1/ Four funding rounds during Q3 qualified it as one of the fifteenth largest to ever occur in the crypto sector. Through three quarters now, twelve of the fifteenth largest deals to ever happen in the industry, or 80%, have occurred this year.

2/ With another quarter in the books, there was another record in venture funding for the crypto/blockchain sector. Private investment was up nearly 21% Q/Q with nearly $8 billion allocated across 423 total deals.

3/ In aggregate, venture capital firms have injected roughly $17.8 billion into crypto firms from the beginning of the year through the end of Q3, which equates to more capital than the previous six years combined

4/ Heading into Q3, the funding market was oversaturated with high valuations for new projects. As a result, heading into Q3, investors were more selective with where/what they were allocating funds toward.

5/The number of funding deals declined 28%, which can largely be attributed to the decline in Seed & Pre-Series deal types. The slow down can be seen further when analyzing the ten most active investors this quarter, who made nearly half as many investments as they did during Q2

6/ A significant trend in Q3 was that the valuations of mid-sized companies conducting a Series B round in the crypto sector increased significantly. Despite nearly the same # of Series B rounds as the last Q, roughly $2.1 billion more was raised in this series type

7/ Mid-sized companies generating revenue have become attractive prospects for traditional finance firms, asset managers, and hedge funds to increase their exposure to the industry e.g. (Altimeter Capital, Coatue Management, Point72, SoftBank, Tiger Global, and Third Point, etc

8/ One additional note is that maturity of the sector and diversification of business models generating revenue are occurring at the mid-stage level. Six of our eight vertical labels conducted a Series B round.

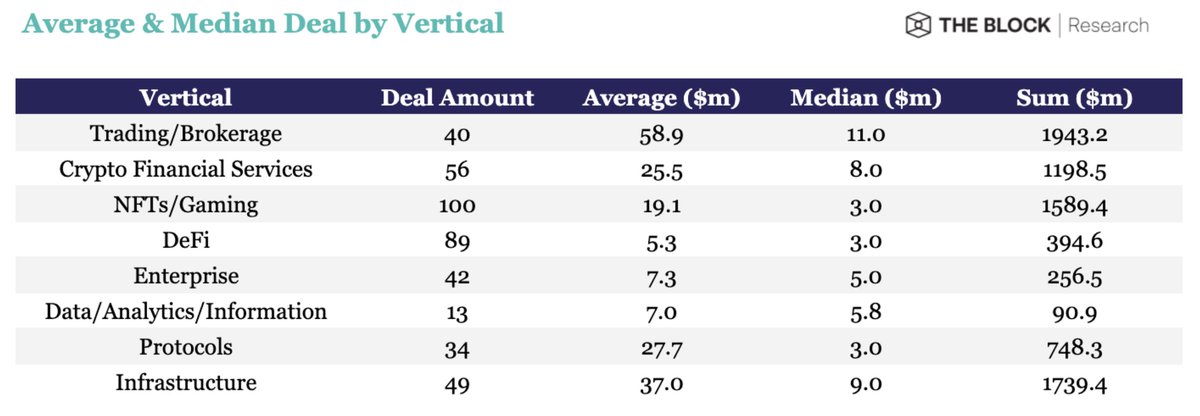

9/ Interest in non-fungible tokens, gaming projects, social tokens, DAOs, and other Web3 technologies led to the NFTs/Gaming vertical being the most popular deal type this quarter, surpassing DeFi which previously led for two consecutive quarters.

10/ The NFTs/Gaming vertical had the largest change in funding, where it went from $754.1 million in Q2 to nearly $1.6 billion in Q3, or roughly a 111% increase. The vertical also had seven funding rounds of $50 million or more.

11/ Compared to DeFi, the NFTs/Gaming vertical is still more heavily weighted towards Ethereum, where roughly 41% of the projects that received funding were solely Ethereum-based.

12/ Newer sub-categories within this vertical that are gaining traction, like social tokens and DAOs, predominately come from the Ethereum ecosystem. However, we expect areas such as gaming to pick up alternative Layer-1s and L2 solutions.

13/ The current NFTs/Gaming landscape mimics DeFi in its early stages, where Binance Smart Chain gained traction early due to its EVM compatibility. Still, then capital began to allocate towards projects building on other L1 ecosystems.

14/ Potential regulatory uncertainty & concerns + the attention of investors turning to the NFTs/Gaming vertical, resulted in DeFi deals declining 44%. Its funding declined 53% from $833.9m in Q2 to $394.6m in Q3. Despite the decline DeFi still was the 2nd most popular deal type

15/ Near the end of the Q, there was a revival in investment in decentralized stablecoin projects, likely due to expected clampdowns by the SEC on centralized stablecoins and the current reliance of ecosystems like DeFi on them. e.g. UXD Protocol, Float Protocol, & Angle labs

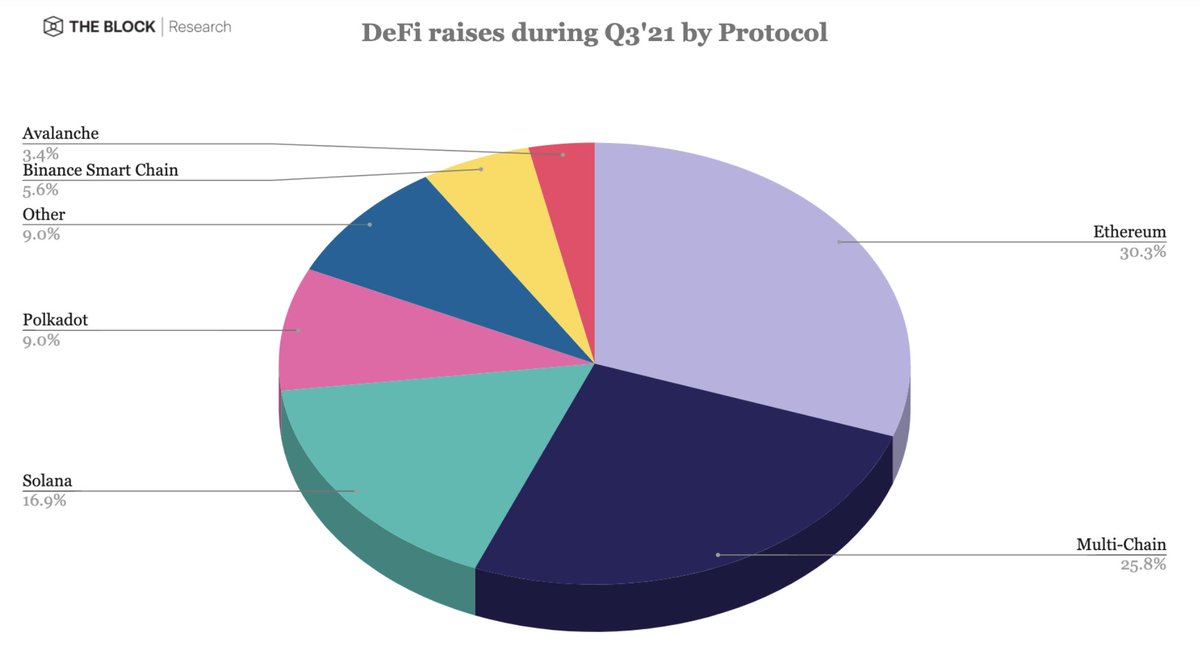

16/ Roughly 26% of the DeFi projects that raised funds in Q3 intend to support multiple blockchains, with the majority being EVM-focused and all providing support to Ethereum.

17/ For the second consecutive quarter, Solana generated the most interest of any Layer-1 blockchain outside of Ethereum. Fifteen projects or roughly 17% of DeFi raises this quarter are developing their applications on top of Solana.

18/ Avalanche joined Polkadot and Binance Smart Chain this quarter as a Layer-1 blockchain to garner more than one investment for DeFi protocol on its network.

19/ The Trading/Brokerage vertical received the most funding during Q3. Roughly 65% of the firms that raised reside outside of the US. The sector is beginning to see the maturity of cryptocurrency exchanges that cater to developing regions or other areas viewed as prime growth.

20/ There was a continued investment in Latin American countries, Southeast Asia, and even Pan-Africa throughout the quarter. Companies that fall under this category entering mid to even later stage include Series B raises by Mercado Bitcoin, Zipmex, Ripio, and CoinDCX

21/ The primary trend amongst the Protocols vertical was the investment in Web3 technologies. interoperability and seamlessly switching between applications and blockchain networks have also been seen as essential for its success.

• • •

Missing some Tweet in this thread? You can try to

force a refresh