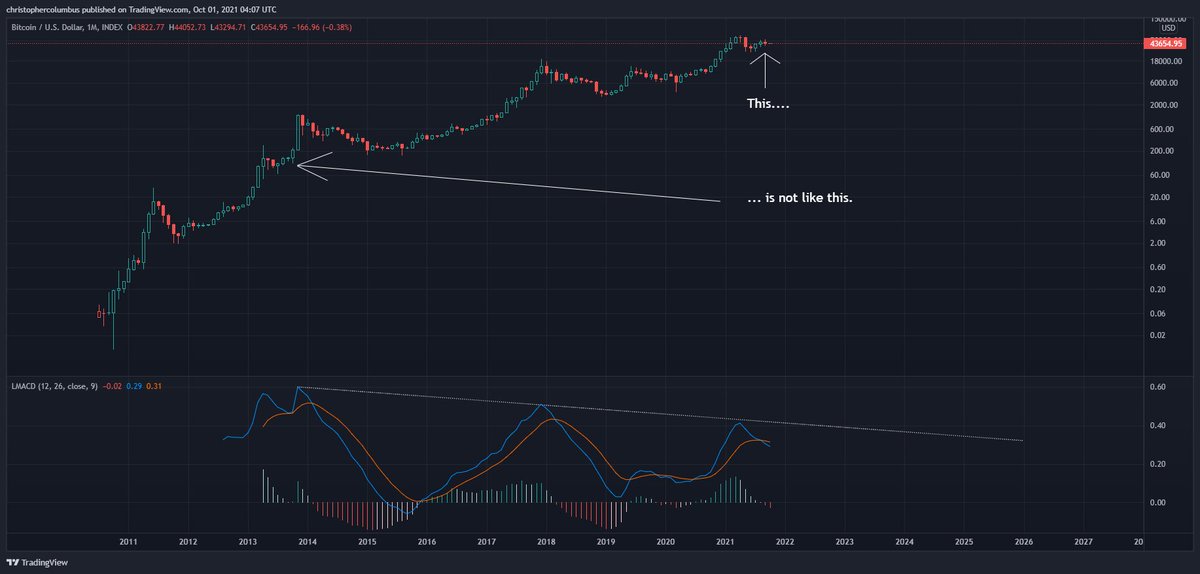

A few more weeks, and you'll have the longest correction within what most term as a cyclical/ bull run up. Portending a double-top?

This would also work in with the absence of a blow-off top that confounded so many. This kind of new price action may reflect an increasingly liquid and maturing market...

Model of the LGC primarily. Add to that, the consolidating monythly MACD, and reasonable to think double top.

The key here is the macro imo. And that is summed up in 'diminishing everything' - diminishing returns, diminishing cycles, diminishing 'bear markets' and, most significantly here, diminishing volatility. All of this as BTC is capitalized and heads toward price discovery in...

... an increasingly liquid market. The basic principle is increased liquidity = decreasing volatility. Those lacking these macro concepts are all at sea.🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh