Quick 🧵 on why every single stablecoin protocol will end up looking identical to @fraxfinance given sufficiently long time. #AllRoadsLeadtoFRAX

@MakerDAO launched their DAI minting module today. This is a bigger deal than most people think because it makes $DAI algorithmic.

@MakerDAO launched their DAI minting module today. This is a bigger deal than most people think because it makes $DAI algorithmic.

The DAI Direct Deposit Module (D3M) mints fresh $DAI into @AaveAave for users to borrow. If too much DAI is minted and interest rate <4% then D3M contracts supply to target 4%. If rate >4% then DAI supply expands (algorithmically).

https://twitter.com/MakerGrowth/status/1455190296912875525

When designing $FRAX v2 we came up with the concept of an "algorithmic market operation" module. FRAX is minted into a selected protocol if $1.01 & contracted/burned if price is $.99. The abstract idea is to create composable levers for rebalancing FRAX supply instantly anywhere.

One of the first AMOs was a system to expand/contract $FRAX supply in lending markets like @RariCapital @AaveAave & @CreamdotFinance. It is exactly how D3M works down to the smallest details. This AMO has been extremely successful in many protocols.

docs.frax.finance/amo/frax-lendi…

docs.frax.finance/amo/frax-lendi…

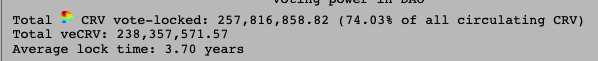

We also designed a @CurveFinance AMO. FRAX is minted if >$1.00 & withdrawn/burned if price is $.99. This has been very useful for making FRAX so tightly pegged at parity that you can hold it as a true USDC/USDT replacement without the 1-2% wobbliness of nonfiat alternatives.

Perhaps Maker's next "direct deposit module" will be algorithmic rebalancing of their dedicated Curve pools/3CRV ;) We can build it for you! We also have a @Uniswap v3 AMO that we could interest you in :p Let's build these money legos together 🤝

Critics might say "wow great, you discovered how to do DAO/treasury management, why brand it as an AMO? That's not a new idea." On the contrary, the design space we formally introduced was the concept that you can create a perfectly stable token onchain with this framework.

By thinking about algorithmic monetary policy with AMO building blocks, we've managed to create a stablecoin that has no central stability mechanism but has held the peg perfectly since inception. That's some great "treasury management" if it was all that was going on.

If it was just boring treasury management, @MakerDAO wouldn't be advertising this deployment as such a huge deal. The fact is, it's not treasury management, this is a huge deal. Algorithmic monetary policy levers being deployed by the OG stablecoin:

https://twitter.com/MakerGrowth/status/1455190235906707464

The core concept of AMOs are: target the open market exchange rate of the stablecoin through supply changes/interest rates across many protocols in parallel so the stablecoin price is always perfectly $1.00. It works, it's novel, and now it's amazing to see Maker doing the same.

The idea that all decentralized stablecoins will slowly become algorithmic stablecoins & all algostables will slowly start to resemble FRAX AMO strategies is something that is playing out in real time. Now imagine how far ahead we are with the Frax Price Index $FPI ;)

Onchain stablecoins are moving more towards targeting their exchange rate in the open market than the deposit collateral/mint model. This is DeFi 2.0 stablecoin theory. FRAX was the first to introduce this idea & make this claim by building our entire protocol around it.

I made this exact claim back in early April & it's cool to see it playing out prophetically #AllRoadsLeadtoFRAX

https://twitter.com/samkazemian/status/1380022662538297345

@RyanWatkins_ was one of the earliest people to see the potential of FRAX AMOs. And he correctly notices how important the DAI AMO is for Maker, it's not just treasury management, it's algorithmic monetary policy:

https://twitter.com/RyanWatkins_/status/1455585857407172613

I'll just end with the exact same tweet I made 7 months ago, seems even more apt today #AllRoadsLeadtoFRAX

https://twitter.com/samkazemian/status/1380022663809101827

• • •

Missing some Tweet in this thread? You can try to

force a refresh