We published our 200th story today.

This is a huge milestone for our small nonprofit newsroom—mind if we indulge in a quick recap of our recent work? ⬇️

This is a huge milestone for our small nonprofit newsroom—mind if we indulge in a quick recap of our recent work? ⬇️

This story from @darakerr was one of @ToddFeathers’ favorite pieces of journalism this year.

“An example of investigating an industry that tries to turn people into data and turning it around by using data to show the tragedies that attitude can create.”

themarkup.org/working-for-an…

“An example of investigating an industry that tries to turn people into data and turning it around by using data to show the tragedies that attitude can create.”

themarkup.org/working-for-an…

@LeonYin appreciated @tenuous and @colinlecher’s reporting on NYC high school admissions.

“This story investigates a system that upholds segregation through arbitrary and inconsistent rules. I especially appreciated students’ perspectives.” themarkup.org/news/2021/05/2…

“This story investigates a system that upholds segregation through arbitrary and inconsistent rules. I especially appreciated students’ perspectives.” themarkup.org/news/2021/05/2…

One of @tenuous’s favorites came from @jonkeegan and @alfredwkng.

“It’s a great example of The Markup building a dataset when there isn’t one. I really appreciate their no-nonsense approach.” themarkup.org/privacy/2021/0…

“It’s a great example of The Markup building a dataset when there isn’t one. I really appreciate their no-nonsense approach.” themarkup.org/privacy/2021/0…

@darakerr wanted to highlight @corintxt’s work.

“This story really illustrates the backwards ways of Facebook—the company went after watchdogs monitoring its platform, which in turn made its site less accessible to visually impaired users.”

themarkup.org/citizen-browse…

“This story really illustrates the backwards ways of Facebook—the company went after watchdogs monitoring its platform, which in turn made its site less accessible to visually impaired users.”

themarkup.org/citizen-browse…

President @NabihaSyed was struck by @LeonYin and @ASankin’s investigation that found Google blocked advertisers from using many racial justice terms to find YouTube videos and channels to advertise on—and led @ColorOfChange to call for an audit.

themarkup.org/google-the-gia…

themarkup.org/google-the-gia…

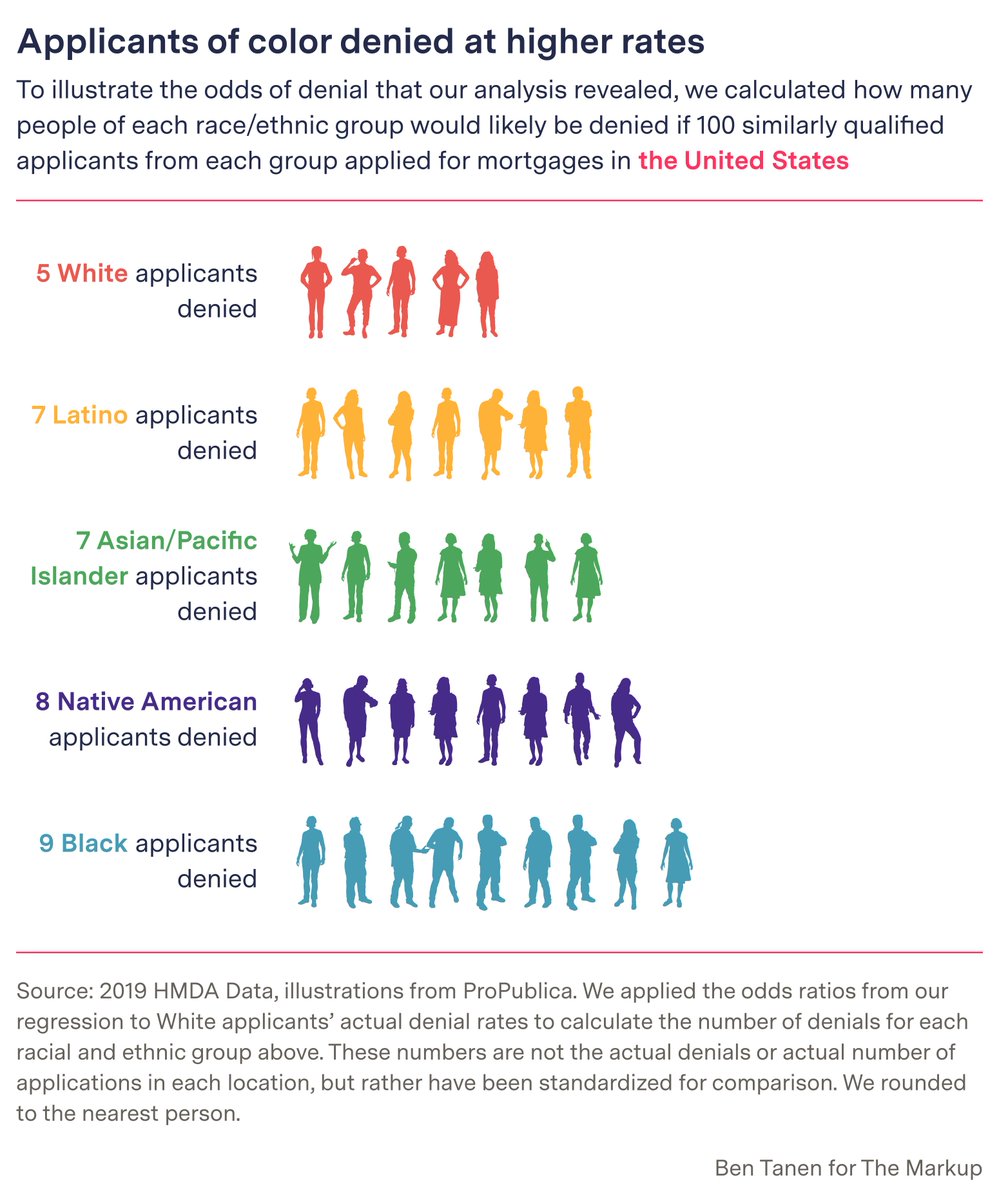

Editor-in-chief @JuliaAngwin admires how this investigation of racial bias in mortgage-approval algorithms from @eh_mah_nwel and @lkirchner highlights how our work extends beyond Silicon Valley into the tech that affects every aspect of our lives. themarkup.org/denied/2021/08…

It’s with reader support that we got to publish 200 stories. And it’s with reader support that we’ll be able to publish 200 more.

Wondering how you can help? Share our work, subscribe to our newsletters, or consider a monthly contribution: themarkup.org/give-today.

Wondering how you can help? Share our work, subscribe to our newsletters, or consider a monthly contribution: themarkup.org/give-today.

• • •

Missing some Tweet in this thread? You can try to

force a refresh