Human, husband, father - interested in crypto, Agile and Teal orgs. 📝 Agile Patryk's notes 📝 - all my resources in one place (link below)

How to get URL link on X (Twitter) App

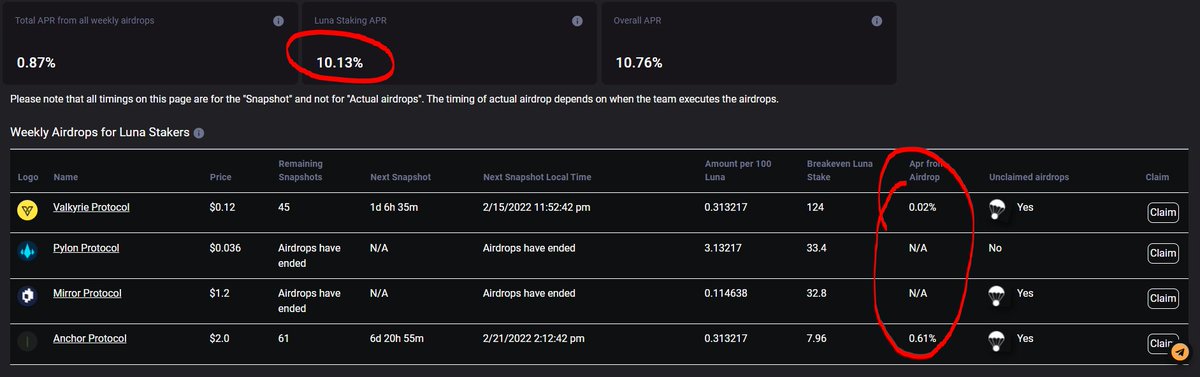

https://twitter.com/AgilePatryk/status/1515020271928942595I the original version of the calculator, I used the term "break-even".

https://twitter.com/cryptrus/status/1510241155409186816You might be curious how Anchor liquidations work - I happen to have a thread on that right here:

https://twitter.com/AgilePatryk/status/1506440557299523585

Privacy is a pretty important topic. On a general-usage blockchain (such as Terra, Avalanche, Harmony One or Ethereum) all the transactions are visible to everyone.

Privacy is a pretty important topic. On a general-usage blockchain (such as Terra, Avalanche, Harmony One or Ethereum) all the transactions are visible to everyone.

https://twitter.com/ErnestasCrypto/status/1501030997374410757I used to provide liquidity for the $KUJI - $UST pair back in the days when it was incentivized with extra $KUJI.

https://twitter.com/nebula_protocol/status/1497164498406305794@nebula_protocol has recently released (part) of their docs that cover the mechanics of "clusters" - the foundation of what the protocol will offer.

@EdgeProtocol will provide:

@EdgeProtocol will provide:

https://twitter.com/stablekwon/status/14858741180296355891️⃣ Loan safeguard mechanisms

https://twitter.com/doktor_make/status/1485355646228836353?s=20

https://twitter.com/AgilePatryk/status/1484464860331229184First, here is a look at the data I used (see picture).

https://twitter.com/dopeboyshanee/status/1483031408541159424Before we jump into head first into anything, I think some of you might be wondering:

https://twitter.com/Krypto_Kakashi1/status/1481302790886461445(I assume you already have some $ONE. If you don't - get it now from your favorite DEX / CEX.)