@FERC and @NERC_Official staff are now providing a report out on their preliminary findings and recommendations stemming from their joint investigation of the February 2021 outages in ERCOT. ferc.capitolconnection.org/#

@FERC @NERC_Official @douglewinenergy asked me to live tweet, and I'm going to try, but I am REALLY bad at it so hold your expectations.

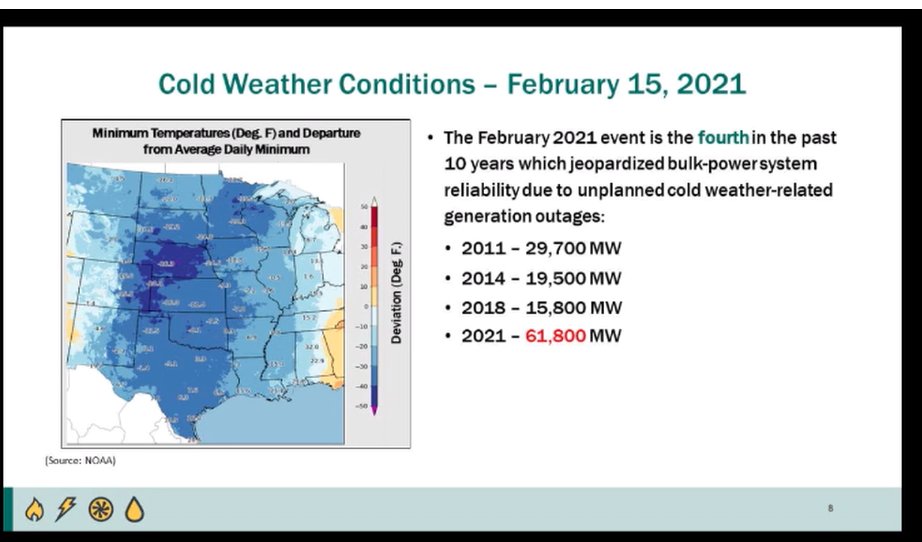

Presentation notes that the Feb. 2021 event is the FOURTH in the past 10 years in which reliability was at risk due to unplanned cold weather-related generation outages. This one was biggest set of outages by a wide margin. Presenter emphasizes these are becoming *common*.

The natural gas system experienced the largest U.S. monthly decline of natural production *on record*. Most producing regions saw sharp declines.

Staff notes many generators are designed with open configuration to avoid excessive heat, which creates risk of freezing in these cold weather events. They noted all generation types need to take steps to winterize to be available during these conditions.

Now reviewing the timeline. This is a familiar graphic but it is still incredible to anyone that been around the industry. The rapid loss of generation and frequency is downright terrifying to see visualized; can't imagine having been in the control room. Load shed here is huge.

Staff now explaining this was also a transmission emergency. Numerous transmission emergencies were called as east-west flows increased to try to fill the gap. Transmission constraints in MISO led to 2000 MW of load shed to maintain reliability. Transmission = resilience folks.

Preliminary key finding one - largest cause was generation freezing issues. Together, freezing and fuel issues accounted for 75 percent of outages. Staff stays cast majority of outages and start failures were in ERCOT (1244 out of 1823 total).

Key preliminary finding 2 - natural gas fuel supply was second largest cause of outages. 87 percent of unplanned outages or failures to start were caused by natural gas fuel supply issues.

Here are the root causes of those issues. The production decline on slide 15 (wasn't able to screen shot it) looks an awful lot like the frequency decline chart.

Preliminary finding 3 - natural gas and electricity reliability interdependency. 60% of gas units had issued before Feb. 14, when load shedding started. 60%!

Preliminary finding 4 - natural gas production and processes were not deemed critical loads, and therefore they were shed with other loads. This contributed to fuel supply and production decline issues.

Preliminary finding 5 - manual and automatic load shedding appears to not have been well coordinated. Size of manual load shed made it difficult to rotate outages, required operators to use automatic shedding, which reduced available of under frequency load shed (wonky, sorry).

Preliminary finding 6 - Looks like SPP, MISO, and ERCOT coordinations and communications went well overall.

Now turning to preliminary recommendations - 28 in all! This presentation includes 9 key recommendations, and include changes to reliability standards, which requires a long development process. All recommendations have timeframes (winter seasons) by which they should be done.

Key recommendation 1 - revise reliability standards to require identification of cold weather critical component, build or retrofit units to operate to ambient air temperature standards. This is a complex recommendation, but basically - winterization should be MANDATORY.

Also recommending changes to protect critical gas infrastructure from load sheds, requirements that generation owners account for precipitation and wind effect in providing temperature data.

There is another recommendation to revise load shed procedures to separate circuits used for manual and circuits used for automatic load shed.

So, generators will be required by the reliability standards to be designed and operated to specified ambient air temperatures. Can't tell, but it seems like the temp specifications and other details are left to the standards development process.

Staff also recommendations on the natural gas side, which fall outside mandatory electric reliability standards. Here is one on improving gas reliability to support the electricity system. Another joint FERC-NARUC Task Force!

(Everything old is new again, example #7456. I spent years on natural gas-electric coordination after the 2011 ERCOT event and 2014 Polar Vortex. Here we are again.)

Lots of good stuff here, but the headlines will, I think, be about the recommendation to develop mandatory reliability standards (that come with $1 m. per day fine potential) on generator winterization. See pages 19 - 23ish in the presentation here: ferc.gov/media/february…

In the world of developing mandatory reliability standards, the time frames are aggressive. Remember, process starts with industry stakeholder process at NERC, filing at FERC, FERC takes comments, then FERC approves or rejects. See FPA Section 215. law.cornell.edu/uscode/text/16…

Chair Glick frustrated that nothing was done on mandatory winterization of generators after 2011 event. Notes Staff report then recommended mandatory standards, and NERC process noted in previous tweet declined, adopting voluntary guidelines. Glick says that won't happen again.

Glick hits back on political rhetoric that renewables were a problem here. Notes all generation types were impacted, focuses on natural gas.

Glick also notes that imports from PJM mitigated situation in SPP and MISO. ERCOT could not do that "because Texas wants to avoid having its power grid regulated by this Commission." Says this isn't about jurisdiction; its about saving lives.

Glick asks staff how recommendations mandatory standards compare to recent FERC order requiring winterization plans. Staff says this builds on that, but would require actual winterization to ambient temps based on local conditions. In other words, retrofits/design, not just plans

Glick also asked how it compares to Texas PUC requirements. Staff says PUC is just requiring plans for not just cold weather but multiple disasters. Staff says they are complimentary (very diplomatic answer - again, these standards would require physical changes to generators).

Glick asked what report recommends on increasing transmission ties to ERCOT. Staff says that because data they have is focused on generator performance and gas system, they did not make specific recommendation, but do recommend that ERCOT study costs/benes of increasing ties.

Staff also notes that MISO and SPP ran into limits in imports due to transmission constraints within each as well (hello, MISO South).

Glick and Staff had a very interesting exchange about the implications of their findings for assessing generator availability, reserve margins, etc. Big takeaway from NERC - get away from nameplate and think about where energy is available, and where it is coming from.

Commissioner Danly with no questions . . .

Commissioner Clements now emphasizing the need to squeeze learnings out here. She likes the timelines staff recommends, to avoid 2011 scenario repeat.

Clements also said she really likes this recommendations. Asks if they considered a technology neutral forum to consider other incentives and investments, beyond the gas focus.

She's interested in the potential for deployment of demand response, for example, as a solution here. Staff says this is informed by the problem statement - natural gas supply issues a top cause of outages here. Suggests separating problem statement from solutions.

Staff says investigation team has lots of openness to solutions; notes report highlights that other potential solutions are out there. They think getting the forum in place will help reveal those solutions and ideas. (Up your travel budgets for weekly state-FERC forums, folks!)

(I kid, I totally agree with the point here - just trying to lighten this up.)

NERC emphasizes it is always open to multifaceted approaches to reliability (editorial note - I'd like to see some proof of this, myself).

On to Commissioner Christie. He says the problem in Texas much bigger than winterization standards - it's how you achieve resource adequacy. He says relying on energy market for RA is "an accident waiting to happen". "No one has an obligation to serve, which is a huge problem"

Christie says that is a feature of "cost of service regulation" and even capacity markets, "recognizing the problems with those". "I think an energy only market is an accident waiting to happen, and it did." 🔥🔥🔥🔥🔥

That was quite an ending. Commissioner Christie definitely lets us know what he is thinking, which I appreciate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh