Fasten your seatbelts New England, it’s going to be a bumpy ride this winter.

https://twitter.com/RichGlickFERC/status/1451200418936094721

Some Key Findings from @FERC’s 2021-22 Winter Energy Market & Reliability Assessment Presentation & Report:

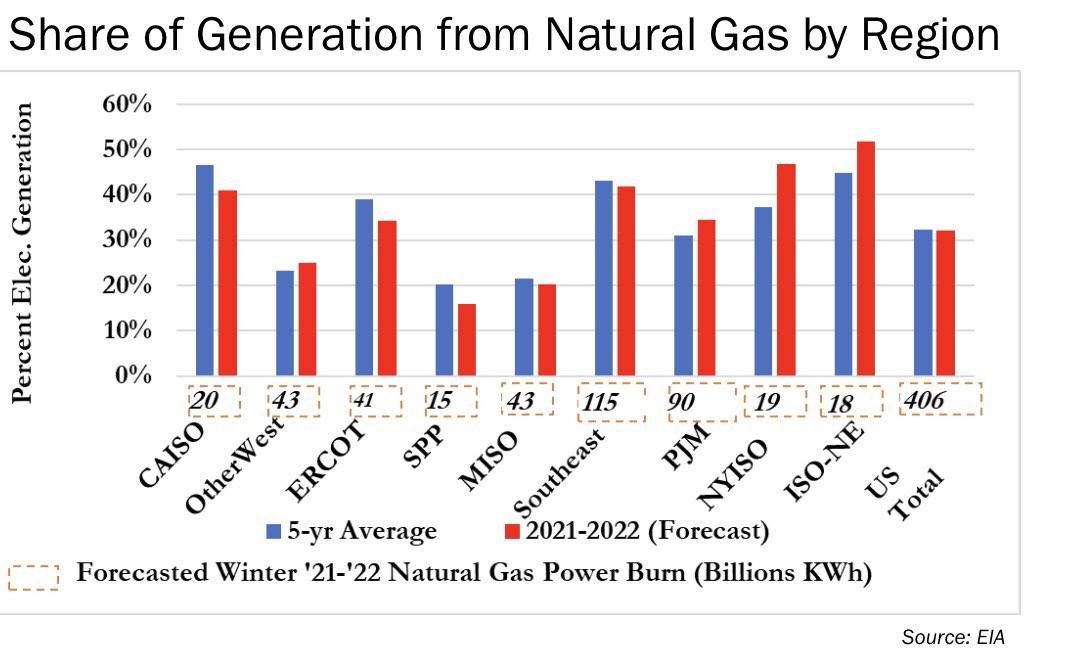

• Increased dependency on natural gas for electric generation and high global LNG demand may increase vulnerability of the Northeast regions to high natural gas prices.

• Increased dependency on natural gas for electric generation and high global LNG demand may increase vulnerability of the Northeast regions to high natural gas prices.

• Higher natural gas prices across the U.S. are expected to decrease power burn but increases in other domestic demand and net exports will likely increase natural gas demand.

• Natural gas and propane storage inventories going into this winter are below the five year average.

• Natural gas and propane storage inventories going into this winter are below the five year average.

Check out the price for gas at NE’s hub—Algonquin—on the far right. 👀

…It’s ~2x more than the rest of the country. 😳

…It’s ~2x more than the rest of the country. 😳

While power burn from fossil gas gen will decrease nationally (higher gas prices will make it cheaper to burn coal instead), in NY & NE power burn from gas gen will *increase* during this period of very high gas prices.

More tidbits from the Report…

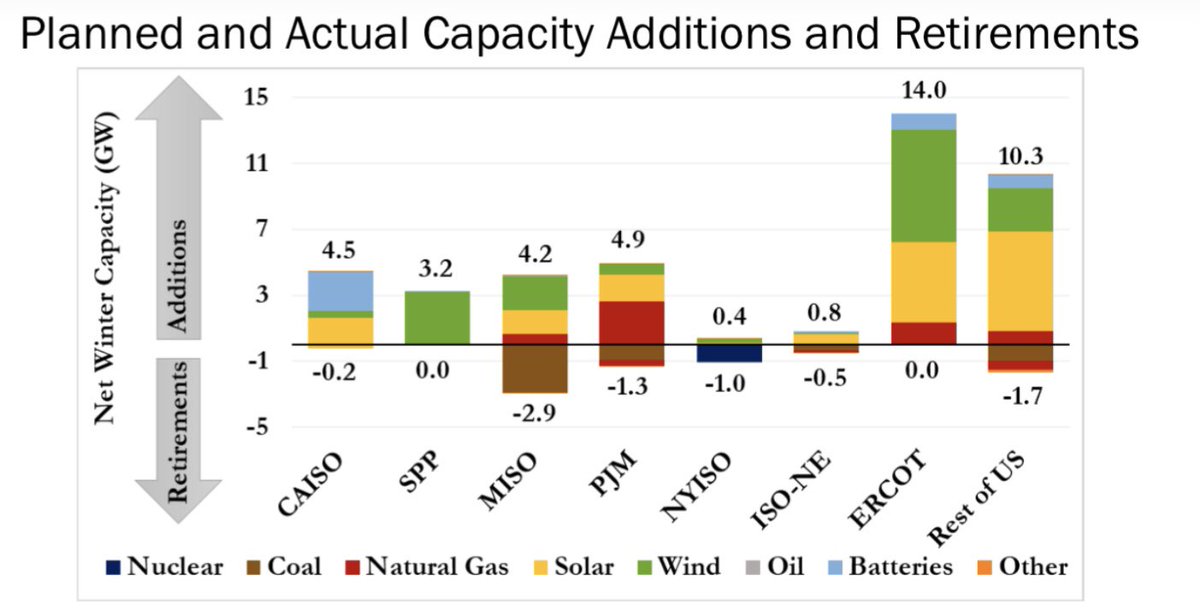

Nationally, March ‘21-Feb ‘22, capacity additions = ~42.4 GW

(which incl 16.3 GW of solar &

16 GW of wind); capacity retirements = ~7.6 GW (which incl 5.1 GW of coal).

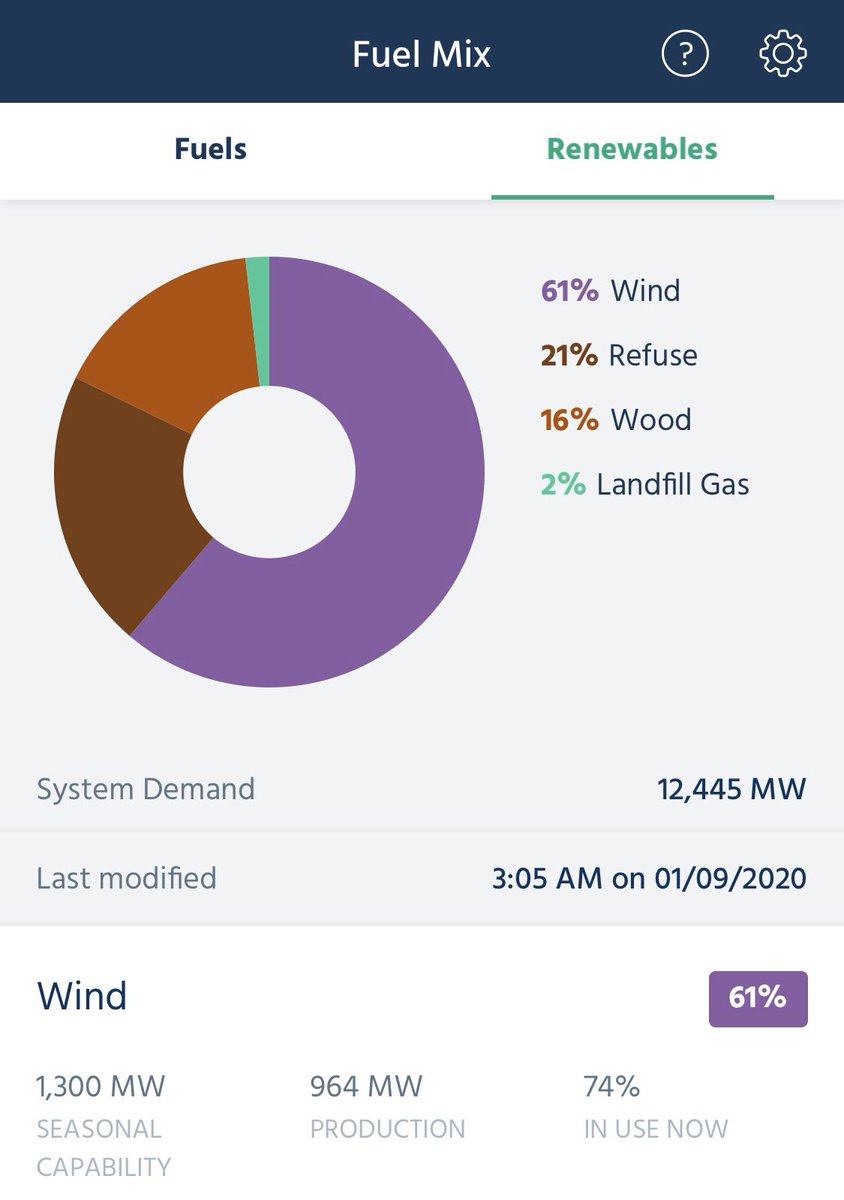

In NE we added .8 GW of wind & solar, and retired .5 GW of gas gen.

Nationally, March ‘21-Feb ‘22, capacity additions = ~42.4 GW

(which incl 16.3 GW of solar &

16 GW of wind); capacity retirements = ~7.6 GW (which incl 5.1 GW of coal).

In NE we added .8 GW of wind & solar, and retired .5 GW of gas gen.

As of 10/13/21 benchmark Henry Hub price for fossil gas =

$5.63/MMBtu) for Nov ‘21-Feb ‘22 (a 103% increase over previous winter settled futures prices).

On 10/13/21, prices for fossil gas at the Algonquin Citygate hub outside Boston = $18.18/MMBtu.

$5.63/MMBtu) for Nov ‘21-Feb ‘22 (a 103% increase over previous winter settled futures prices).

On 10/13/21, prices for fossil gas at the Algonquin Citygate hub outside Boston = $18.18/MMBtu.

Who’s going to be hardest hit by high fossil gas & electricity prices this winter? Clearly low-income customers who are already energy burdened. (Energy burden = % of income needed to pay utilities.) It’s going to be a savage winter for them.

I’ll elaborate on this in a later🧵.

I’ll elaborate on this in a later🧵.

The next group most impacted by high winter electricity prices? LDC basic service customers. MA LDCs will go out to market this month to buy the balance of the power they’ll be delivering Jan. 1. Those prices will be announced in Nov. Be seated when you read them.

The group least likely to be affected by high winter electricity prices? Likely, municipal aggregation customers. Many MA muni aggs locked in power prices for this winter when prices were lower. If you live in a city/town w/a muni agg check out their rates & how long those …

… rates will be in effect. Compare them to the Jan. 1 rates your MA LDC will announce in Nov. If your muni agg’s rates are lower, and will remain fixed for the winter, then you ought to enroll w/ your muni agg if you haven’t already. You’ll save yourself a💰.

###

• • •

Missing some Tweet in this thread? You can try to

force a refresh