It might be worth taking the time to ...

Here we go...

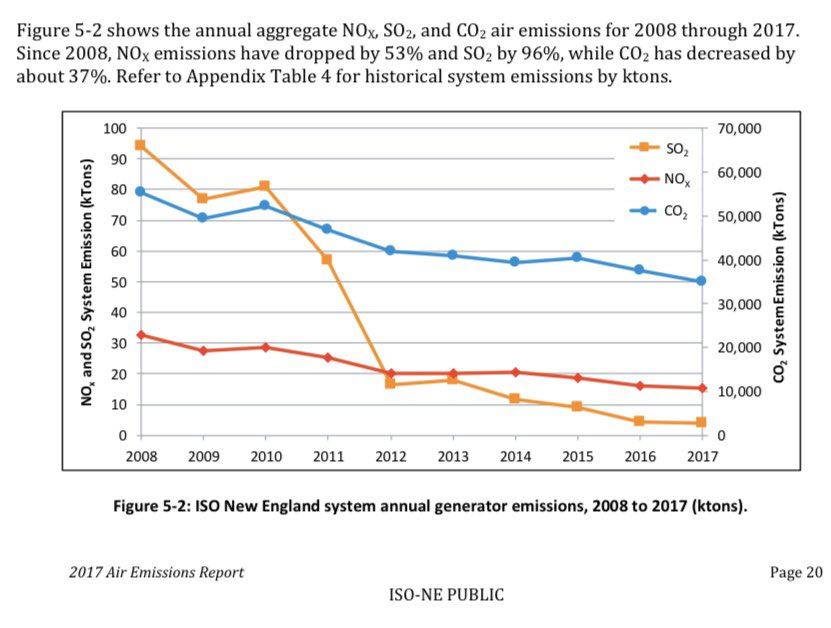

But what about the RT market? Per ISO-NE (bit.ly/30CbVc9 p 1-1) the RT market is administered to: “[s]atisfy Operating Reserve and Replacement Reserve requirements ...

Keep Current with Joe LaRusso 🔌 🕳🐇

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!