🛢️⛽️ My latest Commodity Context post is an update to my near-term oil market view.

🐮 Oil markets remain tight & inventories drawing

BUT

🐻 Short-term headwinds rising: COVID shifting from tail to headwind & sentiment shaky #oott #eft

Full piece here: commoditycontext.substack.com/p/oil-strong-b…

🐮 Oil markets remain tight & inventories drawing

BUT

🐻 Short-term headwinds rising: COVID shifting from tail to headwind & sentiment shaky #oott #eft

Full piece here: commoditycontext.substack.com/p/oil-strong-b…

Short chart summary 🧵:

Starting off with calendar spreads and futures curves.

🐮 We're seeing exceptionally acute backwardation in both WTI and Brent crude.

Calendar spreads have been pretty wild, but the important thing to remember is that they drive INVENTORIES. #oott #eft

Starting off with calendar spreads and futures curves.

🐮 We're seeing exceptionally acute backwardation in both WTI and Brent crude.

Calendar spreads have been pretty wild, but the important thing to remember is that they drive INVENTORIES. #oott #eft

🐮 And oh boy is that STEEP backwardation drawing inventories.

Since August 2020 we've drawn more than *400 million barrels* out of OECD commercial inventories, the strongest draw ever.

Pace of outflows only matched by the builds that cratered oil markets in 2014-16. #oott #eft

Since August 2020 we've drawn more than *400 million barrels* out of OECD commercial inventories, the strongest draw ever.

Pace of outflows only matched by the builds that cratered oil markets in 2014-16. #oott #eft

🐮 Demand continues to recover and, with the help of that energy crisis fuel switching, refining margins have roughly doubled from August levels.

This further eases concerns about lingering weakness in end-product markets I had back in June. #oott #eft

This further eases concerns about lingering weakness in end-product markets I had back in June. #oott #eft

BUT, while I am bigly bullish crude over the medium-to-long-term, I'm starting to get a bit worried about some ST/tactical/transitory (choose your word) headwinds that could make the next few months difficult absent worsening of the energy crisis: COVID & Sentiment. #oott #eft

🐻 As I've said before, the simplest chart in my library looks bearish for crude.

🦠 The COVID waves that have roiled markets all year have had a great record of calling crude's tops and bottoms.

Things look bound to worsen through winter & cases already ticking up! #oott #eft

🦠 The COVID waves that have roiled markets all year have had a great record of calling crude's tops and bottoms.

Things look bound to worsen through winter & cases already ticking up! #oott #eft

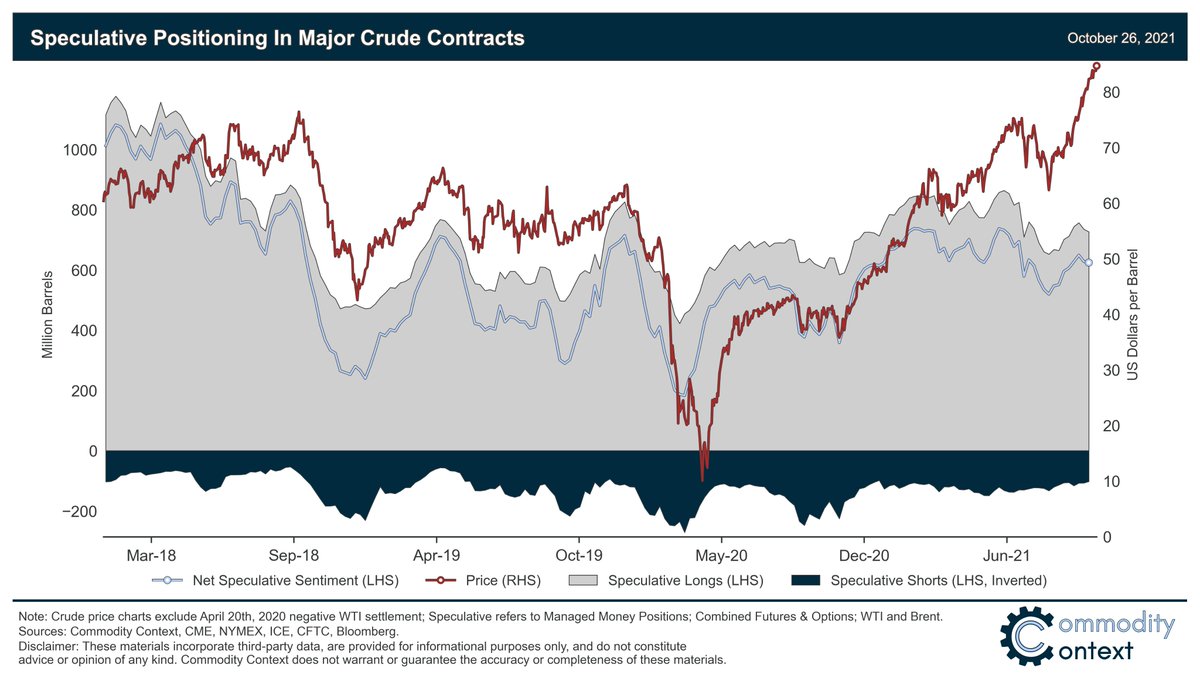

🐻/🐮 Sentiment is kind of a mixed signal at the moment.

We're def overly bullish, which always comes with rationalization risk, but still have room to go to re-reach June-level froth.

Still, looks like we might be rolling over already on the prev tweet's COVID cycle #oott #eft

We're def overly bullish, which always comes with rationalization risk, but still have room to go to re-reach June-level froth.

Still, looks like we might be rolling over already on the prev tweet's COVID cycle #oott #eft

🧵 THE END

🛢️📈 If you made it this far you must *really* love commodities and charts. ⛽️📊

You should definitely subscribe to my Substack because commodities and charts is very much the theme. #oott #eft

commoditycontext.substack.com

🛢️📈 If you made it this far you must *really* love commodities and charts. ⛽️📊

You should definitely subscribe to my Substack because commodities and charts is very much the theme. #oott #eft

commoditycontext.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh