The basic rules of Elliott Wave Theory ARE NOT hard to learn.

However, like anything it does take time.

Within this thread I will cover the basic rules of Elliott Wave Analysis.📖

However, like anything it does take time.

Within this thread I will cover the basic rules of Elliott Wave Analysis.📖

Back in the 1930's, Ralph Nelson Elliott developed EWT to describe recognizable patterns within movement in price.

Elliott identified that price tends to move in recurring "wave" patterns.

These waves can be identified in stock price movements and in consumer behavior.

Elliott identified that price tends to move in recurring "wave" patterns.

These waves can be identified in stock price movements and in consumer behavior.

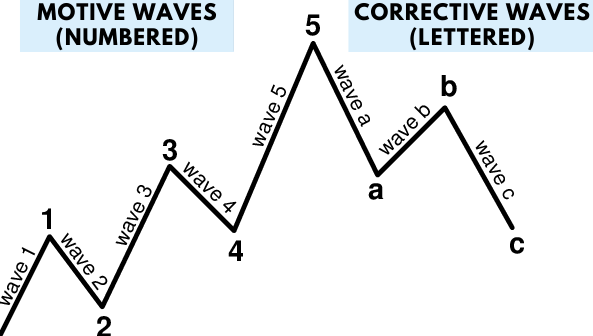

The Complete Cycle:

The recognizable pattern that Elliott had identified was that price cycles move in a total of eight waves.

This cycle is broken down into two separate phases:

1. The five-wave motive phase

2. The three-wave corrective phase

Let me explain these phases...

The recognizable pattern that Elliott had identified was that price cycles move in a total of eight waves.

This cycle is broken down into two separate phases:

1. The five-wave motive phase

2. The three-wave corrective phase

Let me explain these phases...

Motive Waves (Five-Wave):

Motive waves are structured by five waves and move in the direction of the trend of a larger degree.

A motive wave is broken into two types of waves: impulse and diagonal. Impulse is more common between the two, so that is what I will explain today.

Motive waves are structured by five waves and move in the direction of the trend of a larger degree.

A motive wave is broken into two types of waves: impulse and diagonal. Impulse is more common between the two, so that is what I will explain today.

Impulse Waves (1, 3, 5):

Impulse waves are same-directional and affect the directional movement of price. These are waves that set the trend.

Waves 1, 3, and 5 are broken apart by two countertrend corrective waves, 2 and 4.

Impulse waves are made up of 5 lower degree waves.

Impulse waves are same-directional and affect the directional movement of price. These are waves that set the trend.

Waves 1, 3, and 5 are broken apart by two countertrend corrective waves, 2 and 4.

Impulse waves are made up of 5 lower degree waves.

Corrective Waves (2, 4):

Corrective waves are counter-trend interruptions to the directional movement of the impulse waves.

Corrective waves fall into three categories: zigzag, flat, and triangle.

2 & 4 are likely to occur in different forms (ex: wave 2 zigzag, 4 triangle).

Corrective waves are counter-trend interruptions to the directional movement of the impulse waves.

Corrective waves fall into three categories: zigzag, flat, and triangle.

2 & 4 are likely to occur in different forms (ex: wave 2 zigzag, 4 triangle).

Zigzag (A, B, C):

Zigzag is a very common corrective pattern, made up of waves A, B, and C.

You will often time see this in a wave 2.

The sub-wave sequence is 5-3-5, with waves A, and C being motive waves, and wave B being corrective.

Zigzag is a very common corrective pattern, made up of waves A, B, and C.

You will often time see this in a wave 2.

The sub-wave sequence is 5-3-5, with waves A, and C being motive waves, and wave B being corrective.

Sub-waves... what are they?

One important thing to note with Elliott Waves, is that each wave can be divided into sub-waves of a lower degree.

For example (see image):

- Wave 1 of a larger degree is broken into 5 waves of a lower degree.

- Wave 2 is broken into a zigzag (ABC)

One important thing to note with Elliott Waves, is that each wave can be divided into sub-waves of a lower degree.

For example (see image):

- Wave 1 of a larger degree is broken into 5 waves of a lower degree.

- Wave 2 is broken into a zigzag (ABC)

Wave Structure Breakdown:

- Impulse (5-3-5-3-5)

- Diagonal (5-3-5-3-5 or 3-3-3-3-3)

- ZigZag (5-3-5)

- Flat (3-3-5)

- Triangle (3-3-3-3-3)

- Impulse (5-3-5-3-5)

- Diagonal (5-3-5-3-5 or 3-3-3-3-3)

- ZigZag (5-3-5)

- Flat (3-3-5)

- Triangle (3-3-3-3-3)

Three Cardinal Rules of EWT:

1. Wave 2 can NEVER go beyond the start of wave 1

2. Wave 4 can NEVER cross the price territory of wave 1

3. Wave 3 can NEVER be the shortest impulse wave

1. Wave 2 can NEVER go beyond the start of wave 1

2. Wave 4 can NEVER cross the price territory of wave 1

3. Wave 3 can NEVER be the shortest impulse wave

Common themes of Waves:

- Wave 1 is generally the least predictive.

- Wave 2 retracement is often > than 4. Typically zigzag.

- Wave 3 tends to be the strongest wave (represents growing optimism and euphoria).

- Wave 4 can be shallower than 2. Typically triangle or flat.

- Wave 1 is generally the least predictive.

- Wave 2 retracement is often > than 4. Typically zigzag.

- Wave 3 tends to be the strongest wave (represents growing optimism and euphoria).

- Wave 4 can be shallower than 2. Typically triangle or flat.

Finding targets with Fibonacci tools:

- Wave 2 generally retraces 50%, 61.8%, or 78.6% of wave 1

- Wave 3 generally moves to the 161.8% of wave 1

- Wave 4 generally retraces 23.6%, or 38.2% of wave 3

- Wave 5 generally moves to the 61.8% of wave 1-3

- Wave 2 generally retraces 50%, 61.8%, or 78.6% of wave 1

- Wave 3 generally moves to the 161.8% of wave 1

- Wave 4 generally retraces 23.6%, or 38.2% of wave 3

- Wave 5 generally moves to the 61.8% of wave 1-3

Given that a majority of my tweets consist of #elliottwave content, I figured it was only fitting to break it down in my first educational thread.

If you all have any questions please let me know.

Best of luck to all of you future EWT practitioners ❤️

#tradingtips #education

If you all have any questions please let me know.

Best of luck to all of you future EWT practitioners ❤️

#tradingtips #education

Would also like to add a quick credit to @rbc_trading for the cover image. Make sure to give him a follow for great EWT content.

• • •

Missing some Tweet in this thread? You can try to

force a refresh