Meanwhile, they've reduced the impairment by 30%. I'm sure it's all fine.

18. Future profits in decline.

Putting aside Deloitte's fantastic record here. The profit is waning, and this is a bit of a trend. So we're looking at around $7.5m forecast for FY21, of which only $2.3m is expected in 2H21. Okay..

Putting aside Deloitte's fantastic record here. The profit is waning, and this is a bit of a trend. So we're looking at around $7.5m forecast for FY21, of which only $2.3m is expected in 2H21. Okay..

19. Valuations stretched.

Market cap is currently $300m. With $7.5m NPAT FY21f, we're paying a PE of x40. For a company with questionable growth and possible forthcoming impairments, that seems around x4 too much at least?

Market cap is currently $300m. With $7.5m NPAT FY21f, we're paying a PE of x40. For a company with questionable growth and possible forthcoming impairments, that seems around x4 too much at least?

20. Purpose of the IPO.

I'd just conclude that I never understood the purpose of this IPO - the funds raised were 25% of total equity, 75% ownership retained. It seemed mainly just for liquidity for owners to sell out to. Smart, Bell Potter.. Smart.

I'd just conclude that I never understood the purpose of this IPO - the funds raised were 25% of total equity, 75% ownership retained. It seemed mainly just for liquidity for owners to sell out to. Smart, Bell Potter.. Smart.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DM’s open. DYOR.

Disclaimer, I have no position in $RWL.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DM’s open. DYOR.

Disclaimer, I have no position in $RWL.

Oh I meant to say that @lachlanbjensen at @RaskAustralia also did a good review. Check it out here:

https://twitter.com/RaskAustralia/status/1433598851969998848?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh