Major Technology Trends based on Executives & Venture Money published by Mckinsey Today: *Read the full below

I'm long & bullish:

1. $PLTR (Applied AI, ML)

2. $PATH (Next-Gen Automation)

3. $CRWD (Cyber-risk)

4. $ZS & $NET (Trust Architecture)

We're still in early innings!

I'm long & bullish:

1. $PLTR (Applied AI, ML)

2. $PATH (Next-Gen Automation)

3. $CRWD (Cyber-risk)

4. $ZS & $NET (Trust Architecture)

We're still in early innings!

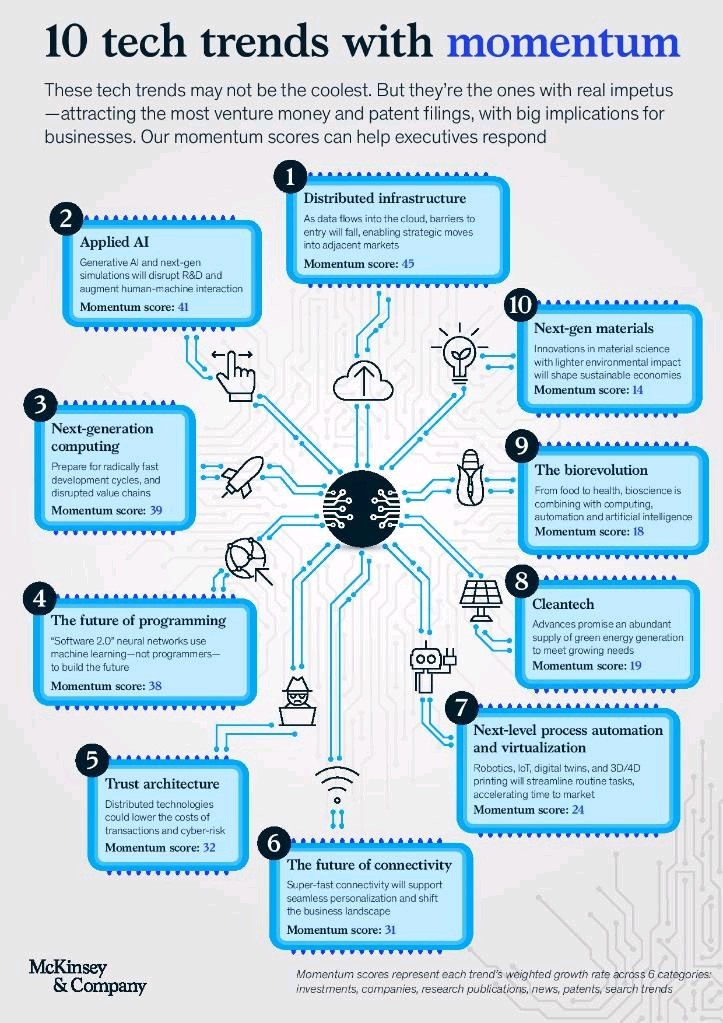

McKinsey Tech Trends Index:

Mapping based on some of these technology maturities and industry/corporate adoption.

The next decade of technological progress will be mind-blowing.

See excerpts from the report below o

Mapping based on some of these technology maturities and industry/corporate adoption.

The next decade of technological progress will be mind-blowing.

See excerpts from the report below o

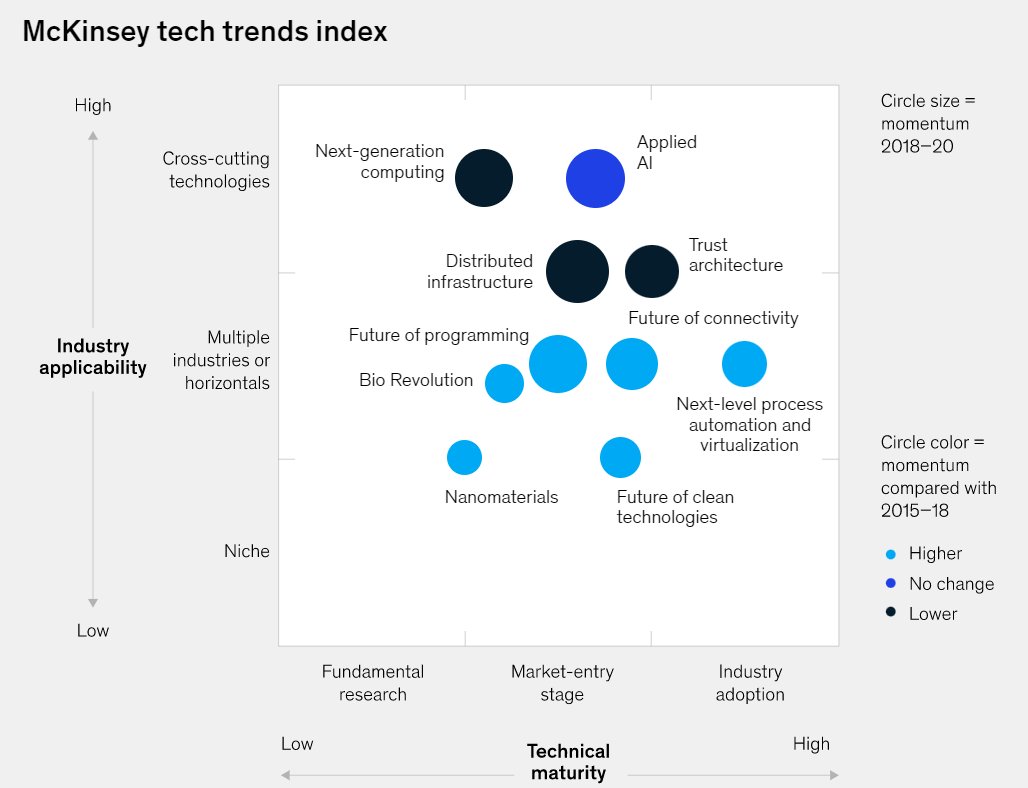

By 2022, 70% of companies will employ hybrid or multicloud-management technologies, tools, & processes, which are the hallmarks of distributed IT infrastructures.

Reflected by a rise in the software sourced by companies from cloud-service platforms, open repositories Enterprise software-as-a-service (SaaS) providers—from today’s 23% to nearly 50% in 2025, if current trends continue, potential for this to jump to 80% if adoption accelerates

The report is absolutely mind-blowing! I can't do it all in a thread.

I could see significant opportunities for companies like

+ $DDOG

+ $DOCN

+ $S and all the cybersecurity companies as seen below

I could see significant opportunities for companies like

+ $DDOG

+ $DOCN

+ $S and all the cybersecurity companies as seen below

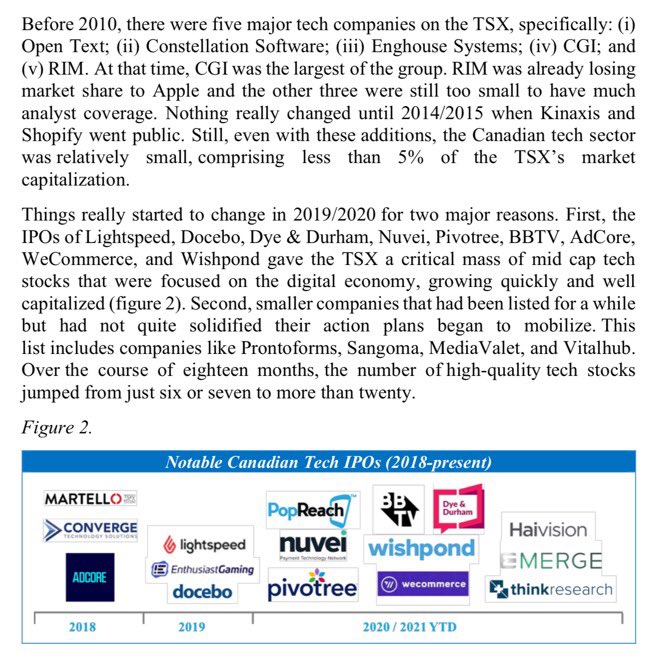

First piece of the report:

This goes into details on the trends --- Details patents, investments and major trends.

Tagging some tech experts : @summerlinARK @hhhypergrowth @StackInvesting @jaminball

mckinsey.com/business-funct…

This goes into details on the trends --- Details patents, investments and major trends.

Tagging some tech experts : @summerlinARK @hhhypergrowth @StackInvesting @jaminball

mckinsey.com/business-funct…

2nd Report was a joint effort btw VC's, Uni-researchers and executives

mckinsey.com/~/media/McKins…

I don't have time to create a full thread, feel free to read everything in the report above.

This is the type of alternative research I love that validates my thesis. Hope it helps!

mckinsey.com/~/media/McKins…

I don't have time to create a full thread, feel free to read everything in the report above.

This is the type of alternative research I love that validates my thesis. Hope it helps!

For those that read the report, feel free to let me know your thoughts on it!

• • •

Missing some Tweet in this thread? You can try to

force a refresh