Charts/ BTC investment/ Altcoin Trading/ Articles.

https://t.co/hjVaoGbgCS

Articles only -

https://t.co/Nj3rWvBzWh

6 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/davthewave/status/1461631590497353730?s=20&t=RHlfH8FWFxX3m_4g9zTH9Q

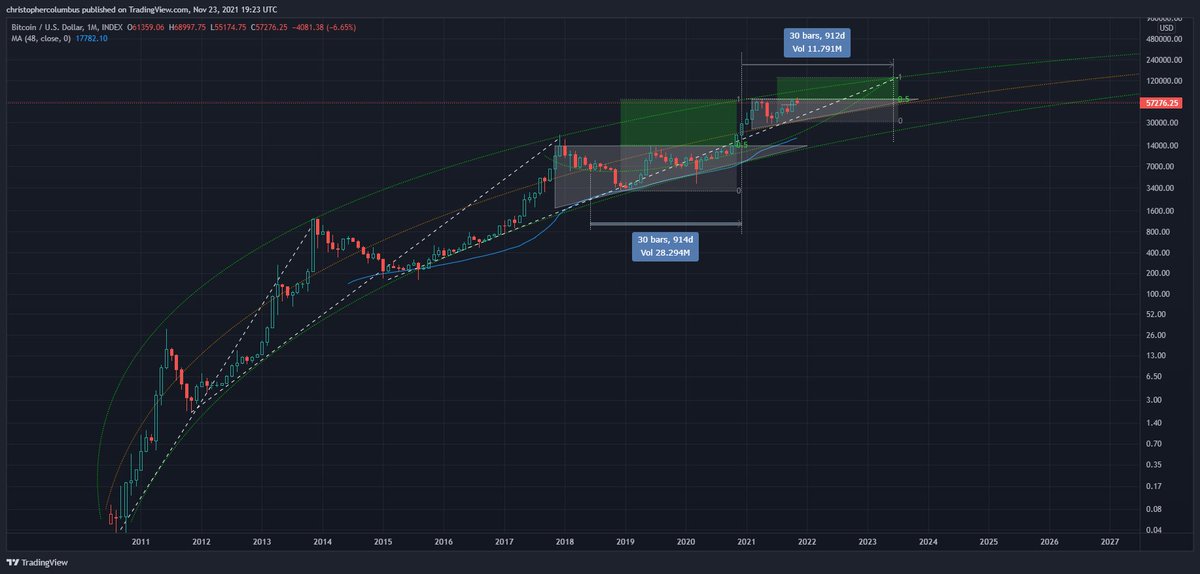

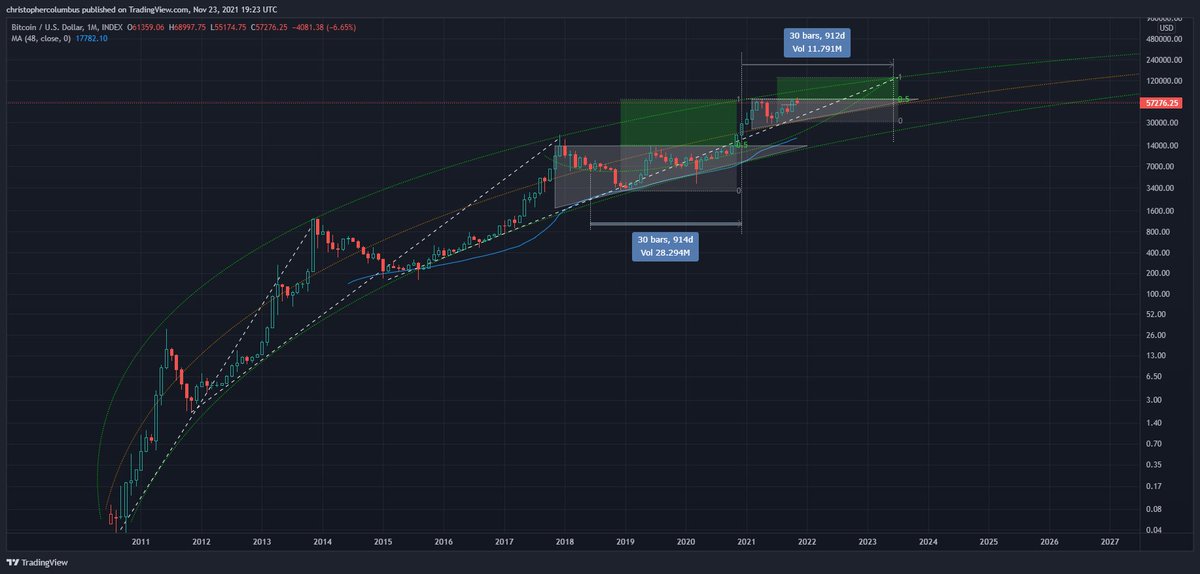

In this metric, there is room for a higher high [eventually] within the price range as configured.

In this metric, there is room for a higher high [eventually] within the price range as configured.https://twitter.com/davthewave/status/1387967847297474562?s=20

It's simple mean of prices that gives a regression curve around which price oscillates.

It's simple mean of prices that gives a regression curve around which price oscillates.

This would also work in with the absence of a blow-off top that confounded so many. This kind of new price action may reflect an increasingly liquid and maturing market...

This would also work in with the absence of a blow-off top that confounded so many. This kind of new price action may reflect an increasingly liquid and maturing market...

https://twitter.com/woonomic/status/1444331560925163526

This chart should show it increasingly unlikely that the current price action is comparable to 2013.

This chart should show it increasingly unlikely that the current price action is comparable to 2013.

Previous short term thread/ fractal -

Previous short term thread/ fractal -https://twitter.com/davthewave/status/1429914974558687240?s=20

https://twitter.com/davthewave/status/11929540379995299841/ Probably the simplest and most straightforward one - long term moving averages.

https://twitter.com/davthewave/status/1177759382320205824

https://twitter.com/davthewave/status/1149287455897505794

Some trigonometry...

Some trigonometry...

https://twitter.com/davthewave/status/1149287455897505794

I can see I might have to develop some vocabulary to avoid confusion between time frames. How about colors?

I can see I might have to develop some vocabulary to avoid confusion between time frames. How about colors?