Good Morning!

If youve checked out my blog then you know I use What I call 'The neutral Strategy for ETF's.

I'm still very intrigued by the strength of $IWM.

Notice the Blueprint I put together on 9/26 and the results

If youve checked out my blog then you know I use What I call 'The neutral Strategy for ETF's.

I'm still very intrigued by the strength of $IWM.

Notice the Blueprint I put together on 9/26 and the results

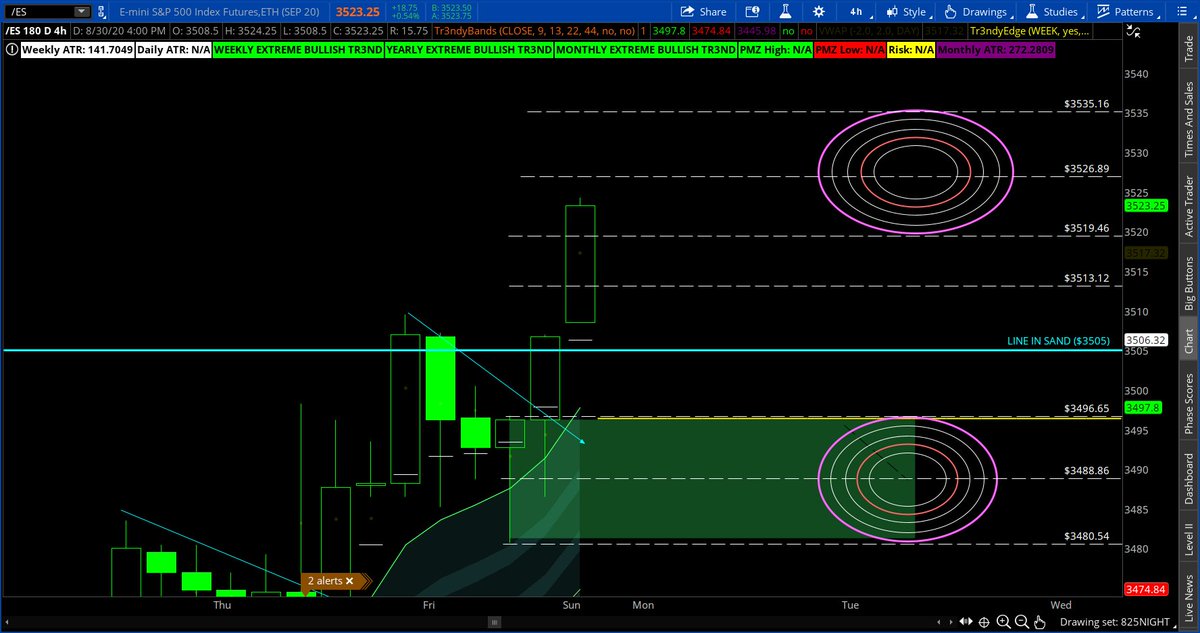

Price pushed into T2 to the upside and rejected and then dropped to lower T1 and supported. Remember levels to the upside are resistance and levels to downside are support. At the end of the week price closed right in the neutral and is getting very tight.

From a #Fibonacci perspective you can see price is still below the 618, the golden fib. Why is this a big deal? A move above the 618 signals a break in trend of the measured range.

Bulls need above 224.41 and a close on the weekly above this would be instrumental

Bulls need above 224.41 and a close on the weekly above this would be instrumental

This week's blueprint I'm projecting a move over 223.91 then we can see a move in the upside. A move below neutral I'd expect support at the lower levels .

overall the Lows are getting higher and this past week #IWM Stayed very strong.

#Smallcaps are definitely on watch

overall the Lows are getting higher and this past week #IWM Stayed very strong.

#Smallcaps are definitely on watch

Check out my blog when you have time to see more examples of my work and strategy at trendytrading.co/blog

#STocks #stockstowatch #StocksInFocus #Stockmarket $spy $qqq

#STocks #stockstowatch #StocksInFocus #Stockmarket $spy $qqq

• • •

Missing some Tweet in this thread? You can try to

force a refresh