In a previous episode, @ChainLinkGod & @Crypto___Oracle discussed the cryptoeconomic security underpinning the $BTC and $ETH network.

Today's episode is a continuation of that episode, focusing on $LINK @chainlink ⛓️

Read on 👇

Today's episode is a continuation of that episode, focusing on $LINK @chainlink ⛓️

Read on 👇

@ChainLinkGod @Crypto___Oracle @chainlink Diff btw Chainlink and blockchain

⛓️ Blockchain operates as a single unified network, providing the same standard of service

⛓️ Chainlink is a heterogeneous network. Millions of independent Oracle networks can run in parallel, each having their own cryptoeconomic security

⛓️ Blockchain operates as a single unified network, providing the same standard of service

⛓️ Chainlink is a heterogeneous network. Millions of independent Oracle networks can run in parallel, each having their own cryptoeconomic security

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Chainlink provides consensus about the subjective external world 🌍

⛓️ Chainlink Oracle networks are highly customizable

1️⃣ Different data types

2️⃣ Some have a couple of sources vs others which have a lot of sources

3️⃣ Some may be paid APIs while others are publicly available

⛓️ Chainlink Oracle networks are highly customizable

1️⃣ Different data types

2️⃣ Some have a couple of sources vs others which have a lot of sources

3️⃣ Some may be paid APIs while others are publicly available

@ChainLinkGod @Crypto___Oracle @chainlink Cryptoeconomic security for $LINK

⛓️ Can be approached from multiple angles

⛓️ From the perspective of rewards

1️⃣ Subsidy

2️⃣ Service fees

⛓️ From the perspective of penalties

1️⃣ Explicit Staking

2️⃣ Implicit Staking

⛓️ Can be approached from multiple angles

⛓️ From the perspective of rewards

1️⃣ Subsidy

2️⃣ Service fees

⛓️ From the perspective of penalties

1️⃣ Explicit Staking

2️⃣ Implicit Staking

@ChainLinkGod @Crypto___Oracle @chainlink Rewards: Subsidy

⛓️ Nodes are incentivized to provide a service because of the subsidy

⛓️ Subsidy used to bootstrap Oracle networks into existence 👢

⛓️ Oracle networks snowball till it becomes self-sustainable

⛓️ Subsidy provides certainty to node operators 👍

⛓️ Nodes are incentivized to provide a service because of the subsidy

⛓️ Subsidy used to bootstrap Oracle networks into existence 👢

⛓️ Oracle networks snowball till it becomes self-sustainable

⛓️ Subsidy provides certainty to node operators 👍

@ChainLinkGod @Crypto___Oracle @chainlink Governance Mechanism

⛓️ Uses a multisig of a team, nodes, & users. They can sign the multisig to remove malicious nodes

⛓️ Rationale for this is to have an administrator to add/remove nodes and data sources

⛓️ Each Oracle network will have its own gov scheme driven by user needs

⛓️ Uses a multisig of a team, nodes, & users. They can sign the multisig to remove malicious nodes

⛓️ Rationale for this is to have an administrator to add/remove nodes and data sources

⛓️ Each Oracle network will have its own gov scheme driven by user needs

@ChainLinkGod @Crypto___Oracle @chainlink Economies of scale

⛓️ Oracle networks are dynamic. If demand for a service ⬇️, that network can be scaled down

⛓️ As the revenue stream ⬆️ and ⬆️ users are onboarded, ⬇️ subsidy is needed

⛓️ Subsidy denominted in $LINK

⛓️ Oracle networks are dynamic. If demand for a service ⬇️, that network can be scaled down

⛓️ As the revenue stream ⬆️ and ⬆️ users are onboarded, ⬇️ subsidy is needed

⛓️ Subsidy denominted in $LINK

@ChainLinkGod @Crypto___Oracle @chainlink As node operators are continuously staking, they will end up having greater amounts of LINK token to stake in the future (as opposed to tokens going directly to retail). Their long-term mindset strengthens the cryptoeconomic security of Chainlink 💡

@ChainLinkGod @Crypto___Oracle @chainlink Dynamic vs standardized reward

⛓️ Blockchains provide service on a standardized timeframe (e.g. every 10 minutes for Bitcoin)

⛓️ For Oracles, services are offered at different frequencies

⛓️ Dynamic block reward system is more appropriate for $LINK — respond to user demand

⛓️ Blockchains provide service on a standardized timeframe (e.g. every 10 minutes for Bitcoin)

⛓️ For Oracles, services are offered at different frequencies

⛓️ Dynamic block reward system is more appropriate for $LINK — respond to user demand

@ChainLinkGod @Crypto___Oracle @chainlink Rewards: Service Fees

⛓️ Every smart contract app pays $LINK to access Oracle services

⛓️ Health of Chainlink is 🔑 to nodes' biz model

⛓️ All users share and fund the same Oracle feed 👍

⛓️ Each new user that comes in ⬇️ cost for all users — ⬆️ quality data for ⬇️ cost

⛓️ Every smart contract app pays $LINK to access Oracle services

⛓️ Health of Chainlink is 🔑 to nodes' biz model

⛓️ All users share and fund the same Oracle feed 👍

⛓️ Each new user that comes in ⬇️ cost for all users — ⬆️ quality data for ⬇️ cost

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Once these Oracle networks grow and service fees ⬆️, the subsidy can be ➡️ launch new networks

⛓️ Lots of abstraction layers: people can pay in whatever cryptocurrency they want, but node operators get paid in $LINK tokens in the background

⛓️ Lots of abstraction layers: people can pay in whatever cryptocurrency they want, but node operators get paid in $LINK tokens in the background

@ChainLinkGod @Crypto___Oracle @chainlink Explicit Staking

⛓️ Chainlink 2.0 whitepaper: LINK staking — collateral for Oracle services

⛓️ Chainlink 2.0 model is broken down into 2 tiers

1️⃣ 1st tier: Network of Oracle nodes continuously generating oracle reports

2️⃣ 2nd tier: A backstop tier used for dispute resolution

⛓️ Chainlink 2.0 whitepaper: LINK staking — collateral for Oracle services

⛓️ Chainlink 2.0 model is broken down into 2 tiers

1️⃣ 1st tier: Network of Oracle nodes continuously generating oracle reports

2️⃣ 2nd tier: A backstop tier used for dispute resolution

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Each node in 1st tier locks up LINK, enabling participation in the network

⛓️ Possibility of nodes colluding. Hence, any node in 1st tier can act as a watchdog 🐶 and raise an alert 🚨

⛓️ When an oracle report is created, each node in 1st tier gets a random priority number

⛓️ Possibility of nodes colluding. Hence, any node in 1st tier can act as a watchdog 🐶 and raise an alert 🚨

⛓️ When an oracle report is created, each node in 1st tier gets a random priority number

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Priority number determines the order the 🐶 alerts are processed

⛓️ Once 🚨 is raised, goes to 2nd tier to be voted on

⛓️ If 🐶 is correct and 2nd tier confirms it, slashed stake from malicious nodes ➡️ highest priority 🐶

⛓️ If 🐶 is wrong, 🐶 would get slashed

⛓️ Once 🚨 is raised, goes to 2nd tier to be voted on

⛓️ If 🐶 is correct and 2nd tier confirms it, slashed stake from malicious nodes ➡️ highest priority 🐶

⛓️ If 🐶 is wrong, 🐶 would get slashed

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Every node is incentivized to raise an alert if the majority is malicious, even if they themselves are malicious, because they have an opportunity to potentially win this concentrated reward, even if they do not have the highest priority number

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ To corrupt the network, the attacker has to bribe each node by that concentrated reward amount, which increases quadratically

⛓️ This is known as the super-linear staking impact

⛓️ This is known as the super-linear staking impact

@ChainLinkGod @Crypto___Oracle @chainlink Example

⛓️ 100 Chainlink nodes, each node staking $1 million

⛓️ Total budget: $100 million

⛓️ Super-linear staking design: Each node needs to be bribed by the concentrated amount/half of the stake = each node needs to be bribed $50 million

⛓️ Attacker needs budget of $5 billion

⛓️ 100 Chainlink nodes, each node staking $1 million

⛓️ Total budget: $100 million

⛓️ Super-linear staking design: Each node needs to be bribed by the concentrated amount/half of the stake = each node needs to be bribed $50 million

⛓️ Attacker needs budget of $5 billion

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ As the number of nodes ⬆️, the cost of attack skyrockets

⛓️ This model ensures a very hard security budget for a lot less stake

⛓️ More capital efficient than other existing models

⛓️ This model ensures a very hard security budget for a lot less stake

⛓️ More capital efficient than other existing models

@ChainLinkGod @Crypto___Oracle @chainlink ⬆️ Cryptoeconomic Security

⛓️ Model only requires 1️⃣ node to be honest

⛓️ As ⬆️ nodes become dishonest, the reward to the honest node ⬆️

⛓️ This incentivizes nodes to be honest

⛓️ Nodes that correctly flag alerts will ⬆️ reputation

⛓️ Most reputable nodes will be in 2nd tier

⛓️ Model only requires 1️⃣ node to be honest

⛓️ As ⬆️ nodes become dishonest, the reward to the honest node ⬆️

⛓️ This incentivizes nodes to be honest

⛓️ Nodes that correctly flag alerts will ⬆️ reputation

⛓️ Most reputable nodes will be in 2nd tier

@ChainLinkGod @Crypto___Oracle @chainlink ⛓️ Another model proposed by @SergeyNazarov would have users in the 2nd tier

⛓️ Unlikely for users (dApps, etc.) colluding and sabotaging their users

⛓️ ⬆️ in $LINK market cap improves cryptoeconomic security of 1st tier

⛓️ 2nd tier piggybacks off market cap of user tokens

⛓️ Unlikely for users (dApps, etc.) colluding and sabotaging their users

⛓️ ⬆️ in $LINK market cap improves cryptoeconomic security of 1st tier

⛓️ 2nd tier piggybacks off market cap of user tokens

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Implicit Staking

⛓️ Nodes get paid in $LINK

⛓️ If network gets corrupted, $LINK price would collapse

⛓️ Strong incentive to provide honest service

⛓️ LINK can be staked in the future. LINK valuation needs to take into account current value of LINK as well as future revenue

⛓️ Nodes get paid in $LINK

⛓️ If network gets corrupted, $LINK price would collapse

⛓️ Strong incentive to provide honest service

⛓️ LINK can be staked in the future. LINK valuation needs to take into account current value of LINK as well as future revenue

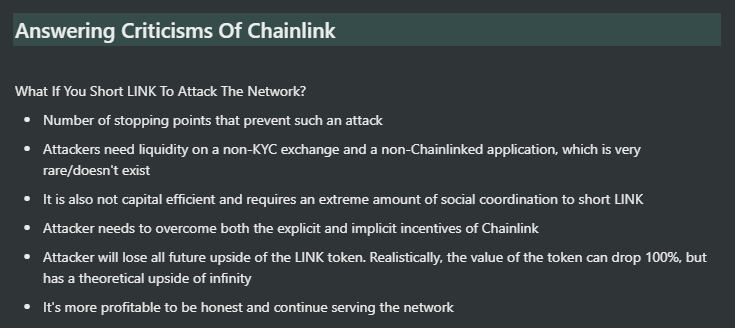

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Answering criticisms of Chainlink

⛓️ There are a no. of stopping points that prevent people shorting $LINK

⛓️ Attackers need liquidity on a non-KYC exchange/non-Chainlinked app, which is rare

⛓️ Not capital efficient, needs extreme amount of social coordination to short LINK

⛓️ There are a no. of stopping points that prevent people shorting $LINK

⛓️ Attackers need liquidity on a non-KYC exchange/non-Chainlinked app, which is rare

⛓️ Not capital efficient, needs extreme amount of social coordination to short LINK

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov ⛓️ Attack needs to overcome explicit & implicit incentives of Chainlink

⛓️ Attacker will lose all future upside of the LINK token

⛓️ Realistically, the value of the token can drop 100%, but has a theoretical upside of infinity

⛓️ More profitable to be honest

⛓️ Attacker will lose all future upside of the LINK token

⛓️ Realistically, the value of the token can drop 100%, but has a theoretical upside of infinity

⛓️ More profitable to be honest

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Cost of being an Oracle node

⛓️ Need to have API subscriptions to high quality data sources

⛓️ Need to run full nodes or have a connection to a full node

⛓️ Need to have some sort of infrastructure (e.g. bare metal server or in the cloud)

⛓️ Need to have API subscriptions to high quality data sources

⛓️ Need to run full nodes or have a connection to a full node

⛓️ Need to have some sort of infrastructure (e.g. bare metal server or in the cloud)

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Reputation

⛓️ Users would want nodes with a high reputation

⛓️ In Chainlink, historical performance of each node is tracked on-chain

⛓️ Many facets of reputation (e.g. uptime, how much LINK is at stake, how long they have been running, the actual entity, etc)

⛓️ Users would want nodes with a high reputation

⛓️ In Chainlink, historical performance of each node is tracked on-chain

⛓️ Many facets of reputation (e.g. uptime, how much LINK is at stake, how long they have been running, the actual entity, etc)

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov ⛓️ Nodes are financially incentivized to build their reputation — allows them to continue earning & be eligible for future jobs

⛓️ Bootstrapping a new reputation is difficult. Have to start from zero 0️⃣

⛓️ Cryptoeconomic incentives to build reputation have cross-network effects

⛓️ Bootstrapping a new reputation is difficult. Have to start from zero 0️⃣

⛓️ Cryptoeconomic incentives to build reputation have cross-network effects

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Conclusion

⛓️ Cryptoeconomic security of Chainlink is dynamic

⛓️ There will be new data sources, security models, & trusted hardware cryptography

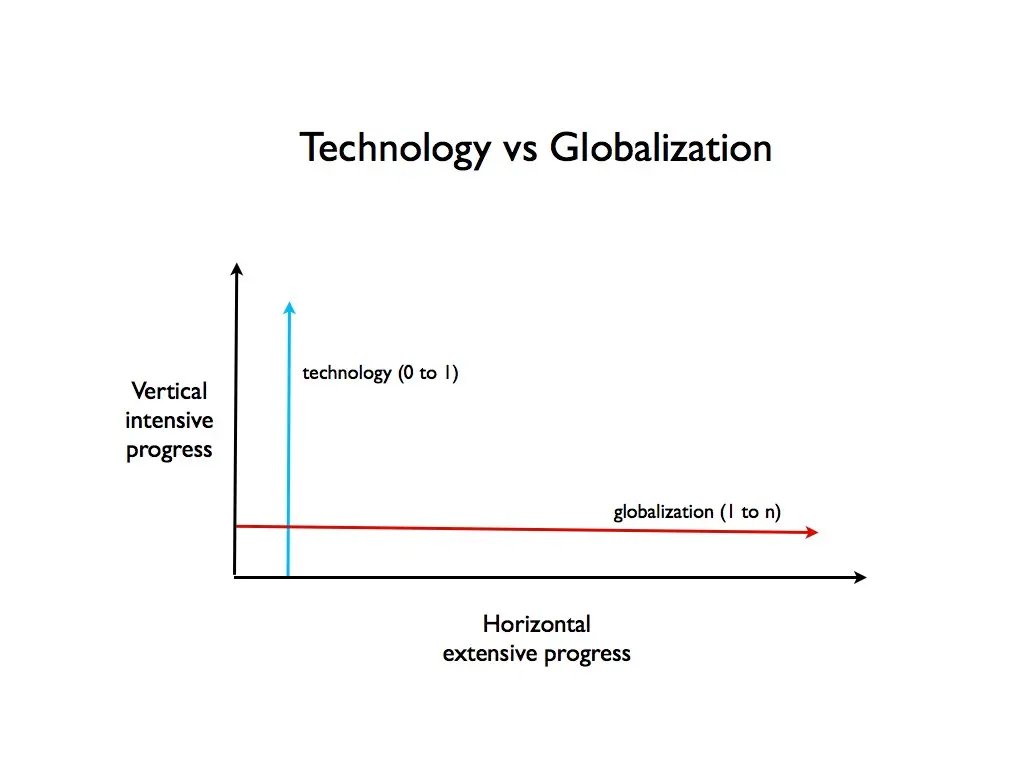

⛓️ Each Oracle network can be used in parallel, enabling horizontal scalability

⛓️ Cryptoeconomic security of Chainlink is dynamic

⛓️ There will be new data sources, security models, & trusted hardware cryptography

⛓️ Each Oracle network can be used in parallel, enabling horizontal scalability

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov ⛓️ Chainlink provides this in-depth defense approach

⛓️ You can layer on multiple forms of cryptoeconomic security to get a total amount of cryptoeconomic security (e.g. adding more stake, adding nodes with a certain reputation, etc.)

⛓️ You can layer on multiple forms of cryptoeconomic security to get a total amount of cryptoeconomic security (e.g. adding more stake, adding nodes with a certain reputation, etc.)

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Links:

Substack post: thereadingape.substack.com/p/chainlinkgod…

Substack post: thereadingape.substack.com/p/chainlinkgod…

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Links:

Podcast: open.spotify.com/episode/4xoQEw…

Thanks to @ChainLinkGod and @Crypto___Oracle for this episode!

Podcast: open.spotify.com/episode/4xoQEw…

Thanks to @ChainLinkGod and @Crypto___Oracle for this episode!

@ChainLinkGod @Crypto___Oracle @chainlink @SergeyNazarov Like our work?

✅Follow us

✅Subscribe to our substack

Apes alone weak 🦍💀

Apes together strong🦍🦍🦍💪💪💪

Stay strong, apes 🦍💪

~ End Thread

✅Follow us

✅Subscribe to our substack

Apes alone weak 🦍💀

Apes together strong🦍🦍🦍💪💪💪

Stay strong, apes 🦍💪

~ End Thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh