New working paper! “The Power of Money: Lessons from Introducing Digital Currency to a Barter Community” economics.mit.edu/files/22266 #EconTwitter #crypto #barter #bunz 🧵

Contribution: I use unique transaction-level data to document the effects of introducing digital money, a monetary expansion, and a currency crisis on transaction activity in a barter community in Toronto.

Context: Bunz is a community started by millennials in Toronto in 2013 to exchange personal possessions (e.g., used clothing, accessories, furniture, and plants). They arrange to trade in person through a mobile app platform with ~10K daily active users

The community has one rule: No cash!

As a result, Bunz users often used beer, store gift cards, and transit tokens to complete transactions. The problem of double coincidence was real! 👇

To reduce trade frictions, the platform introduced a digital token named BTZ in April 2018.

The token could be transferred among users, or redeemed for retail goods at designated local stores at a fixed exchange rate. It was not otherwise convertible.

(think: pegged currency with capital controls)

(think: pegged currency with capital controls)

At first, transaction volume didn't change much.

Then, in September 2018, the platform increased token issuance through helicopter drops to users in an attempt to drive user engagement. As a result, the token supply quintupled.

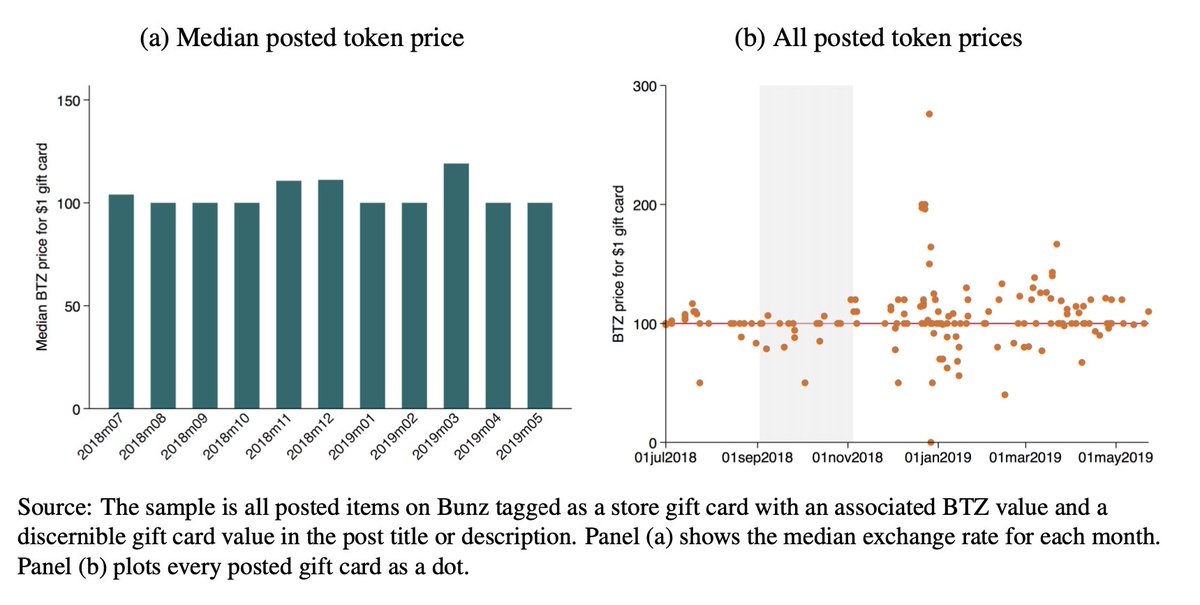

This large monetary expansion did not create inflation, as measured using store gift cards posted on the app with a BTZ price.

But monetary expansion increased in-person transactions by almost 70%, as measured by ratings that users provide for each other after trade completion.

This increase in transactions was persistent and was not due to new users or a new supply of items. Rather, it coincided with increased token transfers on the app.

Takeaway: monetary expansion helped users overcome the problem of double coincidence.

Takeaway: monetary expansion helped users overcome the problem of double coincidence.

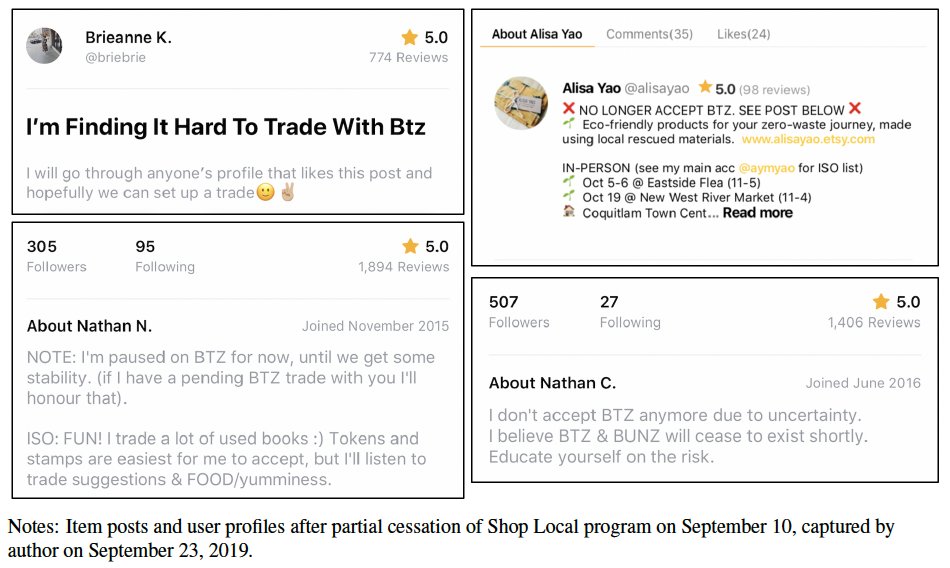

This triggered a currency crisis.

In the paper, I interpret these events through the lens of a search model of money where the token value is fixed (Kiyotaki-Wright 1993).

Takeaway: When barter is difficult and the token value is fixed, money is both non-neutral and essential.

Takeaway: When barter is difficult and the token value is fixed, money is both non-neutral and essential.

Lessons for the #crypto community:

1. Digital money can boost activity in trade networks with high transaction frictions (e.g., in developing countries).

2. Without proper management, private issuance of redeemable currencies can result in financial instability.

1. Digital money can boost activity in trade networks with high transaction frictions (e.g., in developing countries).

2. Without proper management, private issuance of redeemable currencies can result in financial instability.

A lot more can be learned from these unique data in future analyses. Suggestions welcome! 😄 Stay tuned for future updates.

Thank you to @dongheejo68 and @vk_suhas for initial collaboration. Thanks to @bunzofficial, Sascha, @PerryAJ, Jess for help with data and fieldwork. Thanks to @townsend_rm and @IvanWerning for advice. It feels good to finally share this project!

• • •

Missing some Tweet in this thread? You can try to

force a refresh