@pylon_protocol intro

S01E06 - What can I do with $pLUNA?

Today I will explain some uses of $pLUNA - some of them combined with $yLUNA, still simple.

Crazy stuff in S02. 🤫

Similarly to $pLUNA, most of below is based on PRISM Protocol litepaper:

prismfinance.app/PRISM-litepape…

/1

S01E06 - What can I do with $pLUNA?

Today I will explain some uses of $pLUNA - some of them combined with $yLUNA, still simple.

Crazy stuff in S02. 🤫

Similarly to $pLUNA, most of below is based on PRISM Protocol litepaper:

prismfinance.app/PRISM-litepape…

/1

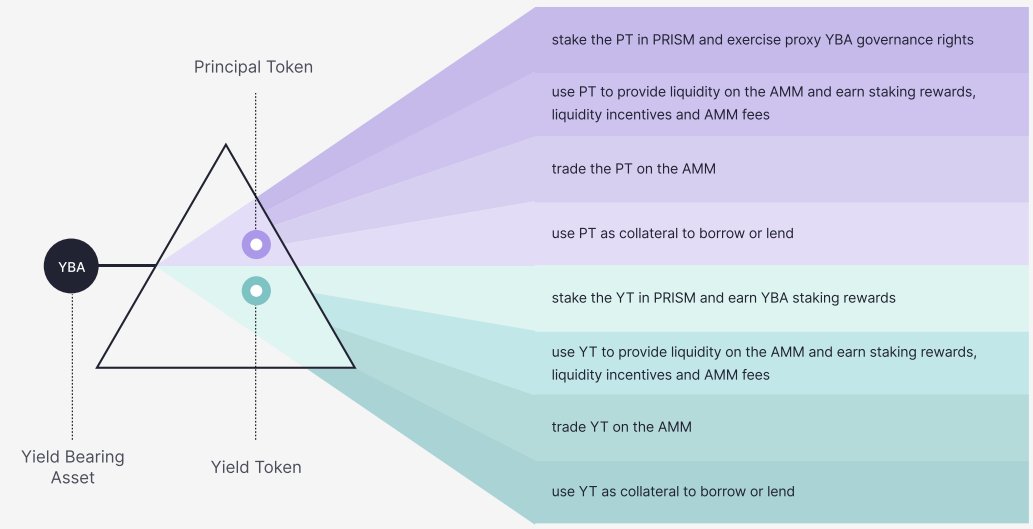

[1] Stake $pLUNA in @prism_protocol and exercise your voting rights.

Even after splitting $LUNA, you will retain the ability to vote in Terra Station through PRISM as a proxy - have a vote in each of the polls.

Maybe not-so-exciting, but oh-so-important for the ecosystem.

/2

Even after splitting $LUNA, you will retain the ability to vote in Terra Station through PRISM as a proxy - have a vote in each of the polls.

Maybe not-so-exciting, but oh-so-important for the ecosystem.

/2

[2] Lend out your $pLUNA

So you're already staking your $yLUNA with Prism and getting staking rewards, airdrops and $PRISM incentives... and it's still not enough for you?

Well, just lend your $pLUNA out on a money-market protocol, e.g. with @mars_protocol.

Extra APR!

/3

So you're already staking your $yLUNA with Prism and getting staking rewards, airdrops and $PRISM incentives... and it's still not enough for you?

Well, just lend your $pLUNA out on a money-market protocol, e.g. with @mars_protocol.

Extra APR!

/3

[3] Borrow against your $pLUNA

Standard staking essentially locks your $LUNA. $pLUNa will not be locked in any way, so why not borrow against it?

Yes, there is a risk of liquidation, but as well a chance for better return on assets...

Even if you put borrowed $UST into ⚓️

/4

Standard staking essentially locks your $LUNA. $pLUNa will not be locked in any way, so why not borrow against it?

Yes, there is a risk of liquidation, but as well a chance for better return on assets...

Even if you put borrowed $UST into ⚓️

/4

Anchor Earn is just the safest option though.

LP, IDOs, $MIM magic - sky is the limit.

Not a single thing would be possible with regular staked $LUNA.

/5

LP, IDOs, $MIM magic - sky is the limit.

Not a single thing would be possible with regular staked $LUNA.

/5

[4] Provide $pLUNA - $PRISM

Honestly, a thought of the above is somewhat scary. I don't like putting $LUNA into LPs as I treat it as an apex asset - something I treat with a lot of respect and wouldn't like to part with it...

PS. Flipping GPs almost gave a heart attack. 😱

/6

Honestly, a thought of the above is somewhat scary. I don't like putting $LUNA into LPs as I treat it as an apex asset - something I treat with a lot of respect and wouldn't like to part with it...

PS. Flipping GPs almost gave a heart attack. 😱

/6

Then again, there will be incentives LP providers. depending on how big these are, I might put a portion of my $pLUNA into LP and earn rewards (as a test, for starters).

/7

/7

[4] Buy/sell $pLUNA

Simply enough, we can sell $pLUNA, e.g. to buy more $yLUNA. If you want to live off of your yield, that would increase your regular paycheck of $LUNA staking.

Or, you could buy more $pLUNA (instead of $LUNA) to benefit/risk more from $LUNA price changes.

/8

Simply enough, we can sell $pLUNA, e.g. to buy more $yLUNA. If you want to live off of your yield, that would increase your regular paycheck of $LUNA staking.

Or, you could buy more $pLUNA (instead of $LUNA) to benefit/risk more from $LUNA price changes.

/8

Just as a reminder - all of the above is possible *regardless* of what you do with your $yLUNA.

Sell it, stake it, LP it - $pLUNA won't care and will let you do your thing independently.

/9

Sell it, stake it, LP it - $pLUNA won't care and will let you do your thing independently.

/9

With this, Season 1 has come to an end. Thank you for bearing with me and my rambling. :)

It would be great to get some feedback - were the explanations clear? Did you learn something new? Should I go more into details on a certain topic?

Please leave a comment or DM me.

/10

It would be great to get some feedback - were the explanations clear? Did you learn something new? Should I go more into details on a certain topic?

Please leave a comment or DM me.

/10

I might share some "filler" threads before Season 2 properly starts. Would like to prep the episodes as well to make sure I can share something daily. ;-)

List of all episodes (with links):

Stay tuned!

/11-end

List of all episodes (with links):

https://twitter.com/AgilePatryk/status/1450492857429766145

Stay tuned!

/11-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh