#WEO2021 is out!

Before a crucial #COP26, it shows that while climate ambitions have never been higher, energy transitions have a long way to go

Governments must give the signal that they will drive a wave of investment in a #NetZero future

Our report: iea.li/3iXLxnx

Before a crucial #COP26, it shows that while climate ambitions have never been higher, energy transitions have a long way to go

Governments must give the signal that they will drive a wave of investment in a #NetZero future

Our report: iea.li/3iXLxnx

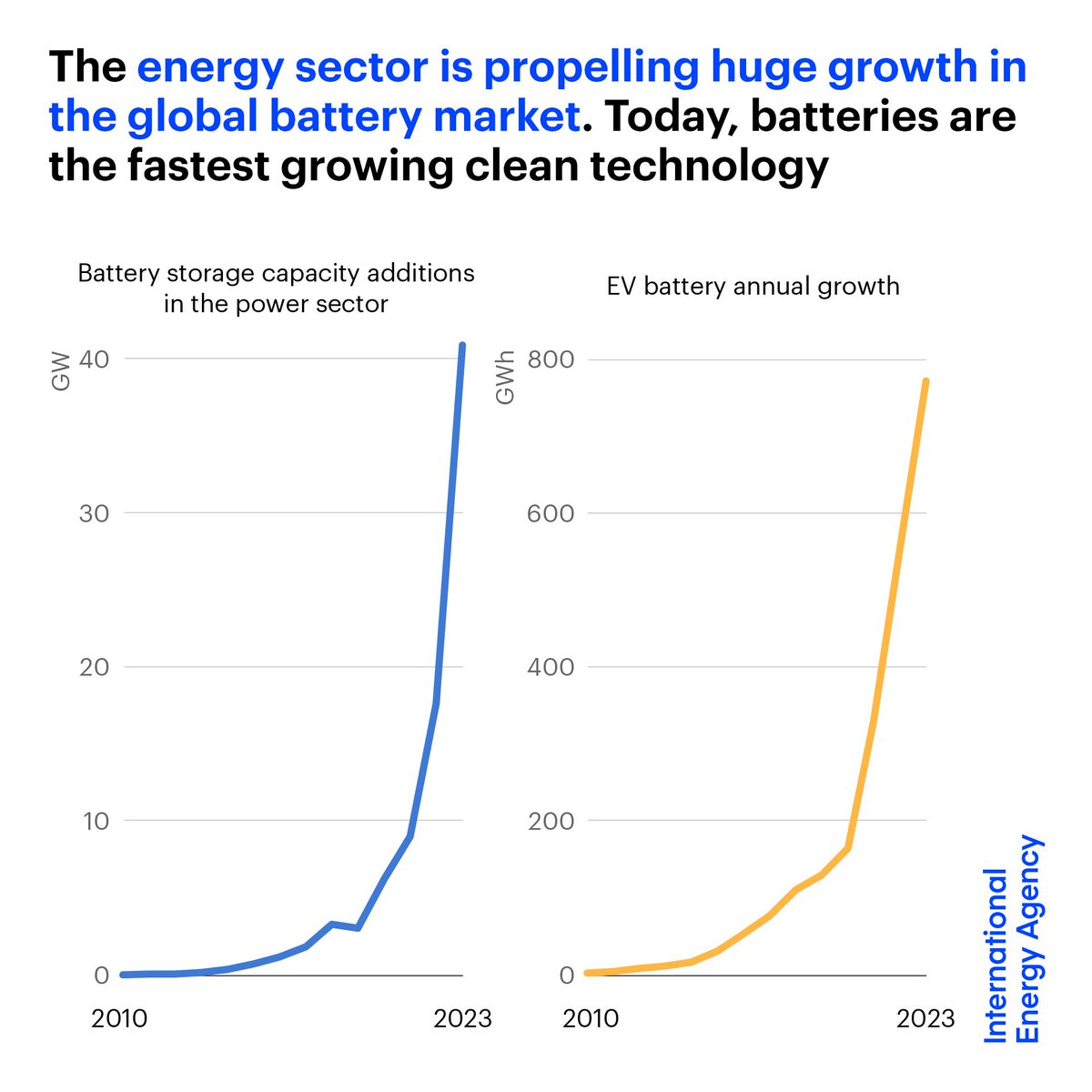

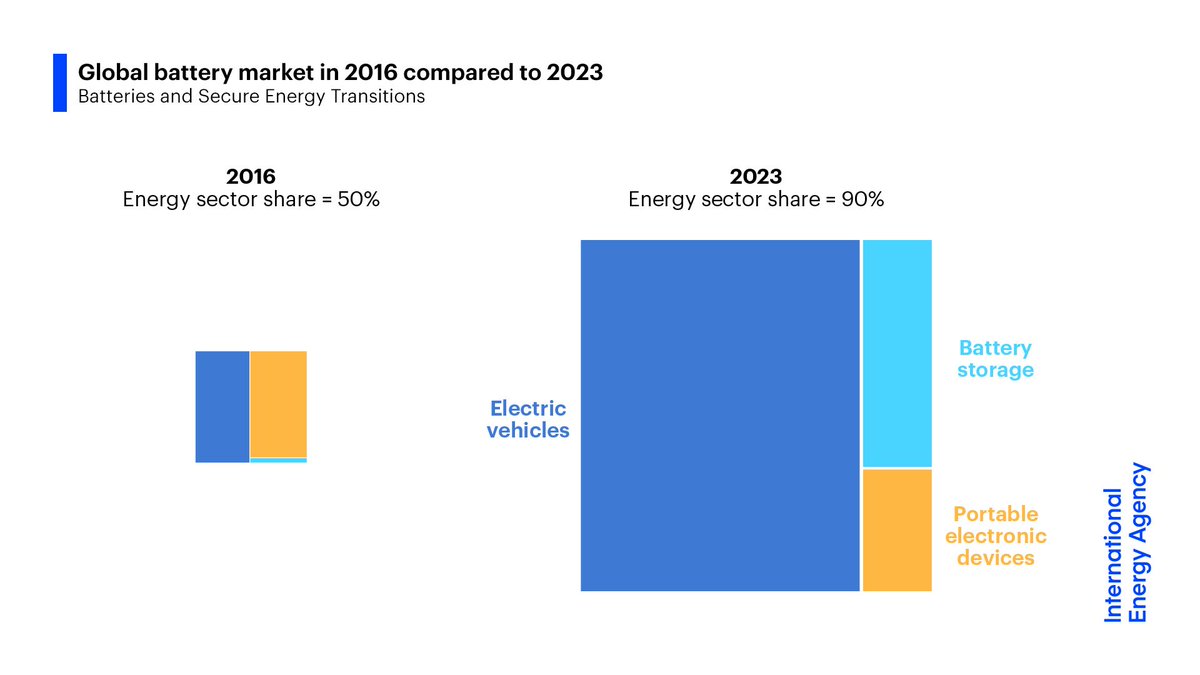

The encouraging news is that a New Energy Economy Is Emerging

#WEO2021 shows that pursuing #NetZero can create a market opportunity for equipment like batteries & wind turbines worth over $1 trillion a year by 2050 – similar to today's oil market

More: iea.li/3oVAVJR

#WEO2021 shows that pursuing #NetZero can create a market opportunity for equipment like batteries & wind turbines worth over $1 trillion a year by 2050 – similar to today's oil market

More: iea.li/3oVAVJR

If governments fully deliver on the climate pledges they have announced so far, it would limit global warming to 2.1 C.

Not enough to solve the climate crisis, but enough to change energy markets, including oil – which would peak by 2025 – and solar & wind, whose output soars.

Not enough to solve the climate crisis, but enough to change energy markets, including oil – which would peak by 2025 – and solar & wind, whose output soars.

Approvals of new coal power plants fall sharply if governments follow through on their announced climate pledges.

And China’s announcement that it will stop building new coal plants abroad could result in further cancellations, saving 20 gigatonnes of emissions through 2050.

And China’s announcement that it will stop building new coal plants abroad could result in further cancellations, saving 20 gigatonnes of emissions through 2050.

Despite progress, current climate pledges close less than 20% of the emissions gap between today’s policy settings & a #NetZeroBy2050 path.

Technologies & policies can close this gap by 2030. Over 40% of the actions are cost-effective, like renewables, efficiency & methane cuts.

Technologies & policies can close this gap by 2030. Over 40% of the actions are cost-effective, like renewables, efficiency & methane cuts.

There's a looming risk of more energy market turmoil.

Oil & gas spending has been depressed by price collapses in recent years. It's geared toward a world of stagnant or falling demand.

But clean energy spending is far below what's required to meet future needs sustainably.

Oil & gas spending has been depressed by price collapses in recent years. It's geared toward a world of stagnant or falling demand.

But clean energy spending is far below what's required to meet future needs sustainably.

Even as the world shifts to an electrified, renewables-rich energy system, potential energy security vulnerabilities require close vigilance.

Trade patterns, producer policies & geopolitical concerns remain vitally important in areas like critical minerals & hydrogen-rich fuels.

Trade patterns, producer policies & geopolitical concerns remain vitally important in areas like critical minerals & hydrogen-rich fuels.

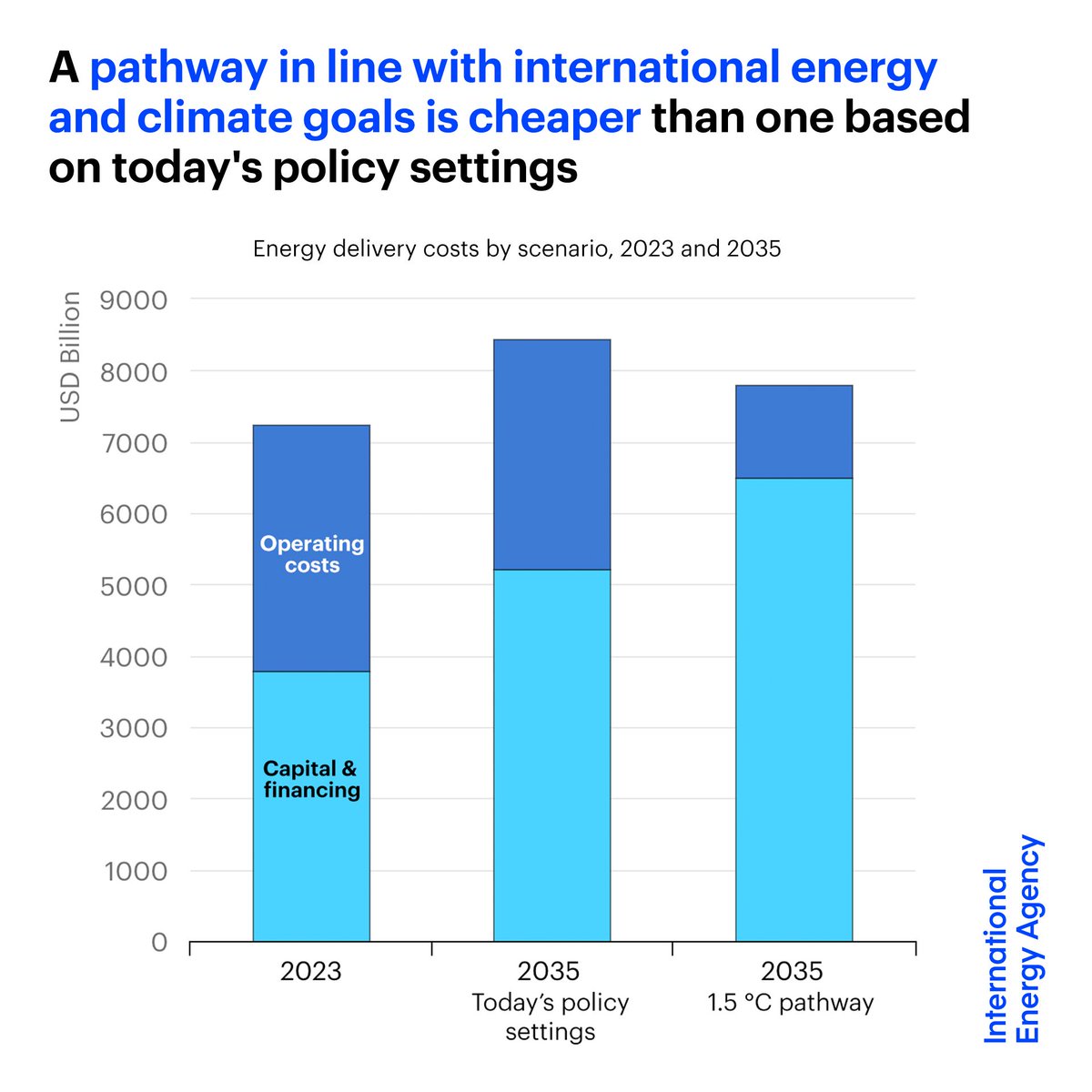

Well-managed transitions to clean energy can cushion consumers from the shock of price spikes for oil & gas.

Policy makers should help households overcome the upfront costs of energy efficiency improvements, like retrofitting homes, and electric solutions, like EVs & heat pumps.

Policy makers should help households overcome the upfront costs of energy efficiency improvements, like retrofitting homes, and electric solutions, like EVs & heat pumps.

For more insights from #WEO2021 – which is designed to be a handbook to #COP26:

➡️ Explore the report's analysis, which is available for free: iea.li/3iXLxnx

➡️ Join @Laura_Cozzi_ , @tim_gould_ & me for our LIVE launch event at 10:30am CEST iea.li/3mJRB45

➡️ Explore the report's analysis, which is available for free: iea.li/3iXLxnx

➡️ Join @Laura_Cozzi_ , @tim_gould_ & me for our LIVE launch event at 10:30am CEST iea.li/3mJRB45

• • •

Missing some Tweet in this thread? You can try to

force a refresh