Budget special #politicslive now with Jo, Laura and Simon

Keep up on joint Budget-Spending Review on @BBCTwo and on our special live page below

bbc.co.uk/news/live/uk-5…

Keep up on joint Budget-Spending Review on @BBCTwo and on our special live page below

bbc.co.uk/news/live/uk-5…

Chancellor says this Budget does not “draw a line under Covid” still “challenging months ahead”.... But he says “today’s Budget does begin the work of preparing for a new economy post Covid. The Prime Minister’s economy of higher wages, higher skills, and rising productivity”

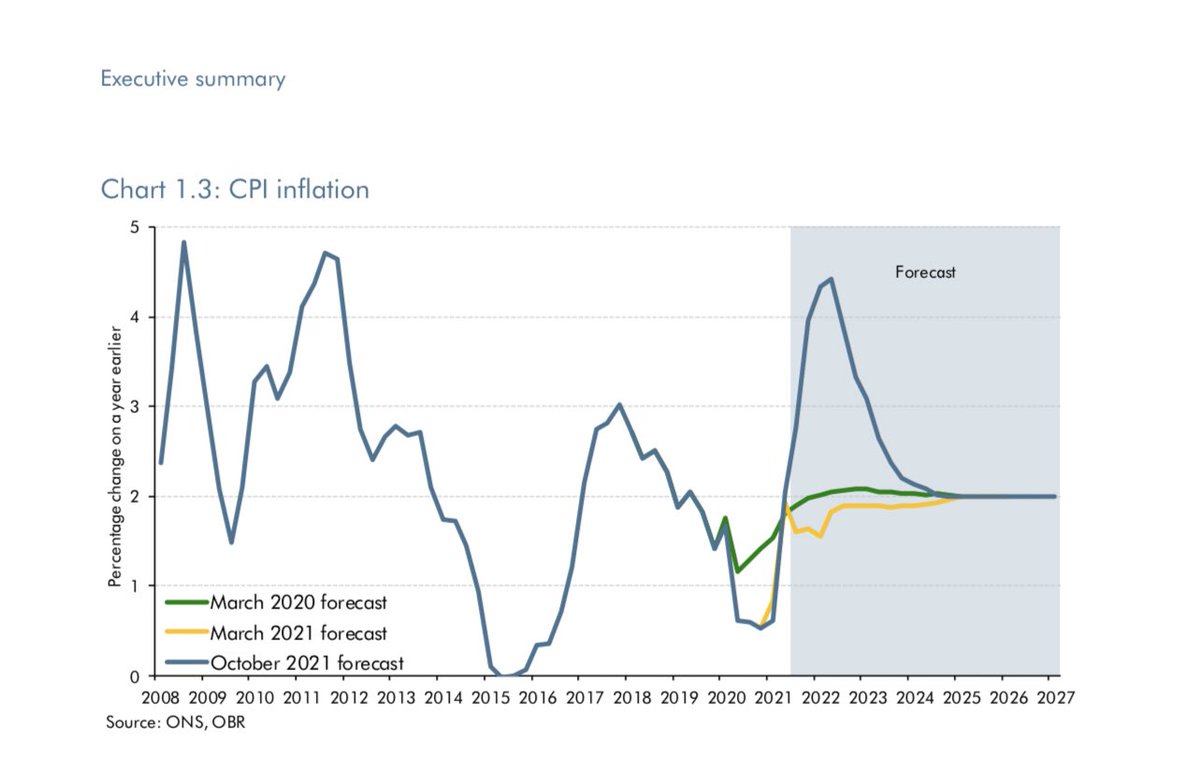

Chancellor says OBR predicts average inflation of 4% over next year and the “pressures caused by supply chains and energy prices will take months to ease. It would be irresponsible for anyone to pretend that we can solve this overnight”

Chancellor says UK will reach pre covid GDP level at the turn of the year - which is 6 months earlier... and growth revised up from 4% to 6.5%... growth next year lower from 7% to 6% - then settles at 1.3-1.6%

Long term scarring of pandemic - OBR assumption down from 3% to 2% which gives extra room for manoeuvre for Chancellor... unemployment also forecast to peak at 5.2% much lower than expected...

Fiscal Rules -

1. underlying public sector net debt must be declining as a percentage of GDP by third year of forecast

2. Borrow only to invest, taxation must cover day to day spending...

Unsurprisingly, Chancellor meets booth fiscal rules he has just set

1. underlying public sector net debt must be declining as a percentage of GDP by third year of forecast

2. Borrow only to invest, taxation must cover day to day spending...

Unsurprisingly, Chancellor meets booth fiscal rules he has just set

“Borrowing as a percentage of GDP is forecast to fall in every single year. From 7.9% this year to 3.3% next year, then 2.4%, 1.7%, 1.7% and 1.5% in the following years”....

That compares with March figures of 10.3%, 4.5%, 3.5%, 2.9%, and 2.8%...

That compares with March figures of 10.3%, 4.5%, 3.5%, 2.9%, and 2.8%...

Sunak delays the PM’s target of £22bn innovation spending for 2024 by two years...

From 2023 R&D tax credit will have to be for investment in the UK, at the moment £48bn is claimed, but total business investment is only £26bn... should repatriate investment into the UK, as other countries do...

Flights between airports within the UK will have a lower rate of air passenger duty from April 2023... lowering tax on carbon emitter ahead of COP - but ultra long haul will be charged more

“We will retain business rates” he says after review, rejecting Opposition push to abolish it. Says revaluations will happen every 3 years - tax break against it for green investments in solar panels...

1 year 50% discount for business rates for retail, hospitality and leisure to reflect pandemic hit...

“Fair and affordable pay rises” for public sector workers under the normal pay body process... says the Chancellor - confirming the £9.50 national living wage...

Chancellor takes on the rise in the tax burden - says he doesn’t like it... but cant apologise for it

Sunak: “My goal is to reduce taxes - by end of Parliament I want taxes to be going down not up - that is what we believe - that is my mission...”

Universal rate taper cut by 8% to 55% - which was IDS original plan... will be brought in in December, a £2bn targeted tax cut, reversing a third or so of the impact of the £20 reduction in Universal Credit...

Spending as a percentage of GDP stabilises at 41.6% of GDP in 24/25 - higher than pre pandemic, highest sustained level since 1970s...

Taxation/ GDP is at its highest level since Clement Atlee’s post war Labour Government - up to 36.2% of GDP

OBR says the Chancellor has “smaller headroom” than most previous Chancellor’s mandates - though none of those previous mandates were met...

0.6% of GDP on debt target (£17.5bn)

0.9% on current budget (£25.1bn)

0.6% of GDP on debt target (£17.5bn)

0.9% on current budget (£25.1bn)

Clip from interview with OBR chief Richard Hughes:

“This Chancellor has raised more in tax in 2021 than any Chancellor has ever raised in a single year since 1993, when it took two Chancellors, Lamont & Clarke to raise as much”

“This Chancellor has raised more in tax in 2021 than any Chancellor has ever raised in a single year since 1993, when it took two Chancellors, Lamont & Clarke to raise as much”

NEW OBR’s Richard Hughes on Brexit -

“so far the data that we've seen on impact of Brexit, especially taking into account fact new trading arrangements came in in January is broadly consistent with assumption we had, which is that it would reduce our long run GDP by around 4%”

“so far the data that we've seen on impact of Brexit, especially taking into account fact new trading arrangements came in in January is broadly consistent with assumption we had, which is that it would reduce our long run GDP by around 4%”

To be clear this is Government’s official forecaster pointing out initial evidence from trade data is consistent with their forecast 4% hit from extra Brexit trade barriers..

OBR’s Hughes confirmed “in the long term it is the case Brexit has a bigger impact than the pandemic”

OBR’s Hughes confirmed “in the long term it is the case Brexit has a bigger impact than the pandemic”

4% has long been OBR forecast of the hit from post Brexit trade barriers with Europe, what is new now is that is double the forecast long term hit of the pandemic, and they see some initial actual data of the fall in UK exports to the EU, and UK export intensity as consistent

... in full report OBR says while initial data is consistent with a 15% fall in the UK’s import and export intensity its too early to be “definitive” because the TCA is yet to be implemented in full, and the full effect will take several years & difficult to disentangle pandemic

free trade agreement meant no taxes on trade, known as tariffs, but it did involve introduction of what is known as “non tariff barriers”, which are more important in modern trade, things like regulations, massive paperwork, customs delays, checks etc.

https://twitter.com/rage_600/status/1453475907369373700?s=21

HT to @benedict_king for asking the question to the OBR - and other ones including the quote on the taxation levels... difficult to argue that the OBR is not acting independently with analyses such as that. Document is a goldmine of interesting analysis - more tomorrow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh