To understand Rakesh Jhunjhunwala’s thinking, let us explore this article - includes the presentation that he apparently made in front of PM @narendramodi recently.

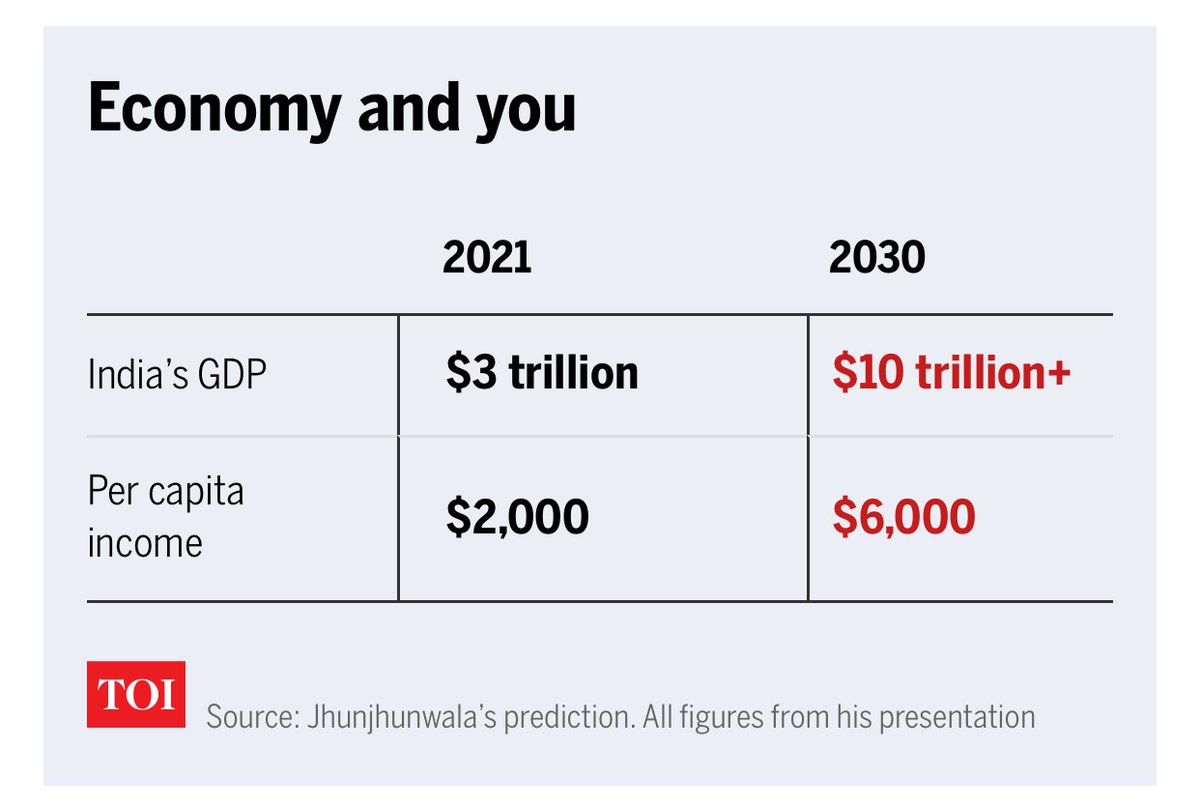

(Some graphs are created by TOI, and are not part of the presentation. Behind paywall)

m.timesofindia.com/india/why-indi…

(Some graphs are created by TOI, and are not part of the presentation. Behind paywall)

m.timesofindia.com/india/why-indi…

First thing to notice is that RJ sees a clear trend towards faster growth in India over the last half century. One can quibble over the numbers but the trend is your friend (until it isn’t.)

I had a similar graph on my substack except it was on per capita growth rates.

I had a similar graph on my substack except it was on per capita growth rates.

The more important thing to notice is that RJ thesis is based on not some narrow financial understanding but a holistic economic history, geo-political and sociological-anthropological basis as well (again, quibbles aside.) That’s the only way to test a view and build confidence.

His view is based on demographics, global factors but above all the confidence in the democratic Indian state becoming more competent and delivering on more promises (partially because of technology.) His confidence in democracy led him to not being overly pessimistic in 2012-13.

He focuses on the tolerance (rather pluralism) of our people, and a drive towards entrepreneurship and education (though starting from a low, forced base) - which in turn underwrites the unity of the Indian state. He talks about our nukes, and about geography being less relevant.

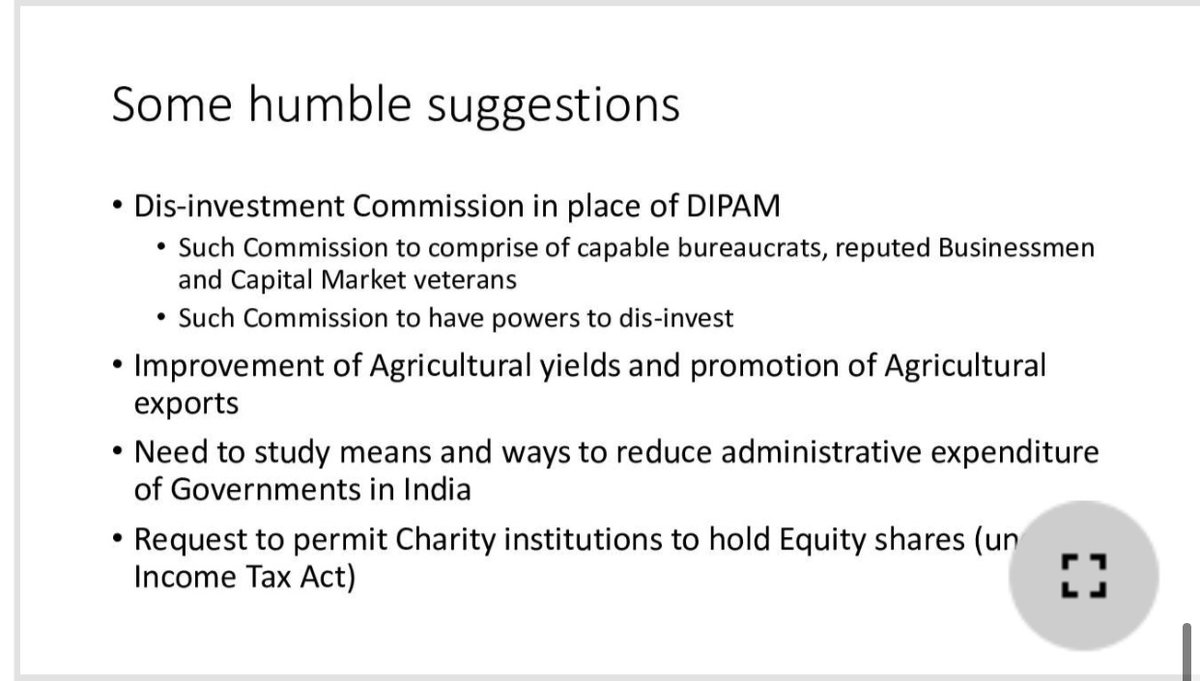

He talks about reforms like GST/IBC/farm/labour/power/real estate, JAM/India Stack (digital public goods), social infra, privatisation, agri yields scope, global low rates, corp tax cuts and overall buoyancy, software, pharma, China+1 opportunity, virtuous cycles of growth/capex.

He ends on a high note and with some suggestions. India has tried crony socialism and failed, and will now double down on success. He quotes @anandmahindra, Mark Twain and others.

He concludes “Nastik ko astik mat banao, samay bana dega”. #LongIndia #NewIndia #RakeshJhunjhunwala

He concludes “Nastik ko astik mat banao, samay bana dega”. #LongIndia #NewIndia #RakeshJhunjhunwala

• • •

Missing some Tweet in this thread? You can try to

force a refresh