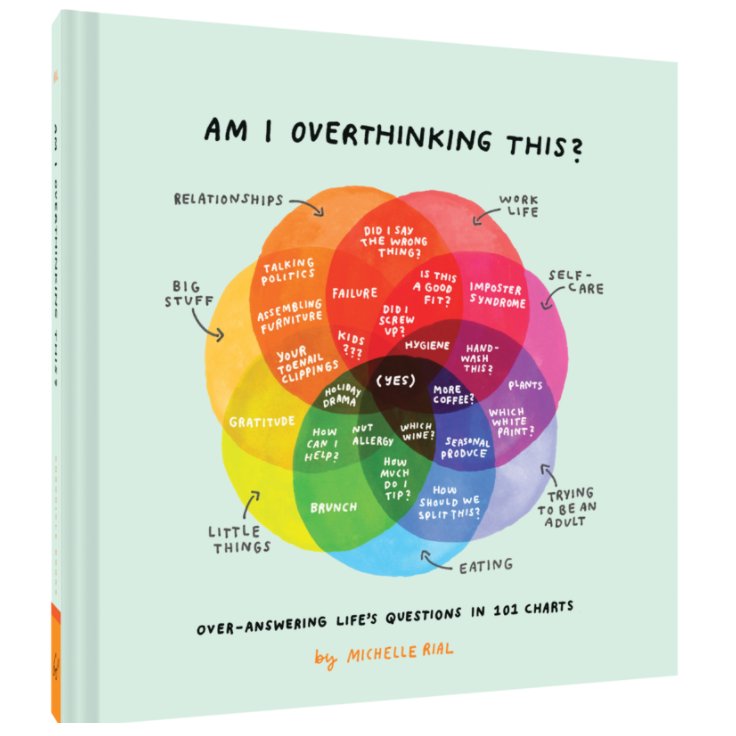

'Am I overthinking this' ~ @TheRialMichelle

💫What an awesome quick picture #book with relatable quips. It’s about searching for answers for things that don’t change !

Perfect for a coffee table!

Sharing my favorite learnings!

Grab your ☕️or🍵 for an easy read...

🧵...(1/10)

💫What an awesome quick picture #book with relatable quips. It’s about searching for answers for things that don’t change !

Perfect for a coffee table!

Sharing my favorite learnings!

Grab your ☕️or🍵 for an easy read...

🧵...(1/10)

→Let us be grateful to the people & things that make us happy !

Always remember: "Be thankful for what you have; you'll end up having more" 💯

Always remember: "Be thankful for what you have; you'll end up having more" 💯

• • •

Missing some Tweet in this thread? You can try to

force a refresh