Thread 🧵:

A Day in the Life of a Trader (A day in my Life)

1) I absolutely love my work❤️! In fact, I grew up dreaming to be a trader. So trading, to me, doesn’t feel like working (except when I lose😂).

It’s fascinating because it’s different every day.

#trading #life

A Day in the Life of a Trader (A day in my Life)

1) I absolutely love my work❤️! In fact, I grew up dreaming to be a trader. So trading, to me, doesn’t feel like working (except when I lose😂).

It’s fascinating because it’s different every day.

#trading #life

2)7:30 AM : Alarm Rings

A typical week day for me begins at 7:30 AM.

I spend the next 30 minutes on my daily chores — get ready for office, grab a quick breakfast & have a hot cuppa coffee.

A typical week day for me begins at 7:30 AM.

I spend the next 30 minutes on my daily chores — get ready for office, grab a quick breakfast & have a hot cuppa coffee.

3) 8:00 AM : Leave for office

On my way to office, I check what happened at the Wallstreet overnight & how are Asian markets performing.

I then look for any macro news that may affect overnight positions

P.S: We are moving to a new bigger office & will share pics of that soon

On my way to office, I check what happened at the Wallstreet overnight & how are Asian markets performing.

I then look for any macro news that may affect overnight positions

P.S: We are moving to a new bigger office & will share pics of that soon

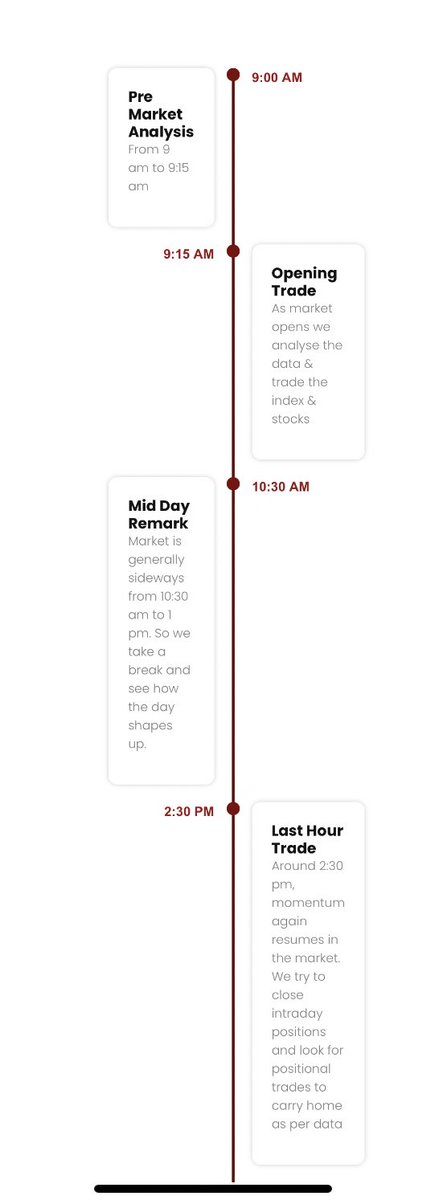

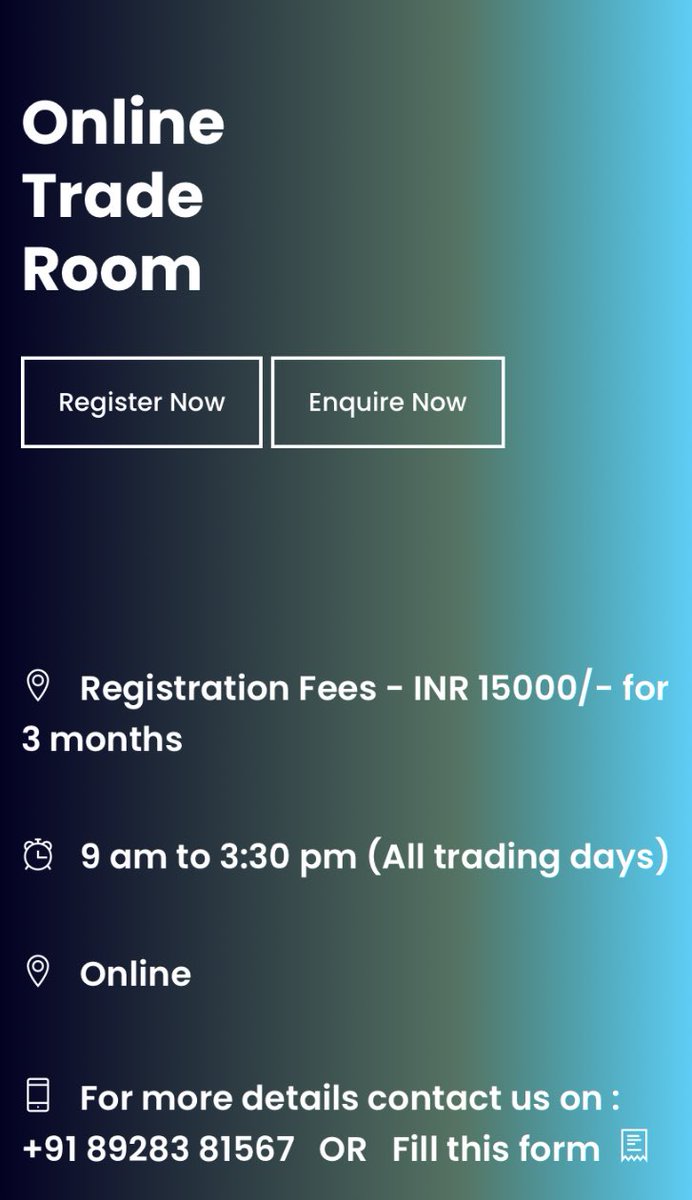

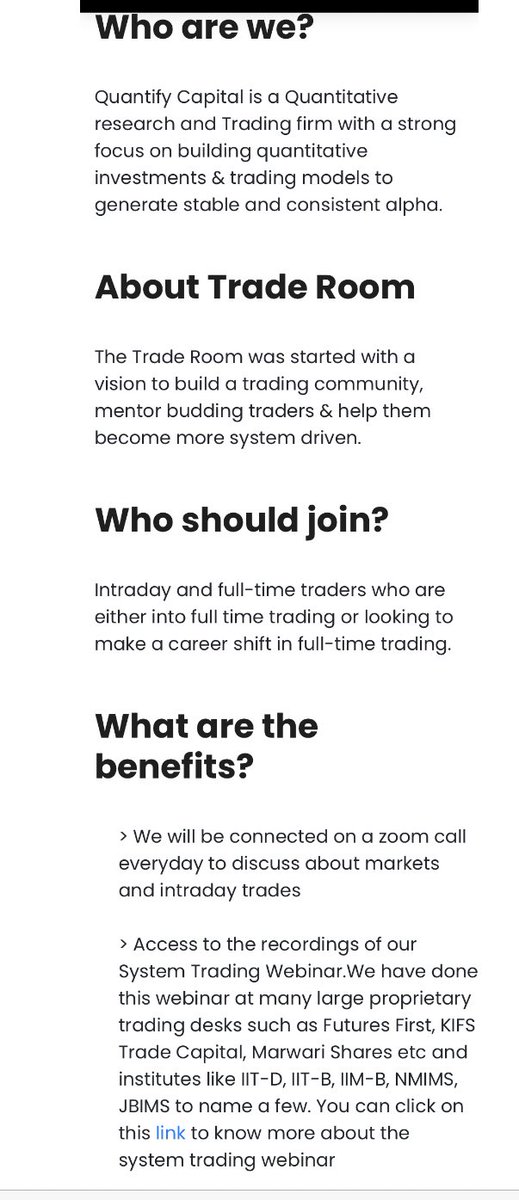

4) 9 AM - Connect with Trade Room members

I connect with trade room members on zoom & share my plan for the day, stocks to keep in radar & how to play the index & which option strategies to execute

For more details about Online Trade Room you can check

quantifycapital.in/webinar/quanti…

I connect with trade room members on zoom & share my plan for the day, stocks to keep in radar & how to play the index & which option strategies to execute

For more details about Online Trade Room you can check

quantifycapital.in/webinar/quanti…

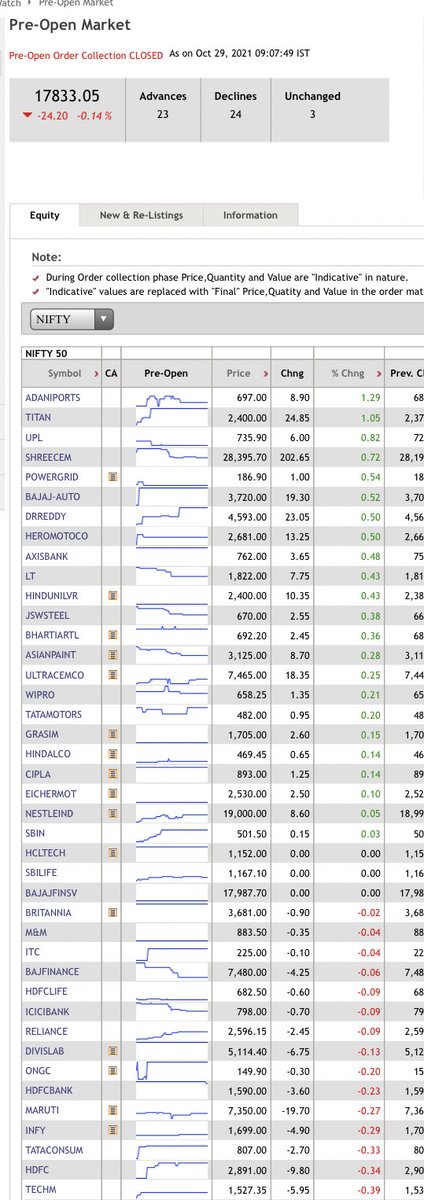

5) 9:07 - Pre Opening session

I keenly observe the pre-opening to get a general sense of where the market is it likely to open. At 9:07 AM, the pre-opening prices are out. I make a note of stocks opening with a big gap up or gap down and keep them on my watchlist.

I keenly observe the pre-opening to get a general sense of where the market is it likely to open. At 9:07 AM, the pre-opening prices are out. I make a note of stocks opening with a big gap up or gap down and keep them on my watchlist.

6 9:15 AM: Market Opens

a) I commence with analysing Bank Nifty.

It’s my first instrument of choice where a bulk of my positions are created.

I run my proprietary system Snorlax on BankNifty.

For the uninitiated, Snorlax is a Pokemon that just sleeps & eats all day.

a) I commence with analysing Bank Nifty.

It’s my first instrument of choice where a bulk of my positions are created.

I run my proprietary system Snorlax on BankNifty.

For the uninitiated, Snorlax is a Pokemon that just sleeps & eats all day.

6 b)

Snorlax is our proprietary intraday theta eating strategy.

The model indicates the intraday trend for the index based on historical data, the opening and certain intraday patterns.

I manually create skewed delta positions as per that and place my stops.

Snorlax is our proprietary intraday theta eating strategy.

The model indicates the intraday trend for the index based on historical data, the opening and certain intraday patterns.

I manually create skewed delta positions as per that and place my stops.

6 c)

I already discussed some concepts of Snorlax( non directional theta decay strategy) on my #face2face on @elearnmarkets with @vivbajaj

I can be a good starting point for anyone who wants to understand how non directional trading works

I already discussed some concepts of Snorlax( non directional theta decay strategy) on my #face2face on @elearnmarkets with @vivbajaj

I can be a good starting point for anyone who wants to understand how non directional trading works

7)9:30 AM : Action Begins

After taking position in BNF, our Momentum based system scans the liquid F&O universe and puts automated orders in futures as per generated signals.

We try to capture intraday moves and is built on concepts of momentum and intraday trading patterns.

After taking position in BNF, our Momentum based system scans the liquid F&O universe and puts automated orders in futures as per generated signals.

We try to capture intraday moves and is built on concepts of momentum and intraday trading patterns.

8) 10:30 AM : Midday Doldrums

Around this time, market moves fizzle out & I again catchup with the traders at Online Trade Room on zoom.

I discuss how the trades discussed in the morning are doing & also share any other stocks on my radar

quantifycapital.in/webinar/quanti…

Around this time, market moves fizzle out & I again catchup with the traders at Online Trade Room on zoom.

I discuss how the trades discussed in the morning are doing & also share any other stocks on my radar

quantifycapital.in/webinar/quanti…

9) 12 PM : Meet the Quant Team

a)Next, I have a quick chat with the Quant team, who analyse raw market data &devise profitable trading strategies.

We thoroughly review the performance of the strategies that we’re back-testing & have built our own backtesting engine inhouse.

a)Next, I have a quick chat with the Quant team, who analyse raw market data &devise profitable trading strategies.

We thoroughly review the performance of the strategies that we’re back-testing & have built our own backtesting engine inhouse.

9 b )

Currently, quant team is working on ML models using CNN to see if we can find non-linear patterns from multi-dependent variables.

Major part of day of quant team is dedicated to back-testing, research and optimization.

Currently, quant team is working on ML models using CNN to see if we can find non-linear patterns from multi-dependent variables.

Major part of day of quant team is dedicated to back-testing, research and optimization.

10) 12:30 pm : TV Time

I go on air on TV @ETNowSwadesh before going online I prerpare which stocks to recommend, look at derivatives data & what additional data point to speak while being on air.

I’ll update my TV schedule soon here on twitter !

I go on air on TV @ETNowSwadesh before going online I prerpare which stocks to recommend, look at derivatives data & what additional data point to speak while being on air.

I’ll update my TV schedule soon here on twitter !

11)Connect with Trader friends

I call trader friends to discuss the markets.I connect with @Ronak_Unadkat almost 3 times during market hours & discuss our views. He is a good trader & friend

I also connect with 2 good traders @prathamesh_pai & @cgarg_ & we discuss our views.

I call trader friends to discuss the markets.I connect with @Ronak_Unadkat almost 3 times during market hours & discuss our views. He is a good trader & friend

I also connect with 2 good traders @prathamesh_pai & @cgarg_ & we discuss our views.

12) 1:30 PM : Back to the Trading Desk

a) I check how my positions for the day are doing.

My actual screen time is quite low! Perks of being a systems’ trader!

The only exception is Thursday when I am actively in front of the screen.

a) I check how my positions for the day are doing.

My actual screen time is quite low! Perks of being a systems’ trader!

The only exception is Thursday when I am actively in front of the screen.

12 b)

Markets tend to gain momentum post 2:00 PM.

We tighten our stops on our intraday positions & look for stocks where action is happening in terms of huge volumes/ large intraday moves/ stock breaking intraday high/ low etc.

We run our inhouse built algo for the same.

Markets tend to gain momentum post 2:00 PM.

We tighten our stops on our intraday positions & look for stocks where action is happening in terms of huge volumes/ large intraday moves/ stock breaking intraday high/ low etc.

We run our inhouse built algo for the same.

13) Scan for Positional Setups

I again connect with Trade Room members. I see if there’s any good positional trade shaping up based on momentum and the top gainers for the day. I design a strategy, discuss the hedge with the team and calculate its risk reward payoff.

I again connect with Trade Room members. I see if there’s any good positional trade shaping up based on momentum and the top gainers for the day. I design a strategy, discuss the hedge with the team and calculate its risk reward payoff.

14) 3 PM : End is near

Time to close all intraday trades. The team ensures that all positional trades & there is adequate margin. Lastly, we run a risk check to see what happens to the portfolio in case of a major gap up or gap down opening on the following day.

Time to close all intraday trades. The team ensures that all positional trades & there is adequate margin. Lastly, we run a risk check to see what happens to the portfolio in case of a major gap up or gap down opening on the following day.

15) Closing Time

I hate to see the markets shut🙁 but, its 3:30 PM and markets are closed for the day.

I manually update my trading journal & note my learnings for the day if any.

I hate to see the markets shut🙁 but, its 3:30 PM and markets are closed for the day.

I manually update my trading journal & note my learnings for the day if any.

16) 3:30 -4 pm : Lunch Time

Yes. I have lunch after market close. While having lunch I & my trading team discuss how did we do today, what could have been done better & crack our lame BnF jokes😋

Yes. I have lunch after market close. While having lunch I & my trading team discuss how did we do today, what could have been done better & crack our lame BnF jokes😋

17) 4 to 5 pm : Relax Time

I leave for home. I try to watch any random episode of Friends ( it’s my favourite show)

Get some nap for 10-15 mins and usually try to relax after a hectic trading day.

I leave for home. I try to watch any random episode of Friends ( it’s my favourite show)

Get some nap for 10-15 mins and usually try to relax after a hectic trading day.

18) 5 to 6:30 PM : No pain, no gain

With so much happening throughout the day, my brain is fatigued. It’s time to give the brain some rest & tire the body. 5 PM. I hit the gym for about an hour.

With so much happening throughout the day, my brain is fatigued. It’s time to give the brain some rest & tire the body. 5 PM. I hit the gym for about an hour.

19) Trade Plan for Tomorrow

As soon as I reach home after gym, I have a quick shower & prepare youtube video till my dinner is getting prepared.

I quickly record the video, discuss stocks to keep in radar & my trade plan for tomorrow !

youtube.com/c/SourabhSisod…

As soon as I reach home after gym, I have a quick shower & prepare youtube video till my dinner is getting prepared.

I quickly record the video, discuss stocks to keep in radar & my trade plan for tomorrow !

youtube.com/c/SourabhSisod…

20) 8 pm : Family Time

The family sits down to have dinner together. The next 2-3 hours are spent on catching up and watching TV.

I prefer to watch any feel good or inspirational movie.

The family sits down to have dinner together. The next 2-3 hours are spent on catching up and watching TV.

I prefer to watch any feel good or inspirational movie.

21) 11:30 PM : Reading Time

As a trader, I like to read about- new developments in quantitative finance, innovative ivestment products, books on risk management/psychology etc

Currently, I am reading ‘The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds!’

As a trader, I like to read about- new developments in quantitative finance, innovative ivestment products, books on risk management/psychology etc

Currently, I am reading ‘The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds!’

22) 12:30 AM : Bedtime

Time to call it a day. Off to bed.

Before sleeping, I look at SGX & Dow. If both are in direction of my overnight positions then I get a even better sleep😄😋

That’s what a typical week day is for me.

Time to call it a day. Off to bed.

Before sleeping, I look at SGX & Dow. If both are in direction of my overnight positions then I get a even better sleep😄😋

That’s what a typical week day is for me.

23) Weekends

a) On most weekends, we train large trading desks & hedge funds on quantitative trading and how to leverage the power of algorithms & data science in trading

For more details about our Quantitative Trading Program, can check

quantifycapital.in/quantitative-t…

a) On most weekends, we train large trading desks & hedge funds on quantitative trading and how to leverage the power of algorithms & data science in trading

For more details about our Quantitative Trading Program, can check

quantifycapital.in/quantitative-t…

23 b )

Weekends are usually spent on brainstorming about other business than trading & discussing new products, ideas & future growth strategy

We ponder over what did we do right that we might be able to replicate in another market, at another time.

Weekends are usually spent on brainstorming about other business than trading & discussing new products, ideas & future growth strategy

We ponder over what did we do right that we might be able to replicate in another market, at another time.

23 c ) Team Building

All work and no play makes Jack a dull boy.

Weekends are put to good use by having an outdoor activity with the team.

At times,we party or play cricket or play any fun team games.

Yes, we have fun too!

All work and no play makes Jack a dull boy.

Weekends are put to good use by having an outdoor activity with the team.

At times,we party or play cricket or play any fun team games.

Yes, we have fun too!

24) Travel

I absolutely love to travel to best hotels in the world & just unwind.

I frequently travel after a good trading week/month to any place of my choice in India or abroad just to relax for a few days.

I absolutely love to travel to best hotels in the world & just unwind.

I frequently travel after a good trading week/month to any place of my choice in India or abroad just to relax for a few days.

25) “The only way to do great work is to love what you do”

I am extremely passionate about markets & have also built my other business around it.

More than the money,trading allows me to live my life as per my terms 😬

That’s all folks! That’s my every day story.

End

I am extremely passionate about markets & have also built my other business around it.

More than the money,trading allows me to live my life as per my terms 😬

That’s all folks! That’s my every day story.

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh