Some great slides from the Crowdstrike investor briefing last week. A few call outs on what makes them such a great business, that others should aspire to:

1. TAM Expansion: The best businesses increase the size of the pie, not just their piece

1. TAM Expansion: The best businesses increase the size of the pie, not just their piece

2. Product Expansion Velocity: At IPO (in 2019) Crowdstrike had 10 modules. They now have 19. Amazing product development velocity

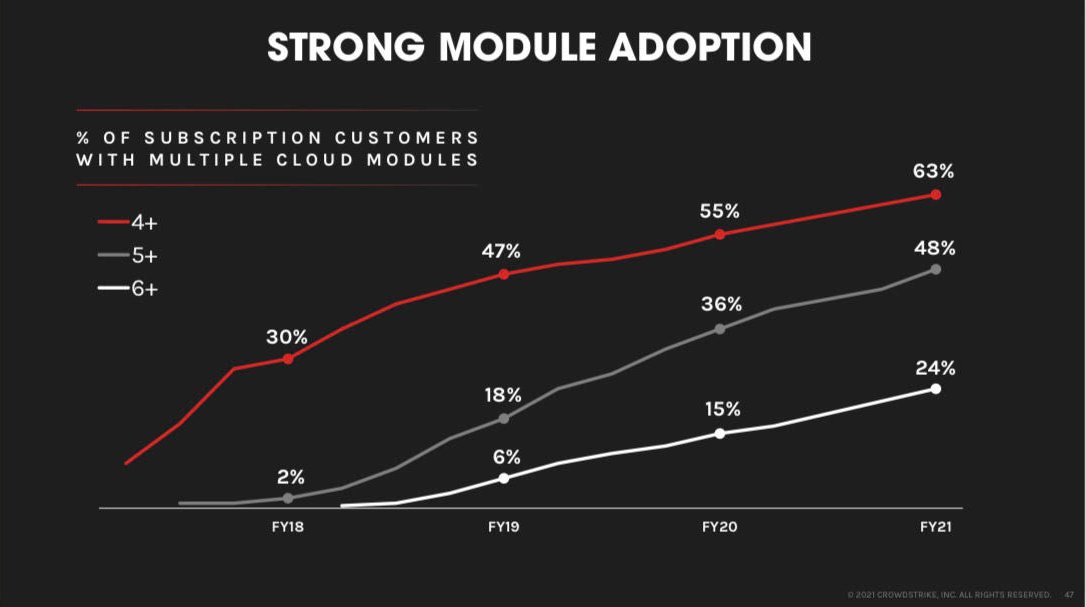

3. Upsell / Cross-Sell: Customers are using more and more Crowdstrike products. Very powerful platform flywheel

• • •

Missing some Tweet in this thread? You can try to

force a refresh