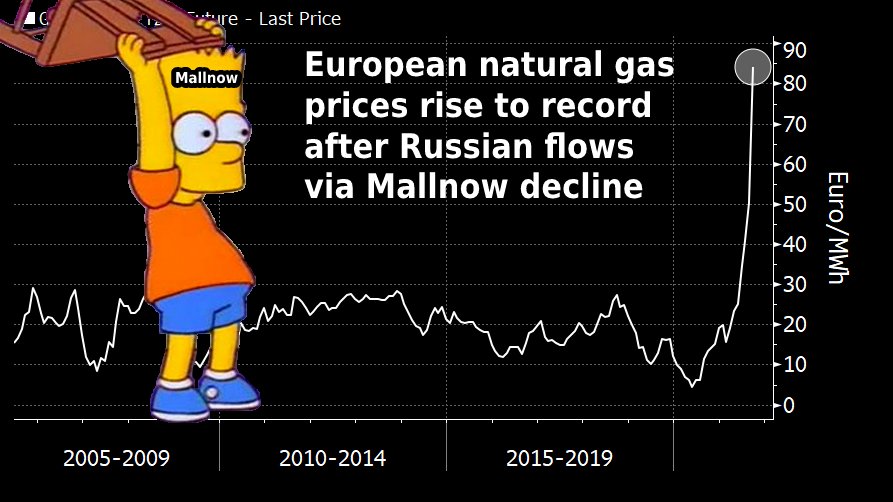

European natural gas prices are again surging toward a record high 📈🚀

That's due in part to:

> Carbon futures hitting an all-time high as utilities turn to coal

> Seasonally low stockpiles, limited supply from Russia/Norway

> Robust Chinese LNG demand

> Uncertain wind output

That's due in part to:

> Carbon futures hitting an all-time high as utilities turn to coal

> Seasonally low stockpiles, limited supply from Russia/Norway

> Robust Chinese LNG demand

> Uncertain wind output

EU benchmark carbon futures surged above 65 euros/ton for the first time ever as utilities seek coal supplies amid the global gas shortage

European coal futures for next-year delivery also surged to the highest since 2008 amid growing demand from the continent's utilities

US gas prices have surged to the highest level since 2014 amid winter supply fears

American LNG exports are poised to reach a record high this winter as new projects ramp up output, leaving less supply for the domestic market

American LNG exports are poised to reach a record high this winter as new projects ramp up output, leaving less supply for the domestic market

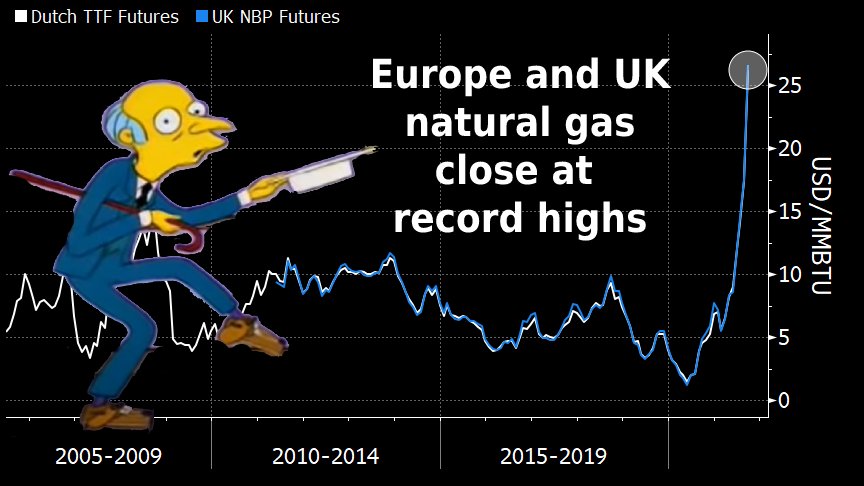

Dutch TTF and UK NBP natural gas prices closed at record highs on Monday amid a global supply crunch

Both are now trading above the equivalent of $26/mmbtu (!)

Both are now trading above the equivalent of $26/mmbtu (!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh