The Federal Reserve sets short term interest rates.

But attempts to control long term interest rates are considered "unconventional".

In truth the Fed has full control of short and long term interest rates. The yield curve is merely a policy choice.🧵

apricitas.substack.com/p/the-yield-cu…

But attempts to control long term interest rates are considered "unconventional".

In truth the Fed has full control of short and long term interest rates. The yield curve is merely a policy choice.🧵

apricitas.substack.com/p/the-yield-cu…

America's yield curve has been decreasing and flattening since the Great Recession. That means that short term and long term interest rates are decreasing, and the gap between them is narrowing. To understand why, we have to understand what determines a bond's yield.

Yields can be decomposed into expected short term interest rates plus bond risk premium.

Expected short term interest rates reflect expected future Fed interest rate policy.

Bond risk premiums reflect duration risk (bond price sensitivity to rate changes) and liquidity risk.

Expected short term interest rates reflect expected future Fed interest rate policy.

Bond risk premiums reflect duration risk (bond price sensitivity to rate changes) and liquidity risk.

Critically, both expected short term interest rates and bond risk premiums are set by Federal Reserve policy!

If the Fed wanted to, they could pin bond yields wherever they pleased by changing expected future interest rates and liquidity/duration risk.

If the Fed wanted to, they could pin bond yields wherever they pleased by changing expected future interest rates and liquidity/duration risk.

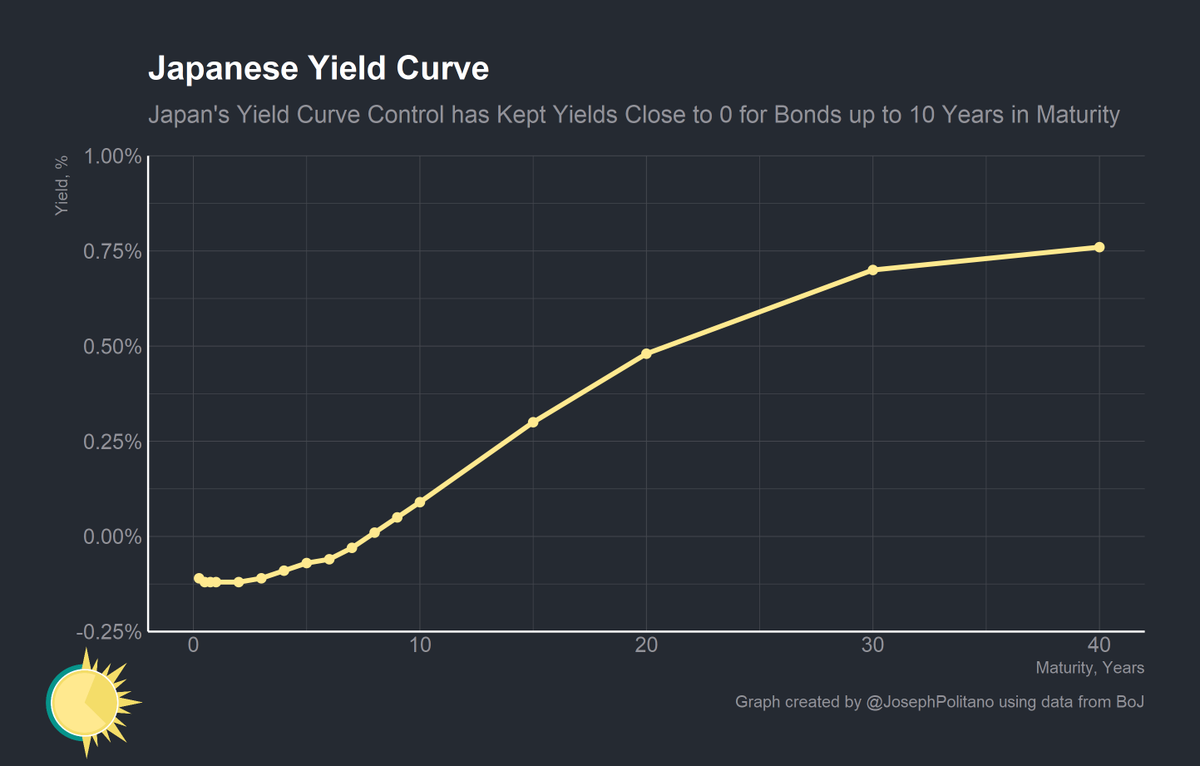

This is exactly what Bank of Japan is currently doing. Since 2016, they have set yields on 10 year government bonds to 0%.

They have not even had to "enforce" their Yield Curve Control (YCC) policy through large purchases of bonds. Their commitment is enough to keep yields low.

They have not even had to "enforce" their Yield Curve Control (YCC) policy through large purchases of bonds. Their commitment is enough to keep yields low.

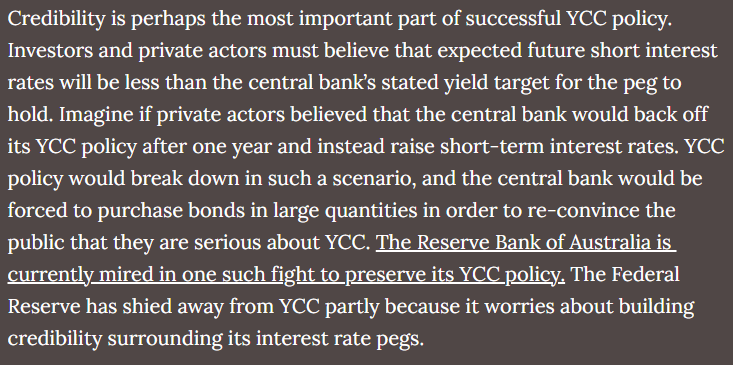

Credibility is therefore critical to successful YCC policy. Policy targets that are not seen as credible will fail to keep yields pinned down!

Understanding that the yield curve is a policy choice is critical to understanding the power of monetary policy.

Even if short term yields are stuck at 0% the central bank has tremendous power to affect nominal growth though its control of the yield curve!

Even if short term yields are stuck at 0% the central bank has tremendous power to affect nominal growth though its control of the yield curve!

If you like what I write, consider subscribing! It's free and helps me out a ton.

I wouldn't be able to write this newsletter without the support and feedback of my readers!

apricitas.substack.com

I wouldn't be able to write this newsletter without the support and feedback of my readers!

apricitas.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh