@prism_protocol intro

S01E05 - What can I do with yLUNA?

Today, we will look into some (rudimentary) use cases and strategies using $yLUNA.

$pLUNA might sneak here or there, but in general, I will leave its story until the next episode.

/1

S01E05 - What can I do with yLUNA?

Today, we will look into some (rudimentary) use cases and strategies using $yLUNA.

$pLUNA might sneak here or there, but in general, I will leave its story until the next episode.

/1

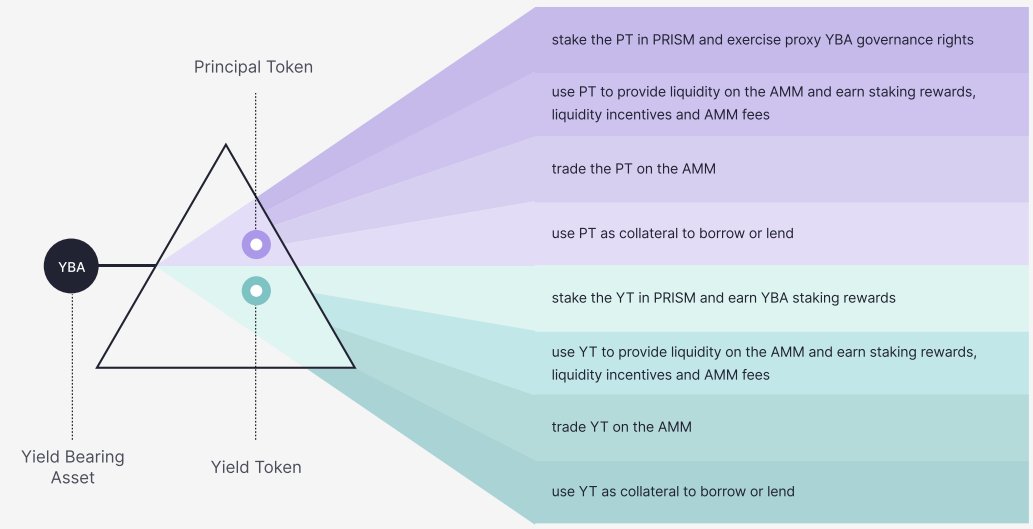

Almost entirety of what you'll read in a moment is based on PRISM Protocol litepaper, available here:

prismfinance.app/PRISM-litepape…

In particular, on 2 pictures below.

/2

prismfinance.app/PRISM-litepape…

In particular, on 2 pictures below.

/2

[1] Stake your $yLUNA with @prism_protocol - this way you will keep all staking rewards *and* airdrops to $LUNA stakers, with no slashing risk and no unstaking period.

Pretty darn cool, if you ask me. No more 21 days of wait to undelegate your $LUNA and use it elsewhere...

/3

Pretty darn cool, if you ask me. No more 21 days of wait to undelegate your $LUNA and use it elsewhere...

/3

And if that is not enough to convince you to stake with @prism_protocol, yet another table from the litepaper suggests an ongoing airdrop of $PRISM to $yLUNA stakers.

Yes, you read that right:

- $LUNA staking rewards

- Airdrops $ANC $MIR $VKR $MINE & co.

- $PRISM airdrops

/4

Yes, you read that right:

- $LUNA staking rewards

- Airdrops $ANC $MIR $VKR $MINE & co.

- $PRISM airdrops

/4

[2] $yLUNA will be a standalone token, so we'll be able to provide it with $PRISM into $yLUNA - $PRISM LP and earn transaction fees and... $PRISM incentives.

As much as 30% of total $PRISM supply will go towards "Community and Liquidity incentives"

/5

As much as 30% of total $PRISM supply will go towards "Community and Liquidity incentives"

/5

Even more surprisingly, providing $yLUNA to LP will allow us to keep the $LUNA staking rewards and airdrops. 🤯

Good that I am writing this series, as that fact somehow escaped my attention until now...

/6

Good that I am writing this series, as that fact somehow escaped my attention until now...

/6

We'll have a hard time choosing:

Stake $yLUNA

- staking rewards & airdrops

- $PRISM airdrops

Provide $yLUNA to LP

- staking rewards & airdrops

- LP incentives

- transaction fees

In any case: I would keep only a portion of $LUNA staked directly, e.g. to @angelprotocol. 👼

/7

Stake $yLUNA

- staking rewards & airdrops

- $PRISM airdrops

Provide $yLUNA to LP

- staking rewards & airdrops

- LP incentives

- transaction fees

In any case: I would keep only a portion of $LUNA staked directly, e.g. to @angelprotocol. 👼

/7

Next!

[3] Since $yLUNA is a token, we could buy it or sell it. "Why would we do that, ser?" you ask? Please allow me to explain.

It might not be as mind-blowing as the [1] and [2], but should still be fun. ;-)

/8

[3] Since $yLUNA is a token, we could buy it or sell it. "Why would we do that, ser?" you ask? Please allow me to explain.

It might not be as mind-blowing as the [1] and [2], but should still be fun. ;-)

/8

Imagine you sell $yLUNA for ~0.4 $LUNA. That's equivalent of 6.50% APR on staking rewards.

This means: whatever happens, you have exchanged variable APR on $LUNA staking into fixed APR *and* you got those staking rewards up-front.

It's up to you what'll do with the money.😎

/9

This means: whatever happens, you have exchanged variable APR on $LUNA staking into fixed APR *and* you got those staking rewards up-front.

It's up to you what'll do with the money.😎

/9

Or, you could buy $yLUNA at ~0.21 $LUNA, which is equivalent of current 3.19% APR.

Once the staking rewards go to 10%+ (soon, hopefully), price of $yLUNA will likely go to ~0.59 $LUNA. That's a 2.5x move just on stacking up $yLUNA.

/10

Once the staking rewards go to 10%+ (soon, hopefully), price of $yLUNA will likely go to ~0.59 $LUNA. That's a 2.5x move just on stacking up $yLUNA.

/10

[4] Last but not least, @mars_protocol is coming soon-ish. A proper money market will allow us to borrow against more tokens than $bLUNA and $bETH in @anchor_protocol.

So, we could lend $yLUNA for certain APR, or borrow against it.

/11

So, we could lend $yLUNA for certain APR, or borrow against it.

/11

That borrowing part will become particularly interesting when fixed-term variants of $yLUNA become available in future releases of @prism_protocol.

We will be able to borrow against $yLUNA-12m, i.e. 12 months worth of $LUNA staking rewards and...

/12

We will be able to borrow against $yLUNA-12m, i.e. 12 months worth of $LUNA staking rewards and...

/12

... keep $pLUNA-12m, which becomes redeemable 1:1 to $LUNA after a year.

No risk of liquidation, you only risk the yield (=staking rewards & airdrops).

/13

No risk of liquidation, you only risk the yield (=staking rewards & airdrops).

/13

S01E06 - "What can I do with pLUNA?" will be published on 21 Oct 2021 @ ~1600 UTC

Full list of episodes with links:

/14-end

Full list of episodes with links:

https://twitter.com/AgilePatryk/status/1448951059402137611

/14-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh