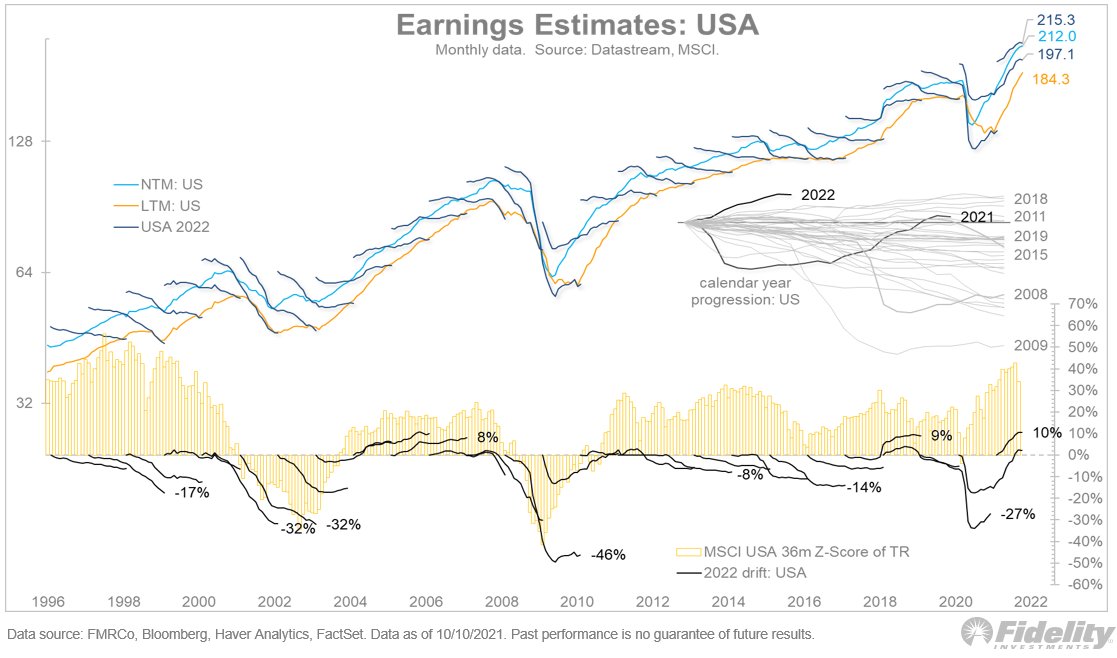

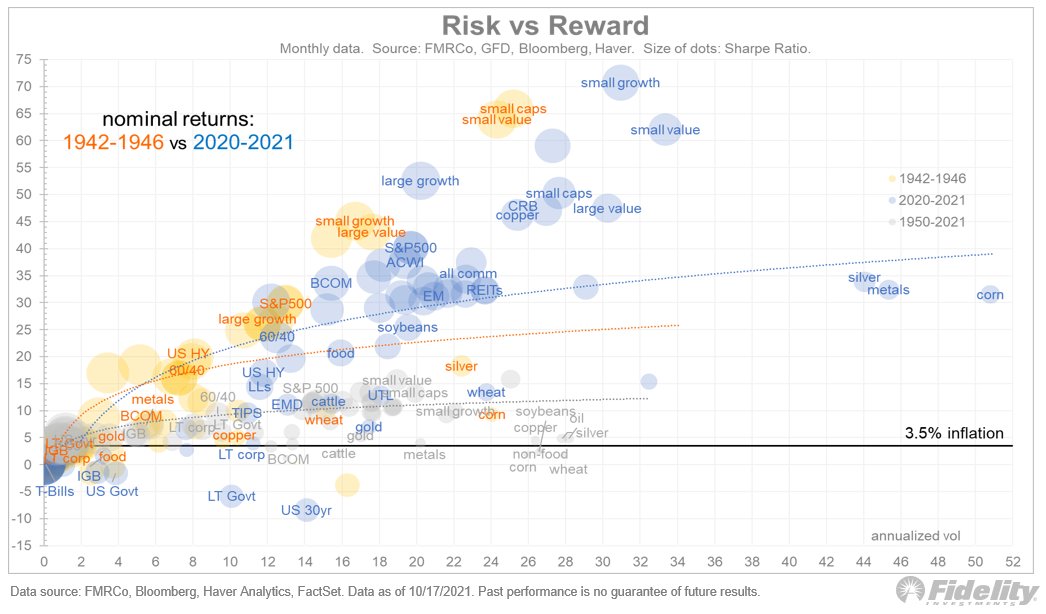

Is today's market an echo of the 1940s? The next few charts show the risk-reward tradeoff for the current cycle and for the WWII era. Look at this first one—a snapshot of the past 70 years—and I'll explain. (THREAD)

The chart above sets the stage with the baseline history. Cash at the lower left, stocks at the upper right, 60/40 in the sweet spot, and commodities in the worst place possible: earning only the inflation rate but with a massive vol. /2

Now let’s look at the past 18 months in the chart below. Commodities are up and to the right, along with equities, while bonds are well below the inflation rate. /3

Now check out the WWII years, below. Price controls slowed commodities, but equities did extremely well. Bonds returns were slightly under the inflation rate, but with inflation checked by price controls, we can assume that the actual real return for bonds was worse. /4

And here is the current cycle compared to the 1942-46 period. A similar story for equities, but with more vol during the current cycle. Bonds are doing much worse now, and commodities are doing much better. /5

Interestingly, the inflation rate since March 2020 is 3.6%, the same as the 70-year inflation rate (CAGR), and also the same as the (official) inflation rate for 1942-46. It makes for an easy comparison in the chart above. /6

Following the surge in equities during the 1942-46 period, there was a bear market and then a long period of sideways. That’s when inflation really took off, as there were no longer any price controls to hold it back. /7

The Fed held bond yields well below the inflation rate until 1951 (the year that the Fed gained its independence). The CAGR for long-term Treasuries during 1942-51 was around 2.5%, while inflation was 5.6%. /8

Below is a look at 1942-46 alone vs the entire “financial repression” era of 1942-51. The previous charts showed nominal returns, but this one shows real returns. /9

The risk-return curve flattened as equity CAGRs had several years of negative real returns. For the nine-year period, real return on cash and bonds was firmly negative, as it is today. The future might look a bit like the 1940s, the Fed’s intended taper notwithstanding. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh