Rule of Law this, Rule of Law that. There are several reasons to seriously consider Leonard Leo, sole trustee of the Rule of Law Trust, accepted a $79M contribution from Guo Wengui in 2018...

https://twitter.com/mrspanstreppon/status/1447547178126397440

...In 2018, Cleta Mitchell was secretary of Steve Bannon's 501c4, Citizens of the American Republic per the 990 & the VA SoS registration. Mitchell & Leo were members of the Council For National Policy per the CNP directory...

...According to David Barboza in Dec 2018, Bannon first hooked up w Guo Wengui in Oct 2017, two months after Bannon left the WH. In fact, Bannon had agreed to chair Wengui's Rule of Law Fund, financed by $100M from Wengui...

nytimes.com/2018/12/04/bus…

nytimes.com/2018/12/04/bus…

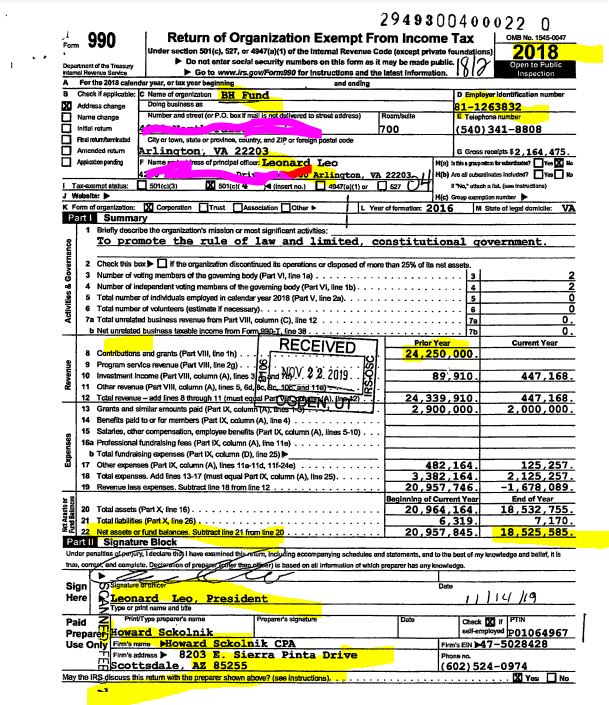

...We don't know the date the Rule of Law Trust was granted tax exempt status because Leonard Leo's CPA of choice, Thomas Raymond Conlon, a sole practitioner who operates out of a shed in his backyard, didn't fill out the 2018 990 properly (as usual)...

..But given investment income on $79M for 2018 was $415k compared to $1.8M in 2019, it's not unreasonable to assume the Rule of Law Trust came into being in the latter half of 2018...

...Steve Bannon & Leonard Leo had a meeting of the minds re Catholicism & the Church. Leo's ties & support for arch conservative clergy are well known & I won't go into them in this thread. Bannon's are noted in his Wiki bio...

...Bannon & Leonard Leo have known each other for years. As far back as 2015, they served on the board of Reclaim New York along w Rebekah Mercer...

...Guo Wengui registered two NFPS w the NYS SoS in Jan 2019, the Rule of Law Foundation III & the Rule of Law Society IV. Per the NYS Charity Bureau database, Steve Bannon was on the board of the Rule of Law Society IV....

...The Rule of Law Foundation III, a 501c3, filed a 2019 990 w the IRS but the Rule of Law Society IV, a 501c4, hasn't...

...After looking at dozens of 990s filed by 501cs associated w Leonard Leo, Neil Corkery, Thomas Raymond Conlon & Jason Torchinsky, I can't stress enough how unusual the structure of the Rule of Law Trust is...

...As I noted in a previous thread, under IRS rules, a trust applying for tax exempt status doesn't have to file as a business entity in the state it is domiciled in & the Rule of Law Trust didn't until April 2020...

...Not being a registered business entity in VA combined w the 2018 990 filed the IRS in Nov 2019 & only posted to the IRS Charity database in Feb 2020 made it difficult to link Leonard Leo to a 501c4 w $79M on hand...

..I first learned of the existence of the Rule of Law Trust in Oct 2020 when I read @RobertMaguire_ 's report on the CREW website...

citizensforethics.org/reports-invest…

citizensforethics.org/reports-invest…

...In 2018, the Rule of Law Trust payments to independent contractors, in particular, legal fees, weren't unusual...

...In 2019, the Rule of Law Trust paid $1M to the Baker Botts law firm so Leo Leonard must have had serious legal issues. Other expenses, likely more legal fees, were buried via a $2.6M payment to the Barton Group LLC registered by Jason Torchinsky, member, in June 2019...

My best guess is Leonard Leo became aware of an investigation into Guo Wengui by the DOJ and/or the SEC in early 2019. Leo would have had two concerns, one, keeping the $79M & two, keeping his name out of an investigation...

...In an Oct 29 2019 article for Axios, Jonathan Swan reported Bannon's one year $1M consulting contract w Guo Wengui ended in Aug 2019 & wasn't renewed...

axios.com/steve-bannon-c…

axios.com/steve-bannon-c…

...The Rule of Law Trust 2020 990 is due Nov 15 2021. Since the books & records are in the possession of Neil Corkery, someone might want to give him a call since he's req'd by law to provide the 990s & all documents supporting the application for tax exempt status...

More later

• • •

Missing some Tweet in this thread? You can try to

force a refresh