Trend in cloud software: Growth Durability 📈📈

Historically, many people have overestimated how quickly software companies would decelerate growth. below chart shows rough Datadog quarterly growth expectations at IPO (orange) and actual (blue)

Historically, many people have overestimated how quickly software companies would decelerate growth. below chart shows rough Datadog quarterly growth expectations at IPO (orange) and actual (blue)

Datadog has grown much faster (by a wide margin) than they were expected to at IPO

The biggest effect of this? Compounding $$ growth

At IPO (Sept '19) Datadog was projected to do ~$610M of revenue in 2021. Current projections? $1.3B!

In just 2 years expectations have doubled🤯

The biggest effect of this? Compounding $$ growth

At IPO (Sept '19) Datadog was projected to do ~$610M of revenue in 2021. Current projections? $1.3B!

In just 2 years expectations have doubled🤯

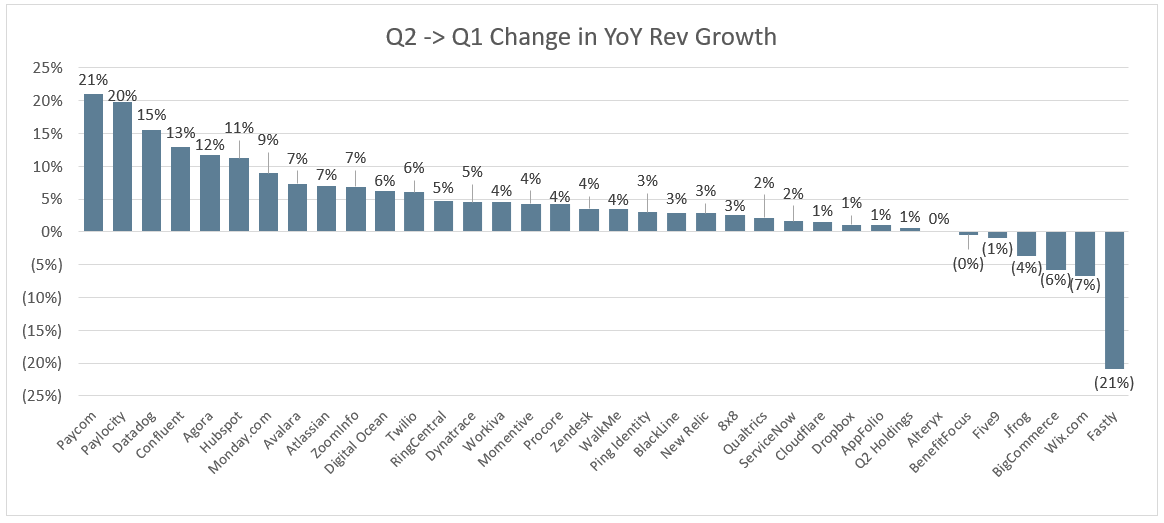

For best in class cloud software businesses we're seeing growth rates prove extremely durable. Markets are much larger than expected, and high net retention rates (growth from existing customer base) is propping up overall growth rates

If you knew Datadog would "outperform" expectations so wildly back in Sept '19, it's fair to say the stock would have looked extremely "cheap" back then.

I think public markets are starting to price this in. One can definitely argue we've gone too far :)

I think public markets are starting to price this in. One can definitely argue we've gone too far :)

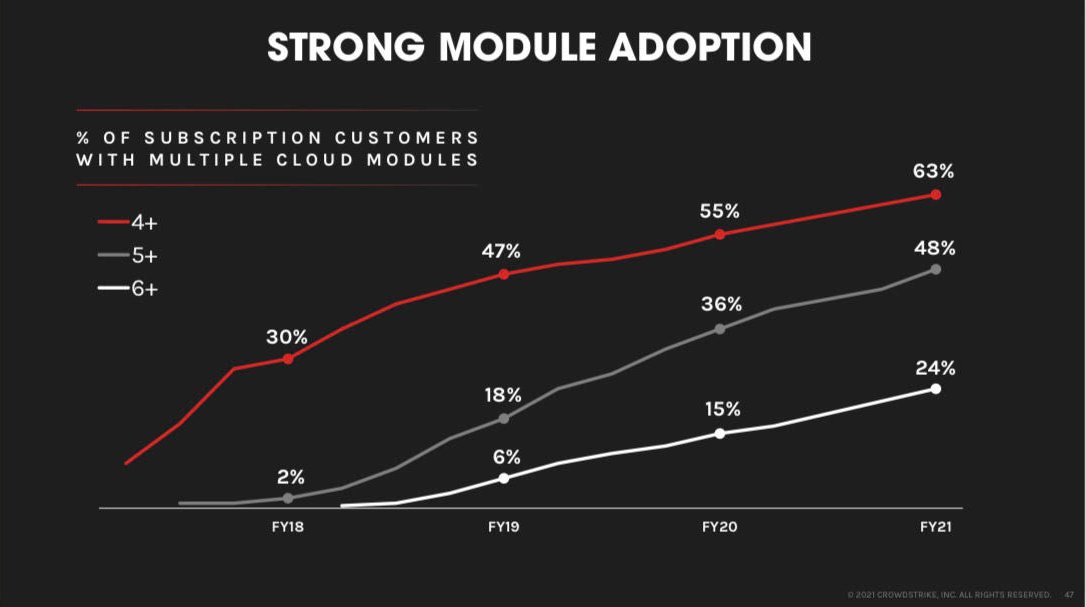

Crowdstrike is another example below. At the time of their IPO (June '19) they were projected to do $756M of revenue in 2021. Current estimate? $1.4B. Just staggering overperformance in 2 short years

The broader market is appreciating what best in class software businesses are capable of. People EXPECT growth to be more durable in the future. Multiples have expanded

However this rising tide (plus many other factors like low rates ) have propped up the entire industry

However this rising tide (plus many other factors like low rates ) have propped up the entire industry

Not all software companies are best in class. By definition there are only a few who deserve to be in that category

And I try and stay sober - software multiples are way too high and due for a contraction to historical averages. It doesn't feel sustainable at all currently

And I try and stay sober - software multiples are way too high and due for a contraction to historical averages. It doesn't feel sustainable at all currently

When multiples contract (which I believe they will), many average software companies will get thrown out with the bathwater

But what happens to the elite? Will they get the (relative) same treatment?

But what happens to the elite? Will they get the (relative) same treatment?

Multiples should come down across the board. But will they fall as hard for the best in class businesses, when there's now a broader appreciation for growth durability? Time will tell!

What businesses today are we vastly underestimating growth durability for?

What businesses today are we vastly underestimating growth durability for?

If history repeats itself, there are companies who will do more than 2x the revenue in 2023 than what they're projected to do currently

I've clearly cherry picked 2 amazing businesses. But there will certainly be more in the future

I've clearly cherry picked 2 amazing businesses. But there will certainly be more in the future

• • •

Missing some Tweet in this thread? You can try to

force a refresh