Nice little Sunday? $BBBY & $HD? what about 🧥? Here’s a #chartstravaganza on why you should check out $SDRY.LN fresh lineup & stock. Let’s shop!

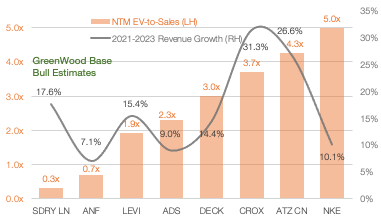

1/ there’s perhaps no better recovery play. Valuation relative to growth expectations make it a coiled spring.

1/ there’s perhaps no better recovery play. Valuation relative to growth expectations make it a coiled spring.

2/ Investors continue to question the viability of Superdry'a brand due to prior management errors and Covid-19.. $SDRY.LN stock is down -87% since 2018, significantly underperforming the FTSE250

3/ In any hands other than the father of the brand, we'd agree with the skeptics. But Julian doggedly disagrees with skeptics, and has been putting his money where his mouth is - with recent purchases this week.

4/ Julian has assembled a world class team to turn this tanker, with great vendor relationships and less logos- allowing them to SIGNIFICANTLY upgrade quality while making it a new benchmark for sustainability (at same gross profit margin)

5/ This massive upgrade needs to be seen to be believed, which unfortunately not many have had a chance to do given the number of store days lost in the most recent year.

6/ To drive awareness of the product changes, $SDRY.LN is building a social media influencer strategy with a hierarchy of talent types to better target specific consumer profiles. High performing influencers receive commissions which fosters skin-in-the-game.

7/ The pinnacle of SDRY's influencers at the moment are Neymar Jr. @neymarjr leading organic cotton campaign.

8/ And like his father, David, @brooklynbeckham will be the face of SDRY's sustainability campaign - lending some credibility to Julian’s goal of being “the most sustainable listed global fashion brand on the planet by 2030”

9/ the digital top funnel efforts have allowed the company to test 4K SKUs annually and allow the digital impulse to scientifically drive the store buys. This is helping it evolve into a faster fashion brand.

10/ the team is being led by Chairman Peter Sjölander, former CEO of Helly Hansen that doubled revenues & sold to Canadian Tire for 20x EBITDA. His experience leading e-commerce turnarounds should help drive growth.

11/ Dunkerton's ownership of 20.3%, growing by the week, ensures strong alignment w/ major skin in the game. If you want more, check out clips from a chat earlier this year, the passion & conviction are clear w/ material upside.

• • •

Missing some Tweet in this thread? You can try to

force a refresh