Cryptoeconomic security are methods in which distributed cryptographic systems use financial incentives to form an honest consensus about the network.

In this episode, @ChainLinkGod and @Crypto___Oracle discusses the cryptoeconomic security of both $BTC and $ETH

Read on 👇

In this episode, @ChainLinkGod and @Crypto___Oracle discusses the cryptoeconomic security of both $BTC and $ETH

Read on 👇

@ChainLinkGod @Crypto___Oracle Cryptoeconomic security

🔹 How do we use cryptocurrency to financially incentivize a group of independent entities to work together? 🤔

🔹 Not just about work done, but to have financial incentives that are high enough to avoid various types of attacks

🔹 How do we use cryptocurrency to financially incentivize a group of independent entities to work together? 🤔

🔹 Not just about work done, but to have financial incentives that are high enough to avoid various types of attacks

@ChainLinkGod @Crypto___Oracle Explicit incentives are direct incentives for the service provided by the miners/validators ⛏️

🔹 Users pay a fee to get their transactions processed

🔹 Revenue of miners/validators is tied to the success of the network

🔹 Have financial resources at stake/locked up 🔒

🔹 Users pay a fee to get their transactions processed

🔹 Revenue of miners/validators is tied to the success of the network

🔹 Have financial resources at stake/locked up 🔒

@ChainLinkGod @Crypto___Oracle Implicit incentives are indirect incentives that are derived from the network and services but are not necessarily defined by the network itself

🔹 People taking on debt to purchase equipment in order to provide services

🔹 Pay back debt by earning revenue in the network

🔹 People taking on debt to purchase equipment in order to provide services

🔹 Pay back debt by earning revenue in the network

@ChainLinkGod @Crypto___Oracle 🔹 E.g. people need ASICs to mine $BTC

🔹 Participants in a network have ongoing financial exposure to the token they are holding (current holdings + future income)

🔹 If they corrupt the network, they corrupt both their current holdings + future income 😰

🔹 Participants in a network have ongoing financial exposure to the token they are holding (current holdings + future income)

🔹 If they corrupt the network, they corrupt both their current holdings + future income 😰

@ChainLinkGod @Crypto___Oracle 🔹 Some networks get users to lock up their tokens 🔒

🔹 A lot of network participants are public businesses, ASIC manufacturers, mining pools, and staking pools. If they are malicious, they can come under regulation through fines and their entire business is affected

🔹 A lot of network participants are public businesses, ASIC manufacturers, mining pools, and staking pools. If they are malicious, they can come under regulation through fines and their entire business is affected

@ChainLinkGod @Crypto___Oracle "So essentially, there's a strong incentive to not devalue the token, because you're going to devalue both your revenue, both the tokens you hold and the hardware you have, which actually generates those tokens." - ChainLinkGod

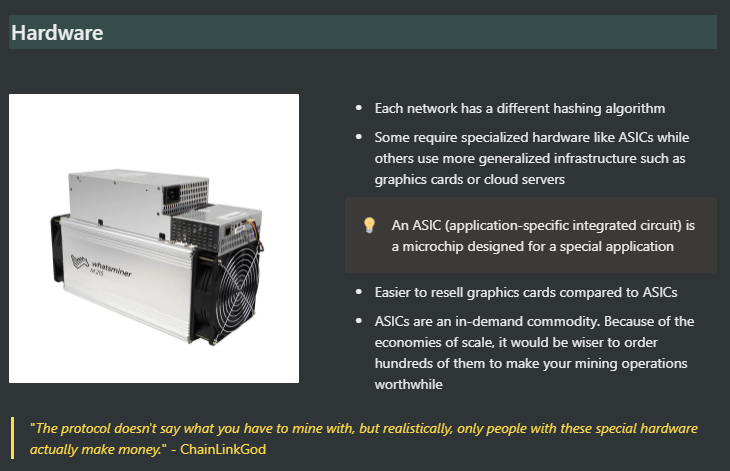

@ChainLinkGod @Crypto___Oracle Hardware

🔹 Each network has a different hashing algorithm

🔹 Some require specialized hardware like ASICs while others use more generalized infrastructure such as graphics cards or cloud servers

🔹 Easier to resell graphics cards compared to ASICs

🔹 Each network has a different hashing algorithm

🔹 Some require specialized hardware like ASICs while others use more generalized infrastructure such as graphics cards or cloud servers

🔹 Easier to resell graphics cards compared to ASICs

@ChainLinkGod @Crypto___Oracle $BTC

🔹 Miners provide computing power in return for $BTC

🔹 Block rewards are adjusted based on the hash power

🔹 The miner who is the successful block producer also gets the transaction fees of that block

🔹 Bitcoin does not have an inflationary supply

🔹 Miners provide computing power in return for $BTC

🔹 Block rewards are adjusted based on the hash power

🔹 The miner who is the successful block producer also gets the transaction fees of that block

🔹 Bitcoin does not have an inflationary supply

@ChainLinkGod @Crypto___Oracle 🔹 Eventually, the block rewards will run out and miners will be compensated only with transaction fees

🔹 Unless $BTC price skyrockets, the Bitcoin community has to consider how to keep the security budget large enough to ensure that the network is secure

🔹 Unless $BTC price skyrockets, the Bitcoin community has to consider how to keep the security budget large enough to ensure that the network is secure

@ChainLinkGod @Crypto___Oracle Bitcoin's Security Budget

🔹 Need people to pay ⬆️ transaction fees. Else miners will leave, leading to the centralization of $BTC

🔹 Current narrative: $BTC as a settlement layer. Everything else occurs on Lightning Network. CLG does not see this happening soon

🔹 Need people to pay ⬆️ transaction fees. Else miners will leave, leading to the centralization of $BTC

🔹 Current narrative: $BTC as a settlement layer. Everything else occurs on Lightning Network. CLG does not see this happening soon

@ChainLinkGod @Crypto___Oracle 🔹 CLG: People don't understand exponential decay. In 20 years, $BTC block rewards will drop by 90% 🚨

🔹 Bitcoin community needs to know what to do in the next few decades, not the next 100 years 🚨

🔹 Bitcoin community needs to know what to do in the next few decades, not the next 100 years 🚨

@ChainLinkGod @Crypto___Oracle Attacking $BTC

🔹 Difficult to pull off an attack

🔹 Malicious miner could fork the network. Honest miners could deem it illegitimate

🔹 Attacker would have wasted their resources trying to attack the network

🔹 Difficult to pull off an attack

🔹 Malicious miner could fork the network. Honest miners could deem it illegitimate

🔹 Attacker would have wasted their resources trying to attack the network

@ChainLinkGod @Crypto___Oracle $ETH

🔹 Currently very similar to $BTC

🔹 Will be moving towards Proof of Stake in Eth 2

🔹 Last month, 50% of the miner income came from transaction fees rather than the block subsidy

🔹 Currently very similar to $BTC

🔹 Will be moving towards Proof of Stake in Eth 2

🔹 Last month, 50% of the miner income came from transaction fees rather than the block subsidy

@ChainLinkGod @Crypto___Oracle 🔹 $ETH is not just generating cryptoeconomic security around its tokens, but its applications as well

🔹 For Proof of Work, miners need to constantly sell to cover their costs. In Proof of Stake, there is no such cost. This leads to lower selling pressure and a higher ETH price

🔹 For Proof of Work, miners need to constantly sell to cover their costs. In Proof of Stake, there is no such cost. This leads to lower selling pressure and a higher ETH price

@ChainLinkGod @Crypto___Oracle Moving to Proof of Stake

🔹 In Eth 2, validators lock up 32 ETH to gain the right to propose & validate blocks

🔹 Enter a queue process in order to enter or exit as a validator

🔹 The ⬆️ the price of ETH, the more secure the network becomes

🔹 In Eth 2, validators lock up 32 ETH to gain the right to propose & validate blocks

🔹 Enter a queue process in order to enter or exit as a validator

🔹 The ⬆️ the price of ETH, the more secure the network becomes

@ChainLinkGod @Crypto___Oracle 🔹 EIP-1559 introduces another form of cryptoeconomic security

🔹 It replaces the current auction model with a base fee

🔹 Base fee is burnt 🔥, while tip goes to miners

🔹 Combined with Proof of Stake, lowers issuance and makes $ETH deflationary

🔹 It replaces the current auction model with a base fee

🔹 Base fee is burnt 🔥, while tip goes to miners

🔹 Combined with Proof of Stake, lowers issuance and makes $ETH deflationary

@ChainLinkGod @Crypto___Oracle Validating blocks

🔹 Random function used to select a node to become a proposer

🔹 Other nodes serve as validators

🔹 Proof of Stake is energy efficient

🔹 Cryptoeconomic security comes from malicious validators getting their stake slashed

🔹 Random function used to select a node to become a proposer

🔹 Other nodes serve as validators

🔹 Proof of Stake is energy efficient

🔹 Cryptoeconomic security comes from malicious validators getting their stake slashed

@ChainLinkGod @Crypto___Oracle 🔹 The ⬆️ nodes are malicious, the ⬆️ the slashed stake becomes

🔹 This is to incentivize decentralization

🔹 If everyone runs their node on AWS (Amazon Web Services) and AWS goes down, the penalty will be much larger than using one's own hardware and the hardware goes down

🔹 This is to incentivize decentralization

🔹 If everyone runs their node on AWS (Amazon Web Services) and AWS goes down, the penalty will be much larger than using one's own hardware and the hardware goes down

@ChainLinkGod @Crypto___Oracle Differences In Yield

🔹 In Proof of Stake, everyone earns the same percentage yield regardless of their stake 👍👍

🔹 In Proof of Work, a larger node will have a higher yield than a smaller node because of fixed costs, infrastructure, and hardware

🔹 In Proof of Stake, everyone earns the same percentage yield regardless of their stake 👍👍

🔹 In Proof of Work, a larger node will have a higher yield than a smaller node because of fixed costs, infrastructure, and hardware

@ChainLinkGod @Crypto___Oracle Ethereum 2

🔹 Proof of Stake does not increase transaction throughput at all

🔹 Eth 2 will provide data shards that can only hold data

🔹 Layer 2 rollups will continuously consume the main Ethereum blockspace

🔹 Will increase demand for layer 1 👀

🔹 Proof of Stake does not increase transaction throughput at all

🔹 Eth 2 will provide data shards that can only hold data

🔹 Layer 2 rollups will continuously consume the main Ethereum blockspace

🔹 Will increase demand for layer 1 👀

@ChainLinkGod @Crypto___Oracle Bitcoin & Ethereum

🔹 Want sound money with predictable issuance ➡️ $BTC

🔹 Want security guarantees of holding assets using apps ➡️ $ETH

🔹 With cross-chain solutions like @renprotocol, people can bring $BTC to $ETH to experience the best of both worlds 😎

🔹 Want sound money with predictable issuance ➡️ $BTC

🔹 Want security guarantees of holding assets using apps ➡️ $ETH

🔹 With cross-chain solutions like @renprotocol, people can bring $BTC to $ETH to experience the best of both worlds 😎

@ChainLinkGod @Crypto___Oracle @renprotocol 🔹 If more $BTC ➡️ $ETH, $BTC miners do not accrue fees for transactions on other blockchains

🔹 When push comes to shove, the Bitcoin community will implement things to ensure the survival of Bitcoin as they have major financial incentives to see it succeed

🔹 When push comes to shove, the Bitcoin community will implement things to ensure the survival of Bitcoin as they have major financial incentives to see it succeed

@ChainLinkGod @Crypto___Oracle @renprotocol Miner Extractable Value (MEV)

🔹 Ability for miners to include, exclude, or reorder transactions within a block

🔹 Allows them to front-run or censor transactions to extract value from the transactions of others

🔹 MEV =/= cryptoeconomic security

🔹 Ability for miners to include, exclude, or reorder transactions within a block

🔹 Allows them to front-run or censor transactions to extract value from the transactions of others

🔹 MEV =/= cryptoeconomic security

@ChainLinkGod @Crypto___Oracle @renprotocol 🔹 Flashbots and MEV auctions help prevent gas price auction wars, but they don't solve MEV

🔹 @chainlink Fair Sequencing Services (FSS) aims to mitigate MEV at the application level and layer 2

🔹 @chainlink Fair Sequencing Services (FSS) aims to mitigate MEV at the application level and layer 2

@ChainLinkGod @Crypto___Oracle @renprotocol @chainlink Links:

Substack post: thereadingape.substack.com/p/chainlinkgod…

Substack post: thereadingape.substack.com/p/chainlinkgod…

@ChainLinkGod @Crypto___Oracle @renprotocol @chainlink Links:

Podcast: open.spotify.com/episode/5T7l9h…

Thanks to @ChainLinkGod and @Crypto___Oracle for this discussion!

Podcast: open.spotify.com/episode/5T7l9h…

Thanks to @ChainLinkGod and @Crypto___Oracle for this discussion!

@ChainLinkGod @Crypto___Oracle @renprotocol @chainlink Like our work?

✅Follow us

✅Subscribe to our substack

Apes alone weak 🦍💀

Apes together strong🦍🦍🦍💪💪💪

Stay strong, apes 🦍💪

~ End Thread

✅Follow us

✅Subscribe to our substack

Apes alone weak 🦍💀

Apes together strong🦍🦍🦍💪💪💪

Stay strong, apes 🦍💪

~ End Thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh